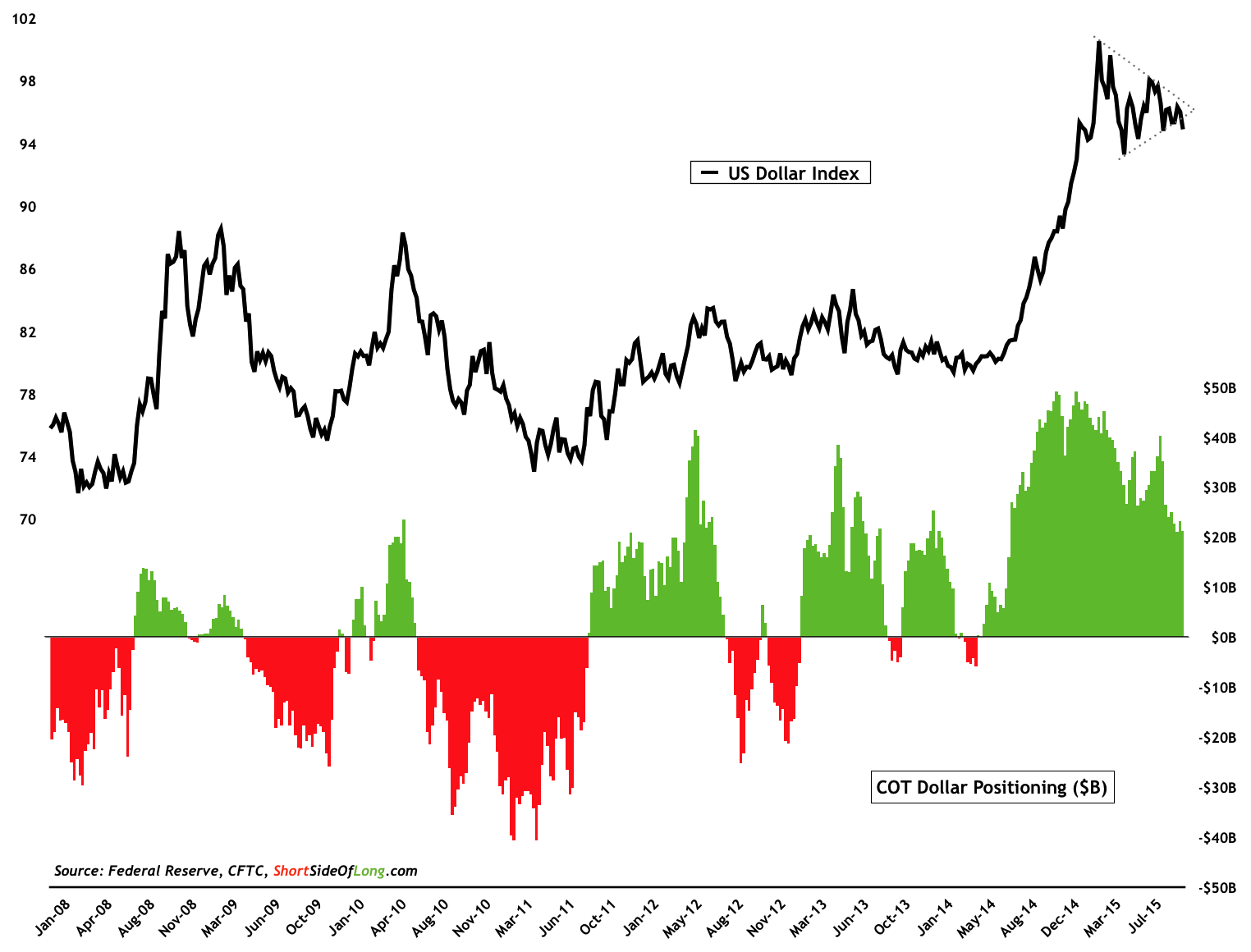

All the way back in March of 2015, just as everyone was extremely bullish on the US dollar with the view that a Fed rate hike as a done deal, we here at Short Side of Long predicted that a meaningful correction was in the cards for the greenback and that the Fed will not pull the trigger. We stated that:

“…even though I remain long the US Dollar (and short Aussie), a high probability exists where the greenback would correct in coming weeks and months. And since the run up was parabolic, the correction could be just as sharp. The catalyst for the USD pullback would be a FOMC surprise, where the initial rate hike is delayed even further. The thinking process was derived from the fact that the economy has weakened a bit, but more importantly inflation expectations have collapsed.” – FOMC Decision, Mar 19 2015

