The US Dollar slightly fell yesterday whilst the Japanese Yen and Australian Dollar performed stronger than other major currencies. We are seeing more signals that reversals in these two pairs may happen in the short run.

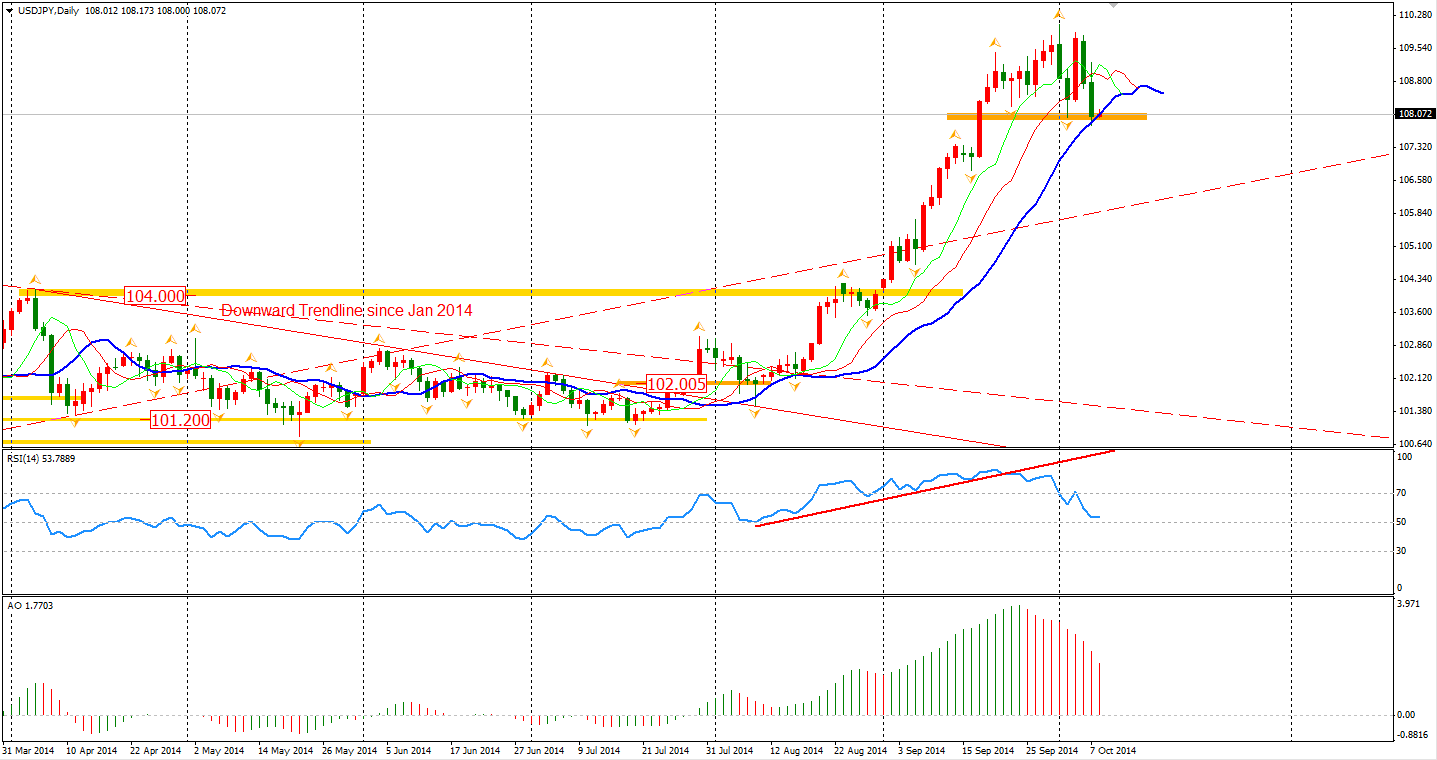

The Dollar/Yen strengthened upon comments made by Japanese PM Abe that the weaker Yen is hurting small companies and household. USD/JPY was up 0.4% in the early Asian morning but all gains were soon erased. The markets are expecting the BOJ may announce additional stimulus in the next 2 months. The pair is still standing beyond the 108 level and the long term outlook remains bullish. The top forecaster for the Dollar/Yen sees the pair possibly hitting the 120 level next year.

