Investing.com’s stocks of the week

Chart 1: US Dollar is extremely overbought and sentiment overly bullish

Source: Short Side of Long

Before last nights Federal Market Open Committee decision, I was talking to a friend at an amazing rooftop bar in Singapore, about the potential of future interest rate rises in the United States. We covered a few case scenarios and the one we discussed in-depth was the fact that the US dollar rallied way too far, way too fast over the last 9 months. Sentiment on the currency was overly bullish, COT positioning skewed towards the net long side and various technical indicators historically overbought (refer to Chart 1).

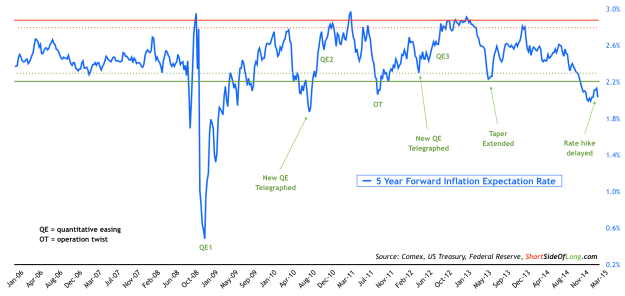

I explained that, even though I remain long the US dollar (and short Aussie), a high probability exists where the greenback would correct in coming weeks and months. And since the run up was parabolic, the correction could be just as sharp. The catalyst for the USD pullback would be a FOMC surprise, where the initial rate hike is delayed even further. The thinking process was derived from the fact that the economy has weakened a bit, but more importantly inflation expectations have collapsed (refer to Chart 2).

We should be able to notice that the current readings of the 5 Year Forward Break Even Rate is below level with which the FOMC is confirmable with. As a matter of fact, in the past the Fed has remained dovish (cut rates or started QE) whenever the inflation expectations fell to similar levels or even lower. It seems that Janet Yellen has followed the script quite well, and just about all asset classes rallied on the news. US dollar was down sharply. The question now is how long will the Fed remain patient for? Some are speculating that we will see no rate hikes in 2015.

Chart 2: Inflation expectations are at levels where Fed remains dovish...

Source: Short Side of Long