Bank stocks lead S&P 500 decline

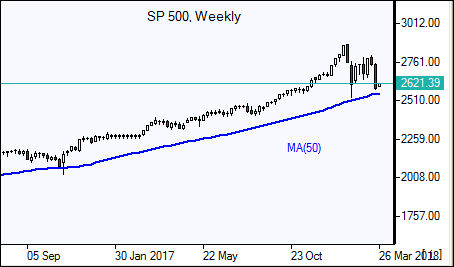

US stock indices ended lower Friday after the selloff in previous session triggered by Trump’s order to draw tariffs on Chinese goods totaling $60 billion. S&P 500 dropped 2.1% to 2588.261, despite a 3.1% jump in durable goods orders in February. S$P 500 tumbled 6% for the week. Dow Jones Industrial Average lost 1.8% to 23533.20. The Nasdaq composite fell 2.4% to 6992.67. The dollar turned lower: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slid 0.2% to 89.62. Stock indices futures point to higher openings today.

European stocks fall

European stocks fell third session in a row on Friday as trade war concerns intensified after President Trump ordered drawing tariffs on Chinese goods. Both the euro and British Pound’s continued climbing against the dollar. The Stoxx Europe 600 index fell 0.9%, ending down 3.2% for the week. The DAX 30 dropped 1.8% to 11886.31. France’s CAC 40lost 1.4% and UK’s FTSE 100 slid 0.4% to 6921.94. Indices opened flat to 0.3% higher today.

Asian indices mostly lower

Asian stocks are mostly lower today amid caution as US-China trade war concerns eased. Nikkei rose 0.7% to 20766.10 aided by continued yen weakening against the dollar as investors covered short bets. Chinese stocks are mixed after China’s commerce ministry threat of reciprocal $3 billion tariffs on US goods Friday followed by Beijing saying today China is willing to hold talks with the United States to resolve their differences over trade: the Shanghai Composite Index is down 0.6% while Hong Kong’s Hang Seng Index is 0.7% higher. Australia’s All Ordinaries Index is down 0.5% as Australian dollar added to gains against the greenback.

Brent slides

Brent futures prices are lower today on United States and China trade dispute concerns. Prices rose Friday on rising likelihood of renewed Iran sanctions and Saudi comments OPEC production curbs could be extended into 2019. May Brent rose 2.2% to $70.45 a barrel on Friday. It gained 6.4% in the week.