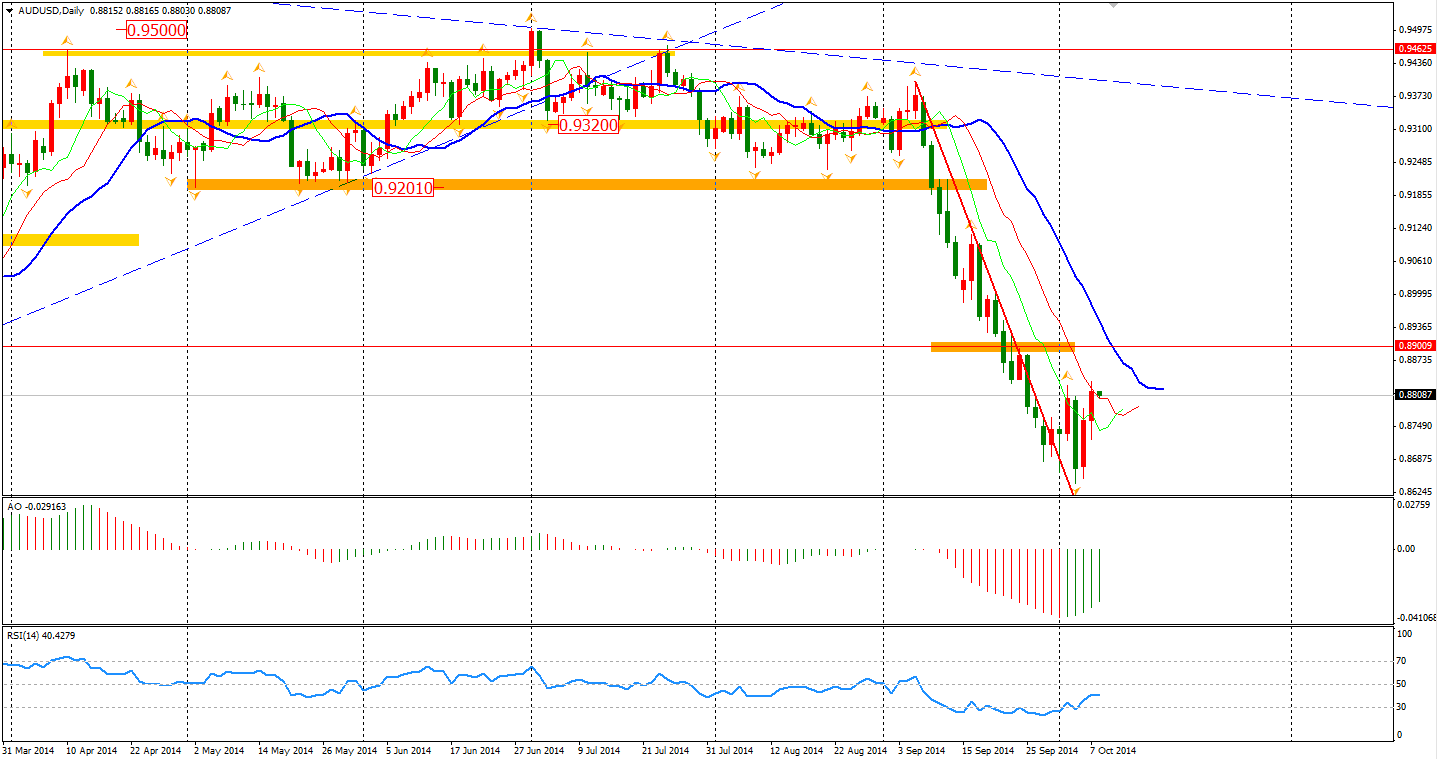

The Aussie/Dollar rose back to 0.88 as some buyers seem attracted by its current interest rate return advantage. The RBA has maintained the benchmark interest rate at 2.5% and left its comments on exchange level unchanged. Even though the Australian Dollar has fallen more than 7% in the last month, the board are still expecting a weaker Aussie Dollar given the recent decline of commodity prices. Considering that the US may raise its interest rate much sooner than other developed nations and that China’s economy looks to be growing at a lowered rate, the outlook of Aussie Dollar is still bearish.

