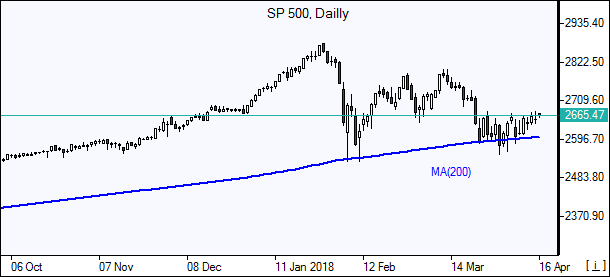

US stocks closed lower Friday despite better than expected first-quarter earnings. S&P 500 lost 0.3% to 2656.30 led by financial stocks. SP 500 gained 2% for the week. Dow Jones industrial average fell 0.5% to 24360.14. The Nasdaqcomposite dropped 0.5% to 7106.65. The dollar turned lower Friday: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down less than 0.1% to 89.732. Stock indices futures indicate higher openings today.

European stocks log third straight weekly gain

European stocks extended gains on Friday. The Stoxx Europe 600 Index gained 0.1%, rising 1.2% for the week. The euro joined British Pound’s climb against the dollar. The DAX 30 rose 0.2% to 12442.40. France’s CAC 40 added 0.1% and UK’s FTSE 100 gained 0.1% to 7264.56. Indices opened flat to 0.3% higher today.

Asian indices mixed

Asian stock indices are mixed today with traders uncertain how events will develop in Middle East after Friday airstrikes against Syria by the US and allies. Nikkei rose 0.3% to 21836 despite yen reversal higher against the dollar. Chinese stocks are a lower: the Shanghai Composite Index is down 1.5% and Hong Kong’s Hang Seng Index is 2% lower. Australia’s ASX All Ordinaries is up 0.2% as Australian dollar extends gains against the greenback.

Brent slides

Brent futures prices are retreating today following US and allies strikes on Syria and data showing rising US oil rig count last week. Prices rose Friday on geopolitical tensions as traders wondered when the US would launch Syria airstrikes ater President Trump’s warning. Brent for June settlement rose 0.8% to close at $72.58 a barrel Friday.