- Dollar/yen rebounds after US GDP data

- Core PCE the next test for Fed rate cut bets

- Yen rally losing steam ahead of BoJ next week

- Wall Street extends slide, more earnings awaited

GDP Data Adds Fuel to Dollar’s Engines

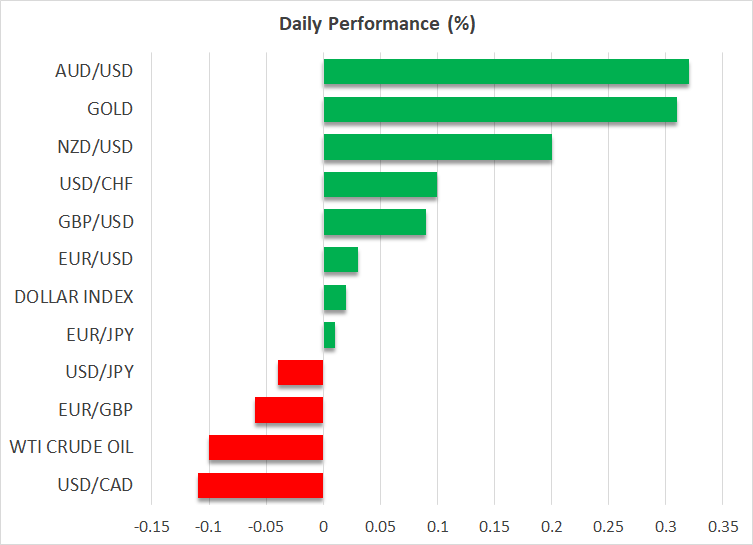

The dollar traded higher against most of its major counterparts on Thursday, trimming losses against the yen and extending its rally versus the wounded Aussie, Kiwi, and Loonie.

What may have allowed the greenback to recover some of the recently lost ground against the Japanese yen was the better-than-expected GDP data for Q2.

The data revealed that the world’s largest economy expanded 2.8% q/q SAAR, beating estimates of acceleration to 2.0% from 1.4% in Q1.

Having said that though, this barely impacted expectations about the Fed’s future course of action as the PCE prints for the quarter confirmed a notable slowdown in inflation.

Investors remain convinced that the Fed will cut interest rates by 25bps in September while assigning a decent 65% chance for a total of three reductions by the end of the year. A third cut is more than fully priced in for January.

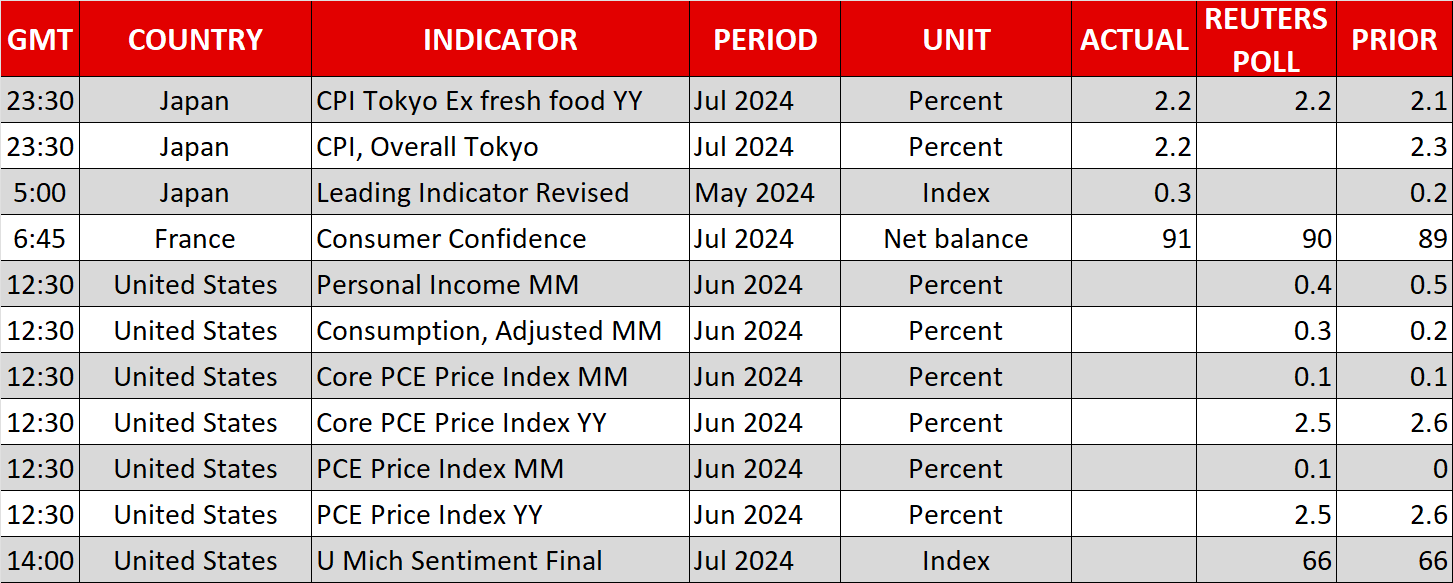

Today, the spotlight is likely to fall on the core PCE price index for June. The forecast points to a downtick in the y/y rate to 2.5% from 2.6%, something supported by the slowdown in the core CPI for the month.

Having said that, a minor slowdown in the PCE data is unlikely to significantly alter rate cut expectations, especially after the strong GDP numbers.

Yen Rally Slows Down; Aussie, Kiwi, Loonie Extend Tumble

The yen began the day on the front foot, with dollar/yen hitting the low of May 3 at 151.85 before rebounding on the stronger-than-expected US GDP data.

The further tumble in equity markets suggests that the yen continued to enjoy some safe-haven flows, also benefiting from the unwinding of profitable carry trades.

However, the counter move on the US data suggests that the rally may have gone a little too far given that the market is not expecting a fast and rapid tightening cycle by the BoJ, although there is a strong 70% chance for another 10bps hike next week. After all, even with the hike taken into account, the rate differentials between the US and Japan remain wide.

The Aussie and the kiwi continued reflecting concerns regarding the Chinese economy, while the Loonie extended its slide after the BoC delivered a back-to-back 25bps cut and said that more cuts are likely if inflation continues to drift south. Currently, there is a 66% chance for another reduction in September.

Nasdaq and S&P 500 See More Losses

The Nasdaq and the S&P 500 extended their slide yesterday, with the former losing nearly one percent as the tech-led selloff resumed by the end of the session. The Dow Jones managed to finish in the green.

From a technical standpoint, both the Nasdaq and the S&P 500 remain above key uptrend lines, which means that the latest tumble is still just a correction.

What’s more, the slowdown of the slide suggests that there may be some dip buyers re-entering the game.

However, what could prove more determinant on whether a rebound is on the cards or more declines are looming may be more earnings results by tech giants. After all, the latest uptrend was driven by the euphoria surrounding those firms.