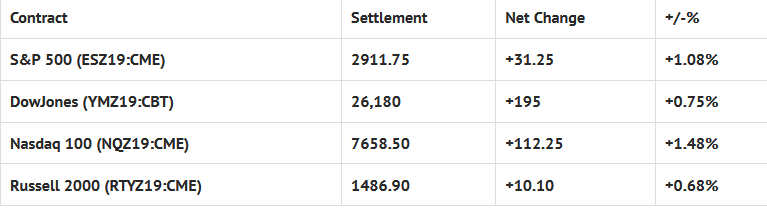

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Employment Situation 8:30 AM ET, International Trade 8:30 AM ET, Eric Rosengren Speaks 8:30 AM ET, Raphael Bostic Speaks 10:25 AM ET, Neel Kashkari Speaks 12:45 PM ET, the Baker-Hughes Rig Count 1:00 PM ET, Jerome Powell Speaks 2:00 PM ET, Lael Brainard Speaks 2:10 PM ET, Randal Quarles Speaks 4:00 PM ET, and Esther George speaks on Sunday 4:45 PM ET.

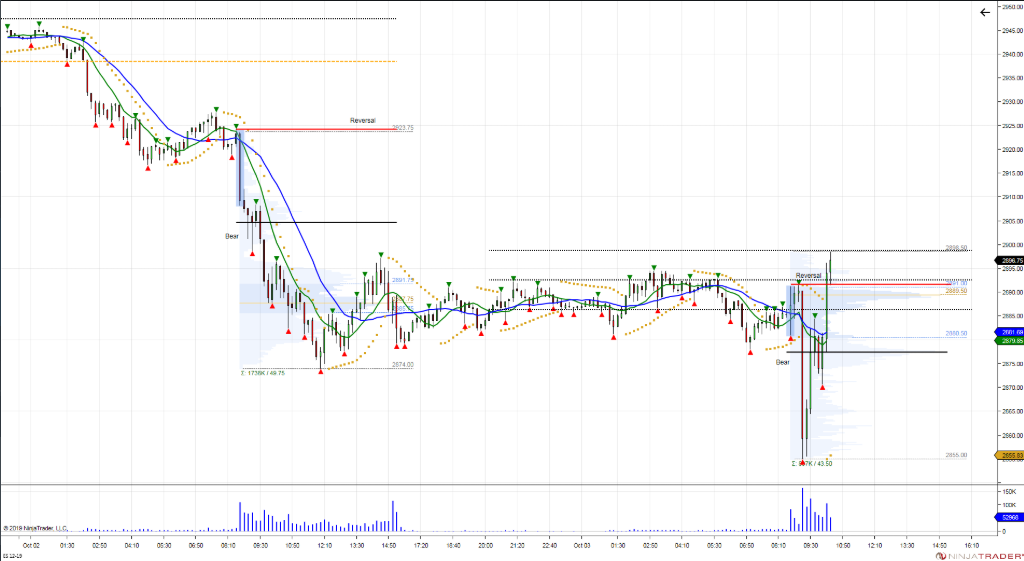

S&P 500 Futures: Lousy ISM #ES Drop & Pop

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Reversal bias after flushing below lower vol window to stop out longs and lure in shorts. Short sellers failed to expand below window, turning into first bear trap in days, using shorts to reverse intraday bear bias.

During Wednesday nights Globex session, the S&P 500 futures (ESZ19:CME) made a high at 2894.50, a low at 2878.00, and opened Thursday’s regular trading hours (RTH) at 2885.25, up +4.75 handles.

After the 8:30 CT bell, the futures down ticked to 2881.00, rallied up to 2891.75 at 9:00, and then tanked down to 2854.75, down 25 handles from the early high, when the ISM index release showed a three-year low, adding to fears of a manufacturing slowdown.

Once the market had a chance to settle down, the ES rallied 27.50 handles, up to 2882.50, pulled back down 2874.25, then rallied back up to a higher high at 2884.75. From there, the futures sold off down to 2870.50, and then began to make a series of higher highs and higher lows, eventually trading all the way up to 2909.50.

While the ISM number did kick in a high level of sell programs, the buy programs were much larger and more consistent. There seemed to be two things at work; 1) traders overly short, and 2) cash buyers entering the stock market. When you have such a big move down, this type of price action tends to be very explosive.

Just after 2:00, the futures pulled back down to 2901.00, as the MiM started to show over $600 million to sell, and after a small three handle pop, traded down to 2900.00 as the MiM slipped to $200 million to sell.

The ES would go on to trade 2903.00 when the 2:45 cash imbalance reveal showed $1 billion to sell MOC, then ripped up to print 2911.00 on the 3:00 cash close, and settled at 2911.75 on the 3:15 futures close, up +31.25 handles for the day.

In terms of the ES’s overall tone, it was all over the place; firm early, extremely weak after the ISM number, and then back to very firm. That doesn’t happen very often. In terms of the days overall trade, volume was on the high end, with 2 million mini S&P futures contracts traded.