Fed’s two day meeting starts today

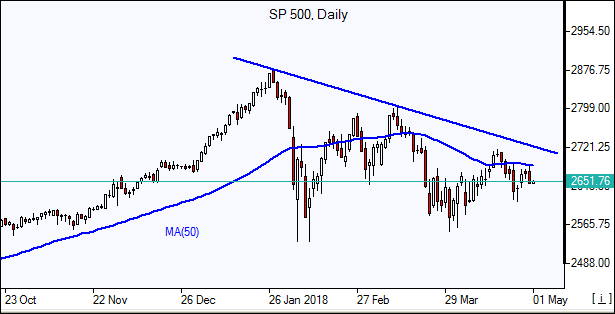

US stocks pulled back Monday despite positive earnings reports. The S&P 500 fell 0.8% to 2648, with all 11 main sectors finishing lower. The Dow Jones industrial lost 0.6% to 24163.15. The NASDAQ Composite index declined 0.8% to 7066. The dollar strengthening resumed: live dollar index data show the ICE US dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 91.795. Stock indices futures point to higher openings today.

Stocks retreated ahead of the Federal Reserve's two day meeting starting today. Investors are weighing the odds the central bank may opt to hike interest rates three more times this year instead of two as data point to pick up in inflation. The personal consumption expenditure (PCE) index, the Federal Reserve’s preferred inflation gauge, rose to 2% year over year in March from a 1.7% in February, hitting the central bank’s 2.0% target for the first time in a year. Core PCE inflation climbed to 1.9% year over year, its biggest gain since April 2012. Treasury yields slipped, however, as investors sold off stocks.

European stocks log sixth straight weekly gain

European stocks ended higher Monday as investors risk appetite was boosted by weaker currencies and merger news. The euro rejoined the British pound’s extended slide against the dollar. The Stoxx Europe 600 index rose 0.2%. The DAX 30 gained 0.3% to 12612.11, France’s CAC 40 outperformed ending up 0.7% and UK’s FTSE 100 advanced 0.1% to 7509.30. Markets in Germany, France, Switzerland and Italy are closed today for Labor Day.

Supermarket shares led advancers as Sainsbury's stock jumped 14.5% on news it agreed to merge with Asda, Wallmart’s UK business. Weak economic data weighed on the euro: German retail sales unexpectedly fell in March, declining 0.6% month-on-month, while headline inflation remained at 1.6%.

Australian stocks lead Asian indices gains

Asian stock indices are mixed today with many markets closed for the Labor Day holiday. Nikkei rose 0.2% to 22508.03 helped by the continued yen slide against the dollar. China’s markets are closed for the holiday. Australia’s ASX All Ordinaries Index is up 0.5% with the Australian dollar little changed against the US dollar.

Brent up

Brent Oil Futures prices are edging higher today. Prices rallied yesterday on rising Middle East tensions after Israeli Prime Minister Netanyahu accused Iran of lying about its nuclear program. July Brent crude settled 1.2% higher at $74.69/barrel on Monday.