“It seems that the major inflection point on the US Dollar Index occurred during last weeks FOMC meeting. Therefore, foreign currencies will now have a chance to regain at least some of the losses suffered in the last 9 months or so. This is true in particular for currencies where hedge funds and other speculators are holding very large short positions [Ed: Euro had the largest short bets at the time]. From a contrarian point of view, a short squeeze could now be playing out and rebounds might be swift and rather powerful, catching many off guard.” – US Dollar Correction, Mar 25 2015

Overly optimistic bets on USD are still in a shake out process

Source: Short Side of Long

Those predictions sounded completely mad to the majority of market participants only six months ago. However, today it isn’t a prediction anymore, but an actual fact. We were completely correct in expecting slower global economic growth and therefore very limited probability that the Federal Reserve will hike short term interest rates, especially with the backdrop of ongoing falling inflation expectations.

As a result, in recent months we have seen a shakeout of US dollar bulls via the Commitment of Traders report. Hedge funds and other speculators continue to reduce net long bets on the buck, from around $45 to $50 billion in early 2015, all the way towards $20 billion contracts last week. Technically, the US dollar has now broken below its 200 day moving average and its short term triangle pattern.

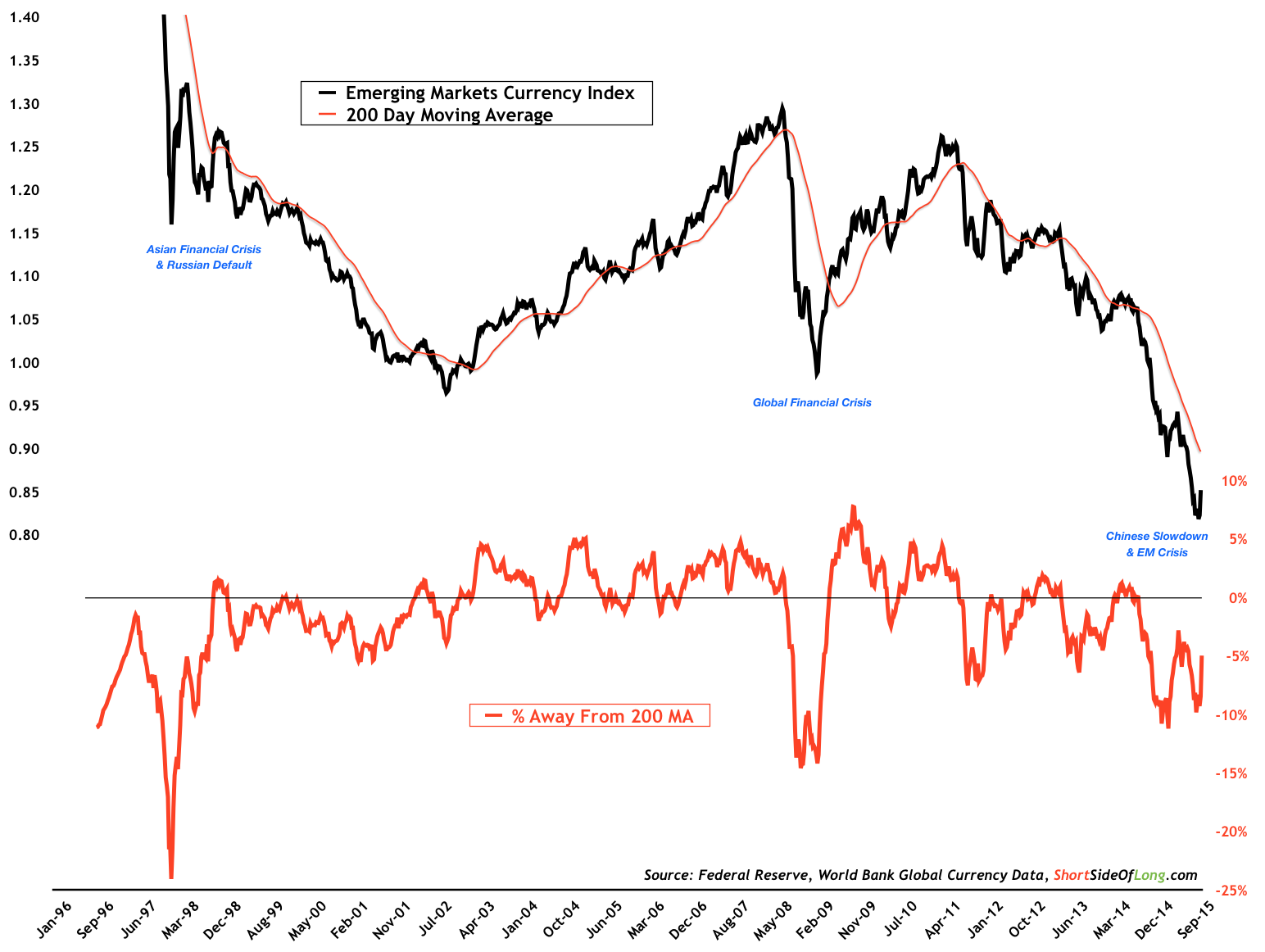

EM currencies have suffered the worst decline since 1998 crisis

Source: Short Side of Long

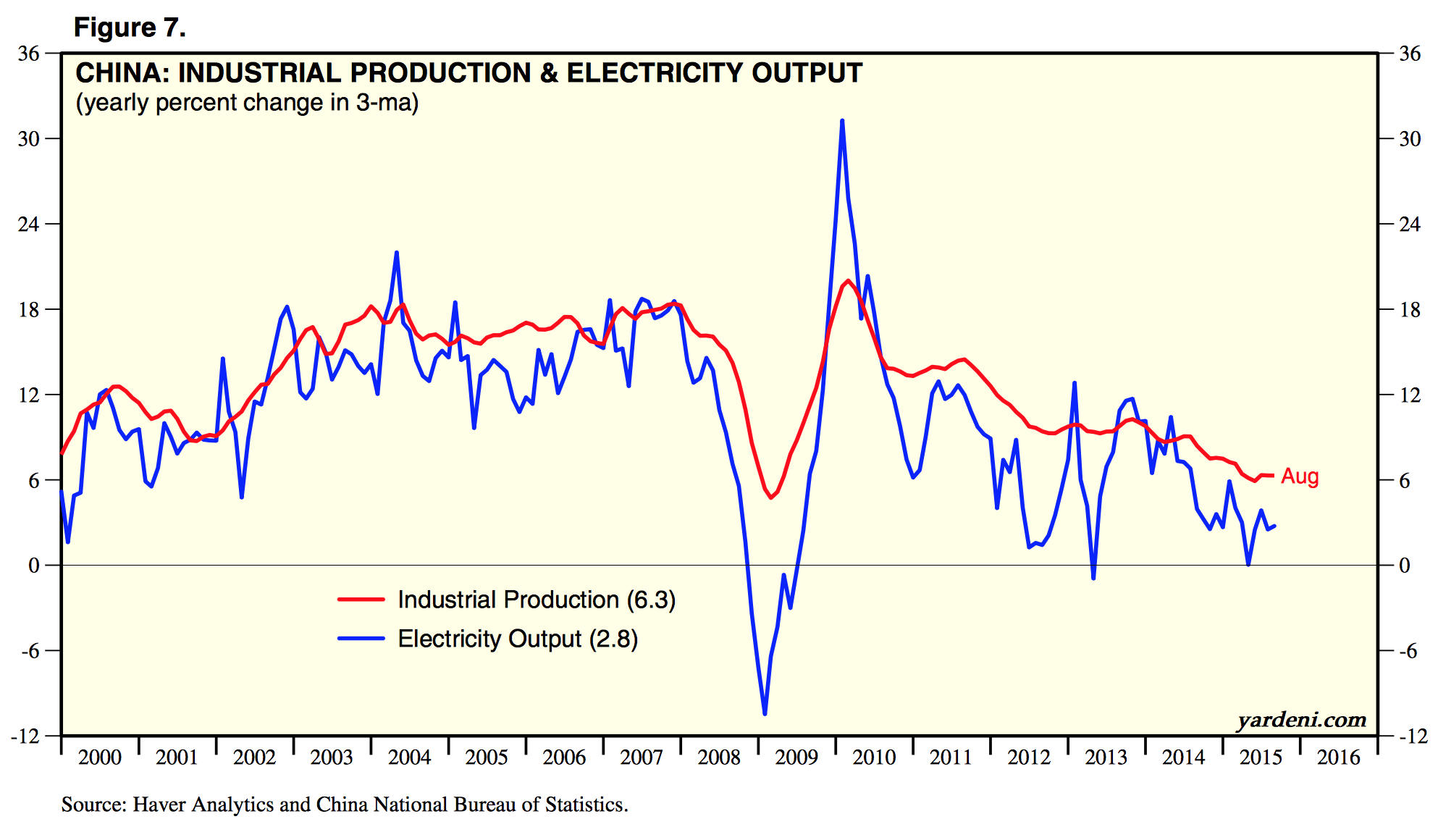

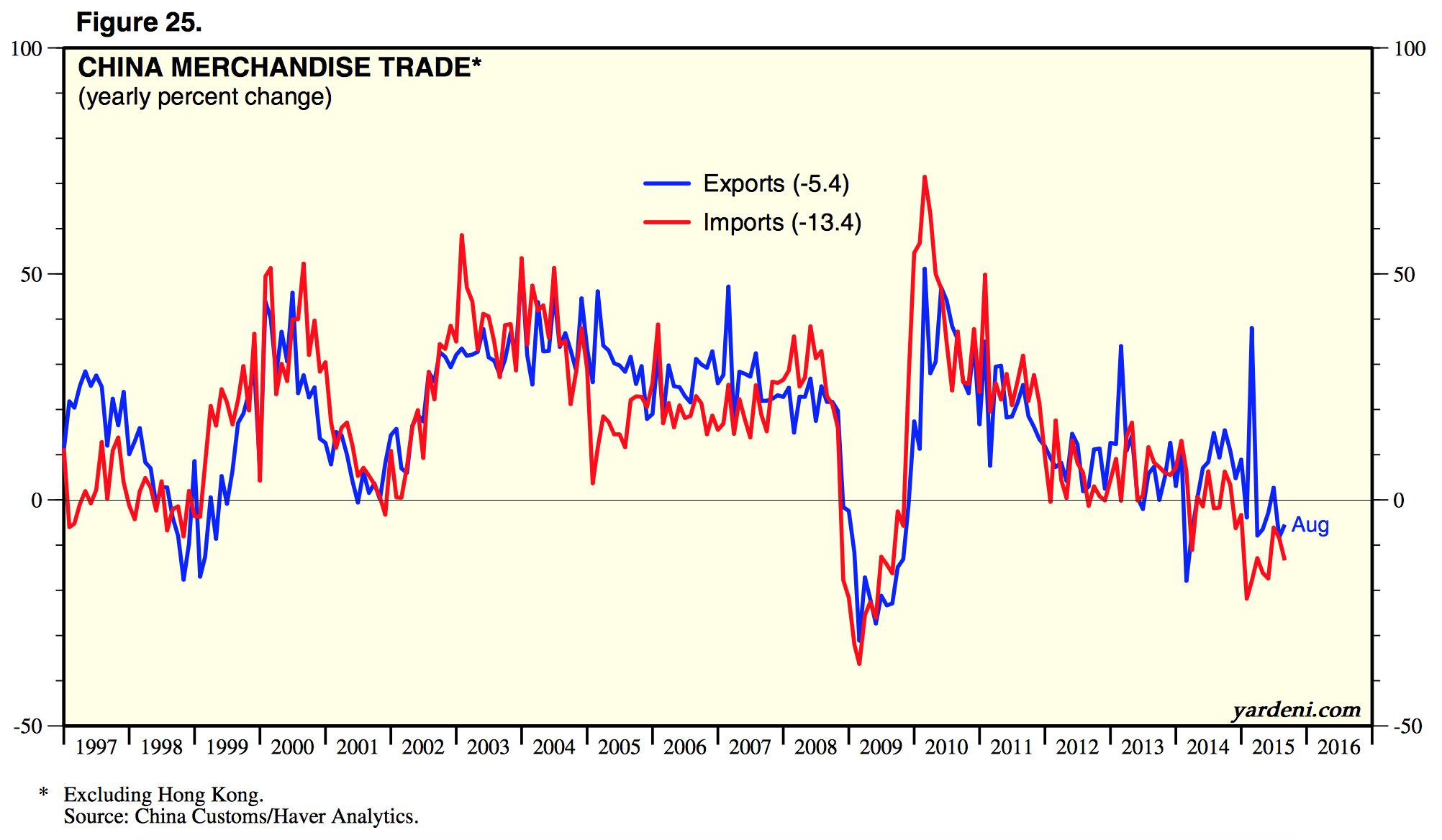

Emerging market currencies have been a lot weaker compared with other majors within the DXY Index such as the euro, yen and the pound. A major catalyst for this weakness is the significant slowdown in Chinese economic activity and import / export trade. It is hard to trust official data from any government and the same is the case for China. However, certain parts of the Chinese economy are definitely a lot weaker than their official headline numbers suggest (hence the sharp fall in EM forex).

Still, a recent delay in rate hikes by the FOMC and further US economic data deterioration (in particular last Friday’s jobs report), have given a confidence boost to some of the EM currencies around the world. Bad news is once again good news, as the Fed remains accommodative for longer.

We correctly predicted the Brazilian real’s intermediate bottom on the day of the reversal, in our recent post. Consequently, many other EM currencies also put in medium term bottoms and started their recoveries.

Slowing Chinese economic activity and trade are impacting world growth

Source: Ed Yardeni