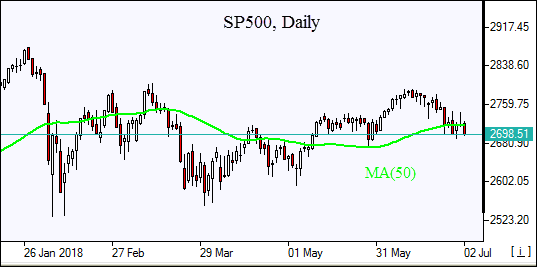

S&P 500 posts second weekly loss

US stock indices extended gains Friday led by energy and materials shares. S&P 500 added 0.1% to 2718.37, ending 1.3% lower for the week while booking 2.9% gain over quarter. Dow Jones industrial average rose 0.2% to 24271.41. The Nasdaqgained 0.1% to 7510.30. The dollar turned sharply lower despite a rise in core personal consumption expenditures index to 2% over year in May from 1.8% in April: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.8% to 94.537 but is higher currently. Stock index futures indicate lower openings today.

European stocks end week lower

European stock indices rebounded on Friday after European Union leaders reached a deal on refugees. Both the euro and British Pound turned higher against the dollar but are lower currently. The Stoxx Europe 600 Index gained 0.8%, however ending 1.3% lower for the week. The DAX 30 rose 1.1% to 12306. France’s CAC 40 ended 0.9% higher and UK’s FTSE 100 gained 0.3% to 7636.93. Indices opened 0.7% - 1.2% lower today.

Nikkei stocks lead Asian indices losses

Asian stock indices are mostly lower today. Nikkei dropped 2.2% to 21811.93 weighed by yen rise against the dollar. Chinese stocks are falling as China's official non-manufacturing PMI inched higher but the manufacturing PMI slipped: theShanghai Composite Index is down 2.5%. Hong Kong’s market was closed for a holiday. Australia’s ASX All Ordinaries is down 0.3% despite the Australian dollar turn lower against the greenback.

Brent climb persists

Brent futures prices are rising today. Prices ended higher yesterday on supply concerns about US sanctions on Iranian oil and production issues at a Canadian oil sands facility: Brent for August settlement closed 0.3% higher at $77.85 a barrel on Thursday.