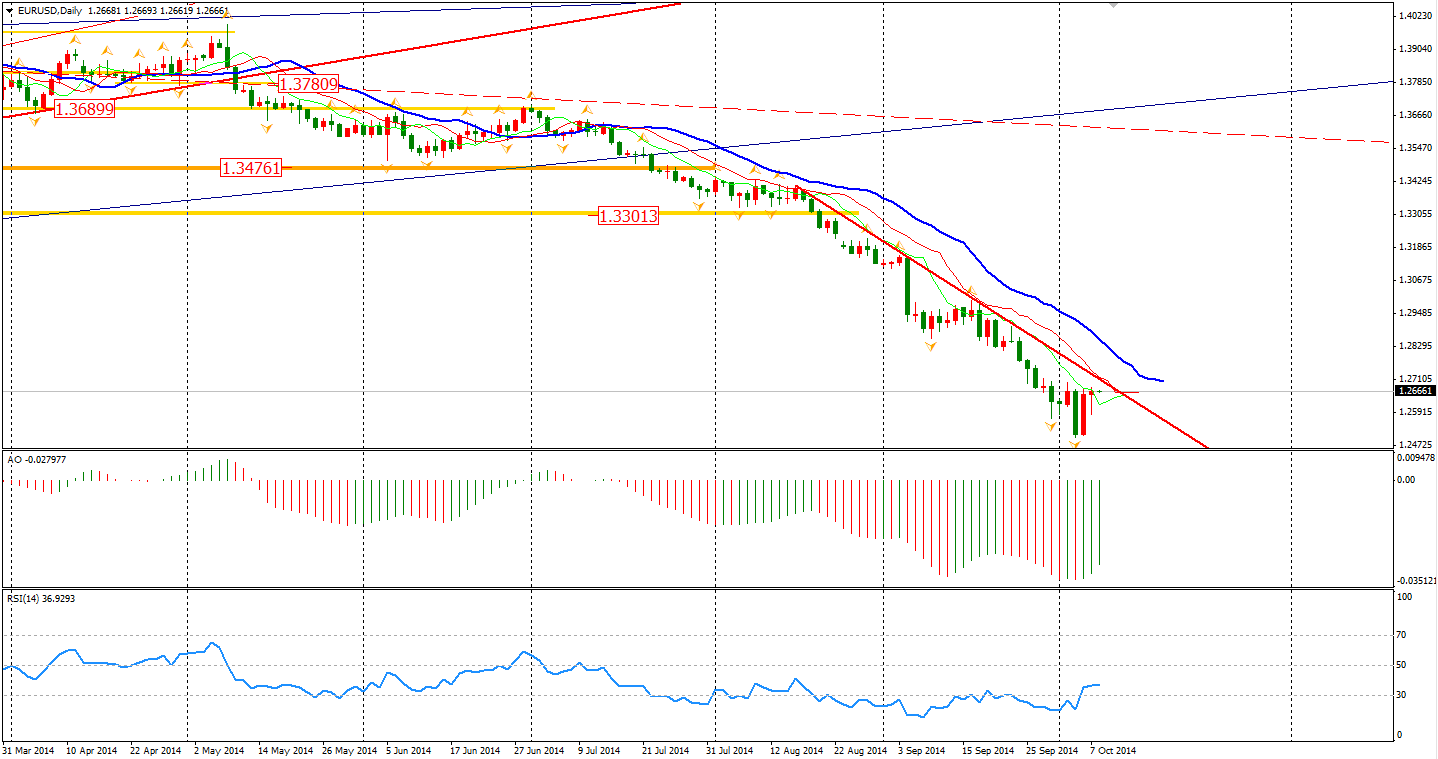

As other majors rebounded against the Dollar, the disappointing German factory orders dragged the performance of Euro. The data declined by 4% in August, showing the Eurozone’s largest economy is facing a difficult situation in economic growth. Its industrial production released on Monday was also lower than expected. These two data results were highly correlated with Germany’s GDP growth rate, which implies an overall weaker performance from Germany and the Eurozone.

The Asian stock markets were slightly weaker yesterday. The Nikkei Stock Average lost 0.67%. The ASX 200 fell 0.16% to 5284 – the 5320 level here will be the critical support. The European stock markets were dampened by the downbeat German data. The UK FTSE was down 0.75%, the German DAX pared 0.96% and the French CAC 40 Index plummeted 1.38%. U.S. stocks dropped sharply as well on concerns over slowing global economic growth. The S&P 500 lost 0.67% to 1935. The Dow edged down 0.81% to 16719, while the Nasdaq Composite Index dropped 1.56% to 4385.

On the data front, Chinese HSBC Services PMI will be released at 12:45 AEST. The Canadian Housing Starts will be at 19:30 AEST. And most importantly, US FOMC Meeting Minutes will be released at 5:00 am Thursday morning.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Dollar Retreating, Stocks Slump While Other Majors Rise

Published 10/07/2014, 07:31 PM

Updated 07/09/2023, 06:31 AM

US Dollar Retreating, Stocks Slump While Other Majors Rise

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.