Market Brief

As expected the Federal Reserve left the target range for the federal fund rate unchanged at between 0.25% and 0.50%. However, it appears that the Fed is more cautious when it comes to discussing the risk to growth and the possible effects of current market turmoil on Fed thinking and more specifically, the path of tightening. It’s clear that the Fed wants to avoid ending up in the same position as last year when, after months of hawkish comments, it had to increase rates to save its credibility in spite of mixed signals from the US economy. The US dollar remained stable amid the rate decision with EUR/USD trading range bound between 1.0860 and 1.0920. The March meeting will be much more decisive, just like the market’s expectations.

After cutting rates four times in 2015, the Reserve Bank of New Zealand decided to leave the official cash rate unchanged at 2.50%. According to the statement, the weak spot in inflation is temporary, “mainly due to falling oil prices“ and is expected to increase over 2016. On the growth side, the RBNZ maintained its optimistic view for the year ahead, writing that “growth is expected to increase in 2016 as a result of continued strong net immigration, tourism, a solid pipeline of construction activity, and the lift in business and consumer confidence”. NZD/USD dropped 1.40% amid the release of the statement as Governor Wheeler made clear that monetary policy will continue to be accommodative, adding that further monetary easing may be required. The bias is clearly on the easing side as the Central Bank wants to maintain the weakness of the New Zealand dollar to help curb disinflationary pressures. We remain bearish on the Kiwi with 0.6240 as next target.

In Japan, retail sales disappointed substantially in December, contracting 1.1%y/y, while economists were expecting an increase of 0.2% and the previous month figure was revised lower to -1.1% from -1.0%. USD/JPY gained 0.40% amid the headlines, rising to 118.90 in Tokyo. Overall, we expect the pair to recover early 2016 losses as the risk-off sentiment fades away and the market refocuses on the country’s lacklustre fundamentals.

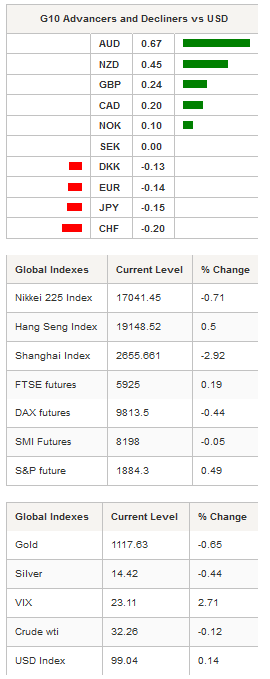

In the equity market, returns are mixed in Asia as the panic move comes to an end. The Japanese Nikkei 225 seemed unable to break the 17,000 level to the downside and is trading slightly above, waiting for buyers to wake up. The index lost 0.71% during the session,while the TOPIX index was down 0.61%. In mainland China, indices continued to move south with the Shanghai Composite and Shenzhen down 2.92% and 4.18%. In Europe, futures are also moving lower, however sellers seem to be losing faith in the sustainability of the sell-off.

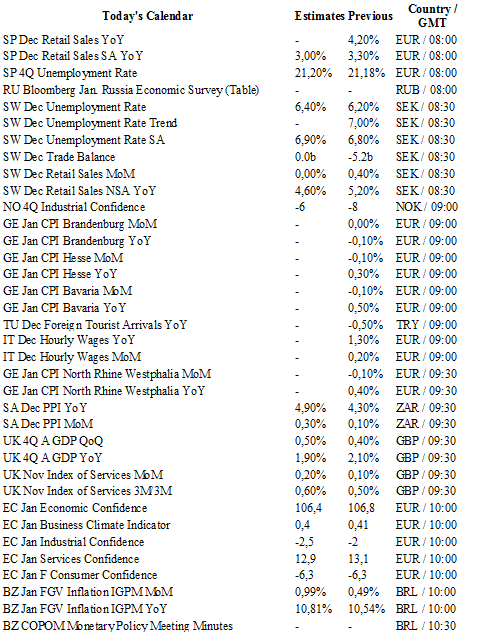

Today traders will be watching unemployment rates from Denmark; retail sales and unemployment rate from Spain and Sweden; 4Q GDP from the UK; COPOM minutes, unemployment rate, central government budget balance and inflation from Brazil; CPI from Germany; initial jobless claims, durable goods orders and pending home sales from the US; interest rate decision from South Africa (a rate hike is expected).

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0879

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4264

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 118.87

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0170

S 1: 0.9786

S 2: 0.9476