Upcoming US Events for Today:- No significant economic events scheduled.

International Events for Today:

- German PPI for April released at 2:00am EST. The market expects a year-over-year decline of 0.8% versus a decline of 0.9% previous.

- Great Britain CPI for April released at 4:30am EST. The market expected a year-over-year increase of 1.7% versus an increase of 1.6% previous. PPI is expected to show a year-over-year increase of 0.7% versus an increase of 0.5% previous.

- Japan Merchandise Trade for April released at 7:50pm EST. The market expected a deficit of ¥630.0B versus a deficit of ¥1446B previous.

The Markets

While markets were closed in Canada for Victoria Day, stocks in the US closed higher on Monday, fuelled by strength in beaten down momentum names. The Biotech ETF (NASDAQ:IBB) gained 1.4%, maintaining the 200-day moving average as a level of support. Support at significant moving averages has become a common theme amongst major equity benchmarks. The S&P 500 and Dow Jones Industrial Average continue to hold support around their 50-day moving average lines, while the 200-day moving average is apparent support for the NASDAQ Composite. Each variable level of support continues to point higher, implying a positive trend, albeit on different timescales. The battle-lines have been drawn; a break of these major moving average levels would escalate selling pressures, but a negative catalyst appears necessary to fuel this move to the downside.

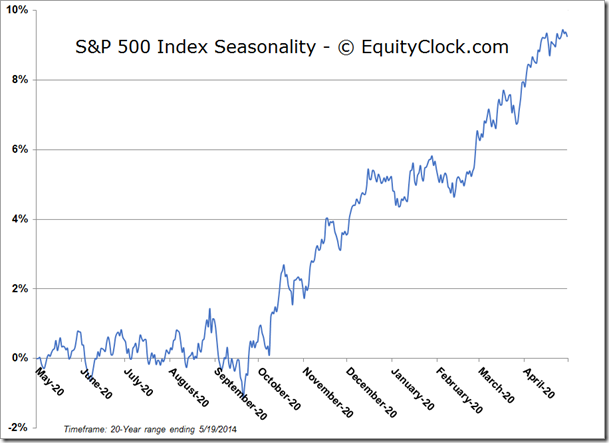

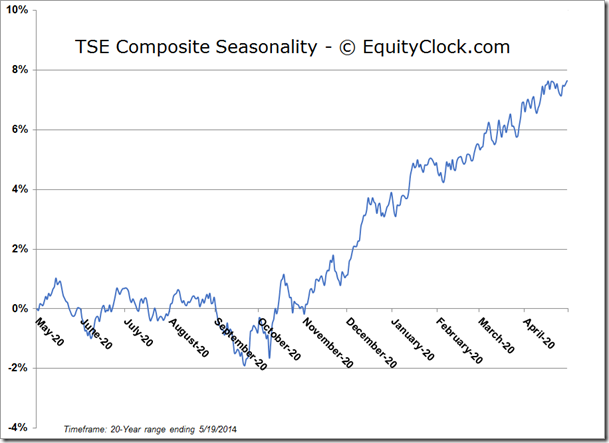

With the Canadian holiday now over, investors may have reason to be happy to be back at work. The Memorial Day holiday will close markets in the US this coming Monday and Canadian stocks tend to gain surrounding this event. Returns for the TSX Composite from the Tuesday prior to Memorial Day through to Memorial Day Monday have averaged 0.78% since 1990. Positive results were achieved 71% of the time. The Canadian market tends to gain during days in which the US market is closed as a result of a holiday. The Memorial day session itself has seen gains average 0.32% for the TSX Composite over the past 24 years with positive results realized in 18 of the past 24 holiday trades. The impact of the holiday doesn’t translate as effectively to the US equity market with the S&P 500 averaging a gain of a mere 0.06% during the week prior to Memorial Day. Since the vast majority of holiday’s in the US and Canada fall on the same date, the Memorial Day trade offers Canadian investors the rare ability to invest in the market without the significant influence of markets in the US.

