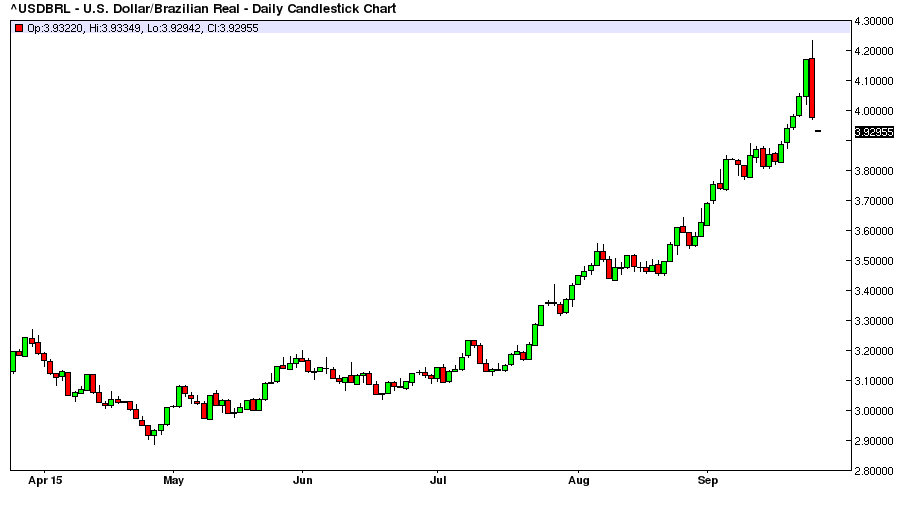

After weakening dramatically for months, Real had a major reversal day

Source: Bar Chart

It is hard to believe that the US Dollar managed to bottom out against the USD/BRL all the way back in July of 2011 at 1.53 Reals per Dollar. Initially, Dollar strength was slow and progressive, increasing towards 2008 highs of around 2.5 Reals. However, in 2015 it has really been the story of Brazilian chaos with the worst recession since 1930s and political scandals. The currency has been weakening dramatically and over the last four months has gone from 3 Reals towards 4.2 Reals per 1 US Dollar.

Sentiment surrounding the country has been moving from negative to outright bearish and in the last 24 hours has potentially reached some kind of an infliction point. Last nights price action was a sharp spike in the US Dollar, followed by an even sharper reversal. There is now a potential for the oversold currency to rebound and stabilise for awhile, which in turn could put a temporary floor for the MSCI Brazil Index (NYSE:EWZ).

MSCI Brazil and equivalent ETFs have suffered a catastrophic bear market

Source: Short Side of Long