- Cruise line shares tank after state quarantine rules introduced

- Euro sinks after new US tariff threats to the EU

- Economic Calendar: ECB minutes, US jobless claims, US GDP

- Bank shares: US Bank Stress Test results later

Markets

After a big run up that saw the NASDAQ rally eight days in a row despite rising coronavirus infections, markets fell under their own weight on Wednesday. European indices were crunched, dropping over 3%. Reports the US might imposes new tariffs and the IMF lowering growth forecasts are still hanging over European shares on Thursday.

Quarantine & Cruises

New quarantine rules for travellers from some US states was the tipping point for investor doubts about the impact of rising coronavirus cases. New York, New Jersey and Connecticut will make travellers from California, Florida and Texas quarantine for 14 days.

Before yesterday investors were content with the idea of localised lockdowns as occurred in Germany. Inter-state travel restrictions will undoubtedly hurt the economic recovery. A 14-day quarantine as good as kills off the prospect of travel to and from these states for holiday (vacation!) purposes. New Yorkers travelling to Florida would have been a necessary ingredient for US-based cruises. Carnival (NYSE:CUK) cruises.

Bank Stress Tests

All eyes will be on the CCAR (not Credence Clearwater Revival..!) the Comprehensive Capital analysis and Review. Here we will find out which of the banks' capital plans are approved by the Fed. Bank shareholders are worried that the Fed will prefer to make capital available for the economy than for their pockets.

They probably needn’t be too worried. Bank-loan loss-reserves are high and banks have not been issuing highly leveraged loans - except credit cards - since 2009. We suspect most bank dividends are secure and that could spur a relief rally in the under-performing shares. Share-buybacks (NYSE:SPYB) have become a political hot potato and may get deferred but perhaps not to the detriment of share prices.

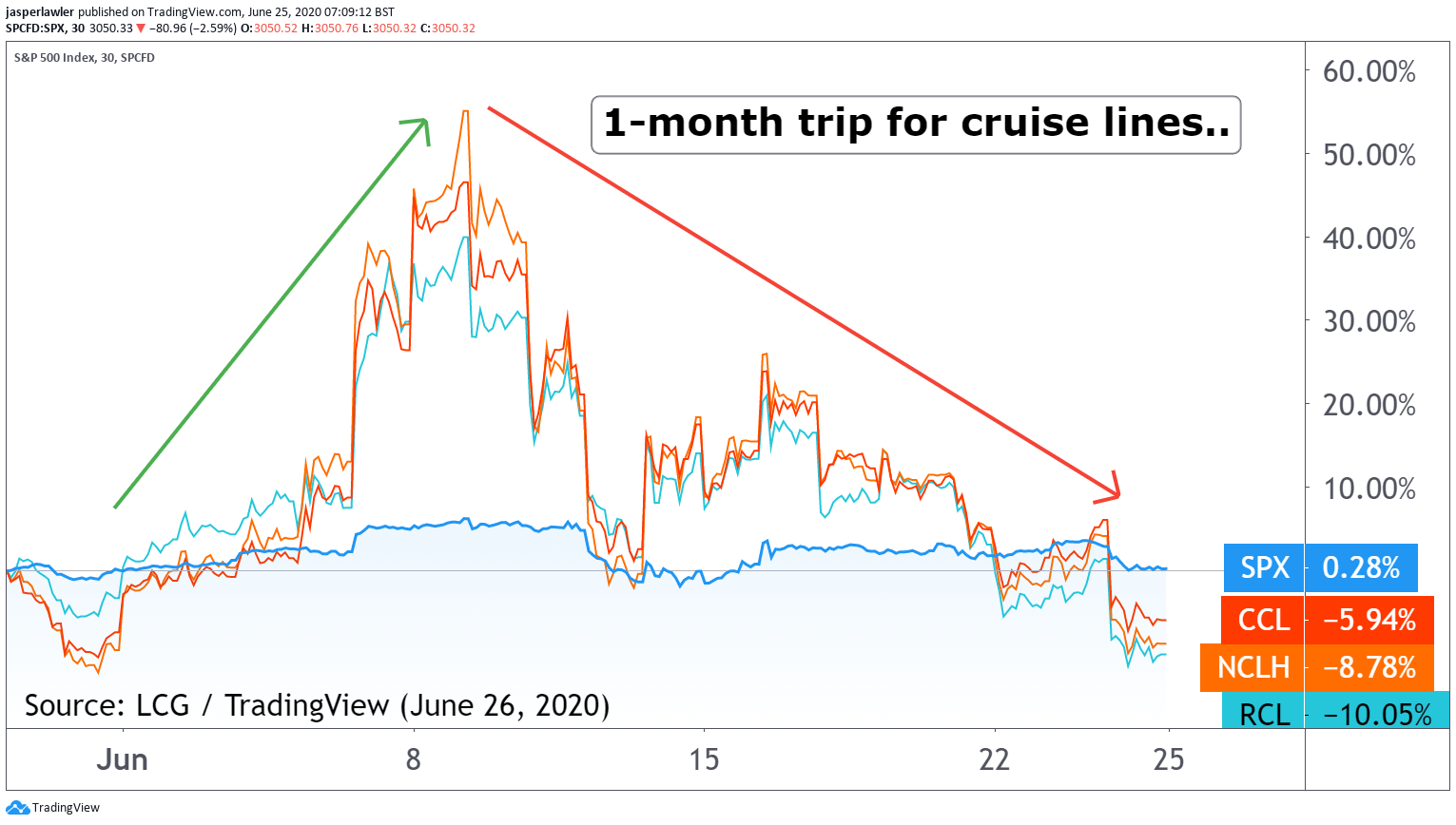

Chart: Cruise lines (1-month)

Cruise line shares have been a leading indicator for market strength and weakness. Having outperformed when markets broke higher, the shares are now down again versus the S&P 500 in the last month.