S&P 500, Dow and Nasdaq log records

US stock indices closed at record highs on Monday on expectations of positive earnings season. The dollar resumed strengthening: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 93.251. S&P 500 closed 0.2% higher settling at record 2557.64 led by financial shares. The Dow Jones industrial average rose 0.4% to 22956.96. The Nasdaq composite index gained 0.3% to 6624.

European stocks advance

European stocks ended little changed on Monday as Spain’s central government gave Catalonia’s separatist leaders until Thursday to back away from the independence push. Both the euro and British Pound fell against the dollar. The Stoxx Europe 600 index ended less than 0.1 points lower. The DAX 30 added 0.1% to 13003.70. France’s CAC 40 rose 0.2%. UK’s FTSE 100 fell 0.1% to 7526.97.

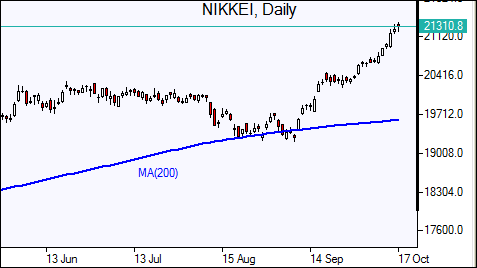

Asian markets up on Chinese data

Asian stock indices are mostly higher today. Nikkei closed 0.4% higher at 21336.12 as yen extended losses against the dollar. Chinese stocks are mixed after data on Monday showed consumer inflation slowed while producer prices rose more than expected: Shanghai Composite Index is 0.2% lower while Hong Kong’s Hang Seng Index is flat. Australia’s ASX All Ordinaries is up 0.7% supported by gains in miner stocks on higher commodity prices and a slide in the Australian dollar against the greenback.

Oil higher on rising geopolitical tensions

Oil futures prices are inching higher today as uncertainty after Iraqi Kurdistan independence vote raises concerns about Iraq’s crude oil exports. Prices rose Monday after Iraqi forces reportedly seized the city of Kirkuk and its surrounding oil fields from Kurdish forces Monday. The government said its troops had taken control of Iraq’s North Oil Company, and the fields quickly resumed production. December Brent crude rose 1.1% settling at $57.82 a barrel on ICE Futures exchange in London on Monday.