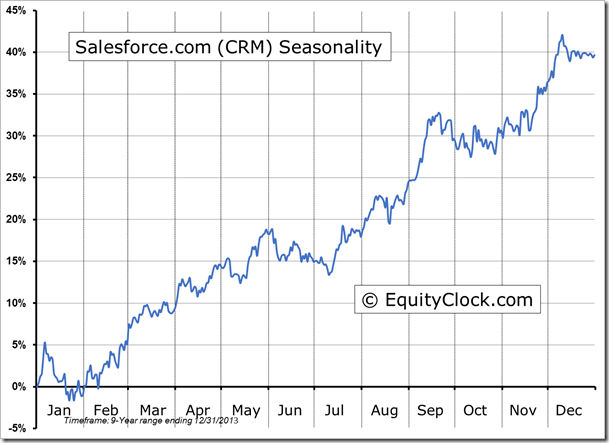

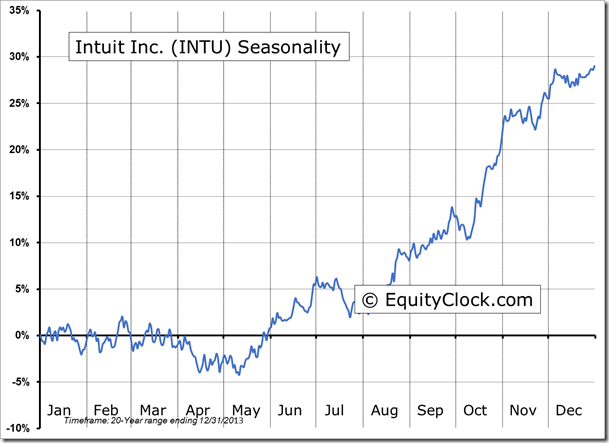

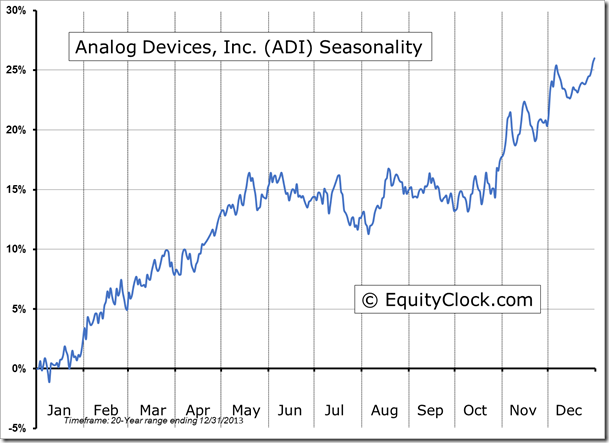

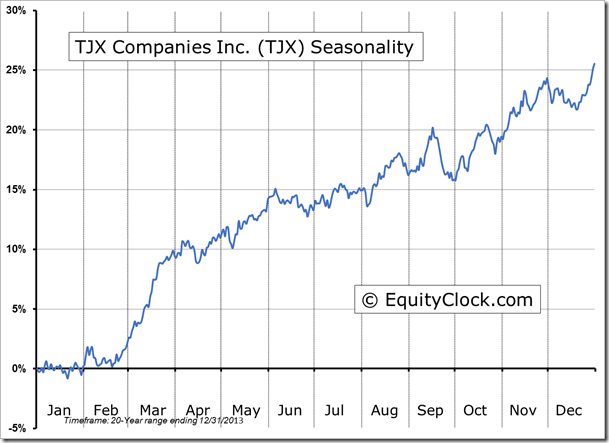

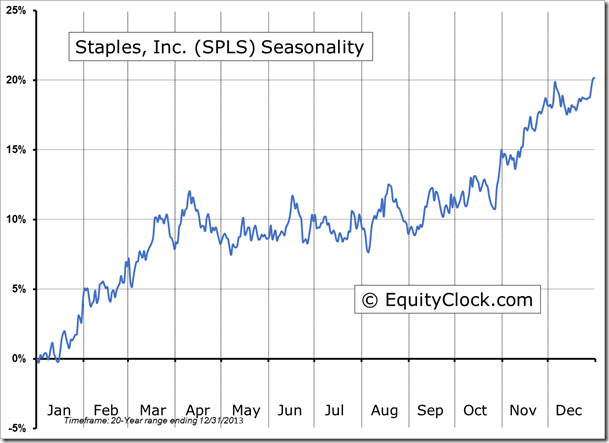

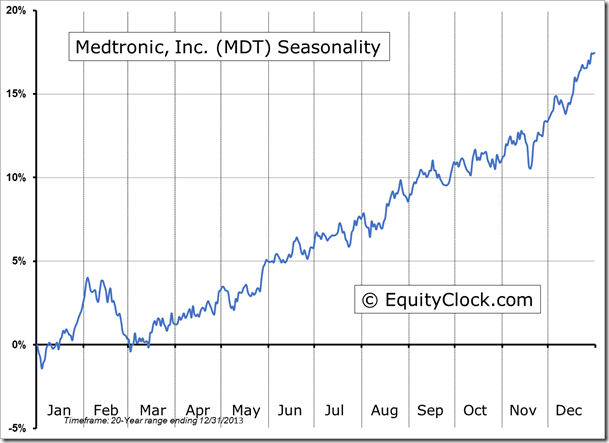

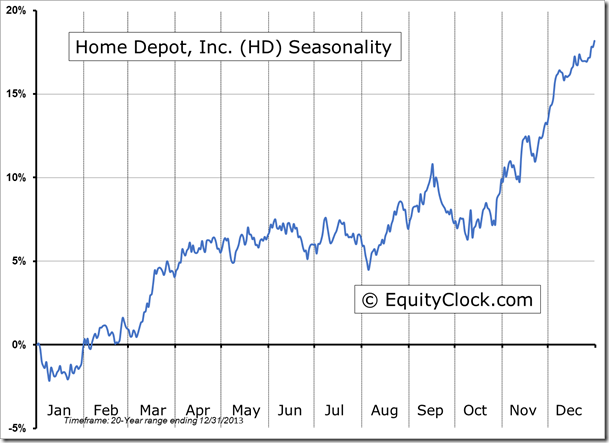

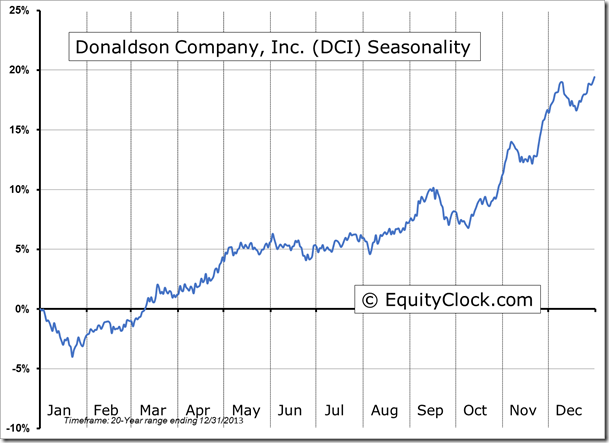

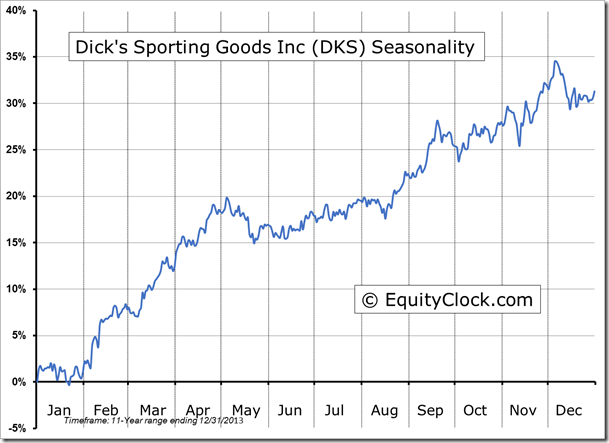

Seasonal charts of companies reporting earnings today:

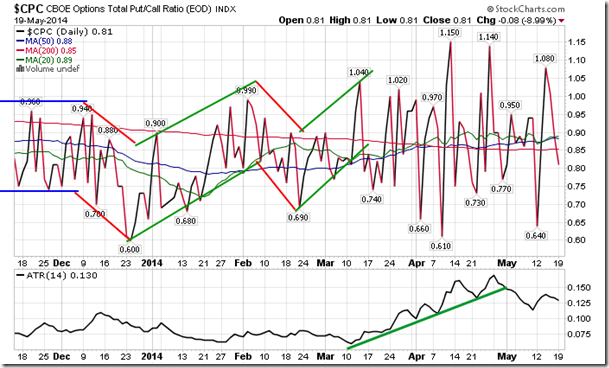

Sentiment on Monday, as gauged by the put-call ratio, ended bullish at 0.81.

S&P 500 Index

TSE Composite

Horizons Seasonal Rotation ETF (TO:HAC)

- Closing Market Value: $14.57 (down 0.21%)

- Closing NAV/Unit: $14.59 (up 0.03%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.03% | 45.9% |

* Performance calculated on Closing NAV/Unit as provided by custodian