Market Brief

Yesterday, investors in New York walked home with a smile on their face as Wall Street’s three favourite equity indices ended up the day well above the neutral threshold. The S&P 500 rose 1.19%, the NASDAQ jumped 1.45% and the Dow Jones gained 0.94%. But the biggest winner was the Russell 2000 with a daily performance of 2.09%. With blue chips indices back to their pre-correction levels, traders now wonder whether there is still some upside potential or if this is an early-warning sign for another correction. The recent sharp appreciation of blue chip equities is due mostly to the fact that the market now understands the Fed’s plan to remain on the sidelines and continue to support the economy for some time to come. Despite the fact that the ongoing earning season brought its batch of good news, especially from tech companies, the underlying fundamentals have barely change over the last the few months and we therefore believe that caution is required. However, small caps’ stocks still have bright days ahead as they did not recover fully from the last correction, the Russell 2000 is still 110 points from its all-time high of June 23rd.

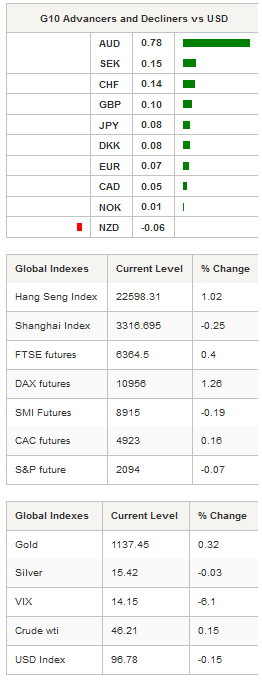

It therefore comes as no surprise that Asian regional markets were also trading in positive territory, following Wall Street’s lead. Japan’s markets are closed due to Culture Day. In Hong Kong, the Hang Seng soared 1.02%, in New Zealand, shares climbed 0.64%, while in South Korea the KOSPI index gained 0.65%. In Singapore, the Singapore MSCI was up 1.03% and in Taiwan the Dow Jones Taiwan climbed 1.14. In mainland China, both the Shanghai and Shenzhen Composite are blinking red, down 0.25% and 0.03% respectively.

In Australia, the S&P/ASX 200 was up 1.42% and AUD/USD gained 1.20% amid a hawkish statement from Governor Stevens. As expected (see our Weekly Market Outlook), the RBA left the cash rate at a record low 2%. However, the statement was surprisingly optimistic about the economic outlook, stating that “While GDP growth has been somewhat below longer-term averages for some time, business surveys suggest a gradual improvement in conditions over the past year.” AUD/USD is now testing the resistance standing at 0.7197 (Fibo. 38.2% on September-October rally). On the upside, a first resistance can be found at around $0.73 and $0.74, both psychological levels and previous highs. We expect further Aussie strength against the greenback, with the $0.73 level as the next target.

EUR/USD has been unable to return above its pre-FOMC statement level at around $1.11. Moreover, the ECB’s clear dovish bias is preventing traders from pulling the single currency to the upside. A support lies at 1.0897 (low from October 28th).

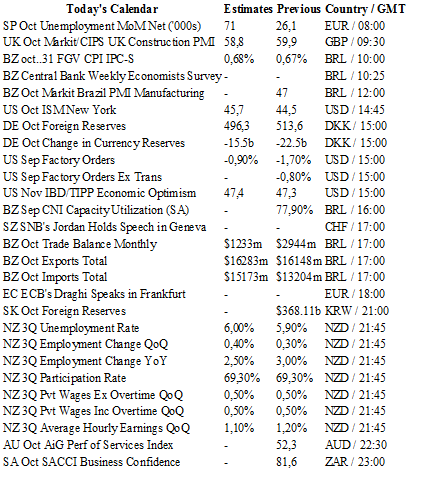

Today’s economic calendar is light. We’ll get UK construction PMI; Brazil manufacturing PMI; factory orders form the US; Q3 job report from New Zealand.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1017

S 1: 1.0809

S 2: 1.0458

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5426

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.69

S 1: 118.07

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 0.9862

S 1: 0.9476

S 2: 0.9384