In quite a few previous articles, I have been writing about US dollar strength and how it has affected so many global asset classes. Beginning today, and continuing for the next several posts, I will be covering the possibility that USD rally has now ended, at least for a while, and how this might benefit some of the asset classes which have been under pressure for so long.

Today we'll start with foreign currencies.

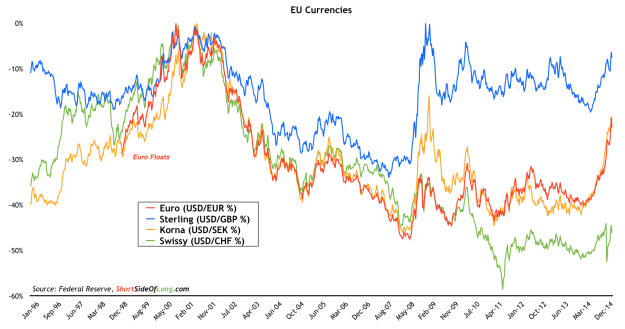

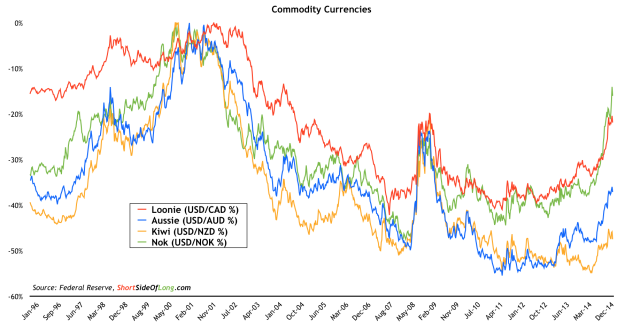

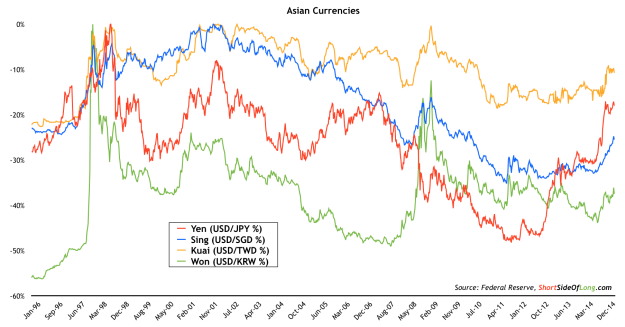

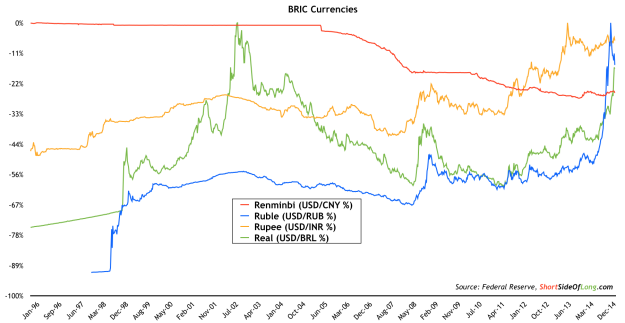

Charts 1, 2, 3 and 4: Foreign currencies have been demolished by the USD

Source: Short Side of Long

When looking at Charts 1 through 4, we can clearly see that the US dollar has just about demolished all major currencies around the world. In Europe, the Swiss franc has managed to hold its own, while the euro and Swedish krona have suffered immensely. As a matter of fact, the Swedish krona is the worst performer out of all the global majors.

In the commodity complex, the Norwegian krone and Canadian dollar have under-performed the Australian dollar and especially the New Zealand dollar. The most likely catalyst has been a sharp correction in energy commodity prices, such as Crude Oil. On the Asian continent, the Taiwan dollar, and to a lesser degree the Korean won have managed to outperform, avoiding the steep losses seen by the Japanese yen over the last two years. Also of interest, the Singapore dollar has been under strong selling pressure in recent months.

Finally, we focus on the major Emerging Markets (BRICs), where three out of the four currencies have suffered steep losses. In 2013, India's rupee was under pressure, but by early 2014 the Russian ruble made that look like a walk in the park with a huge crash. The Brazilian real has been super weak as of late, playing catch up with its own weakness. The only currency that remains strong in this complex is the Chinese yuan (renminbi).

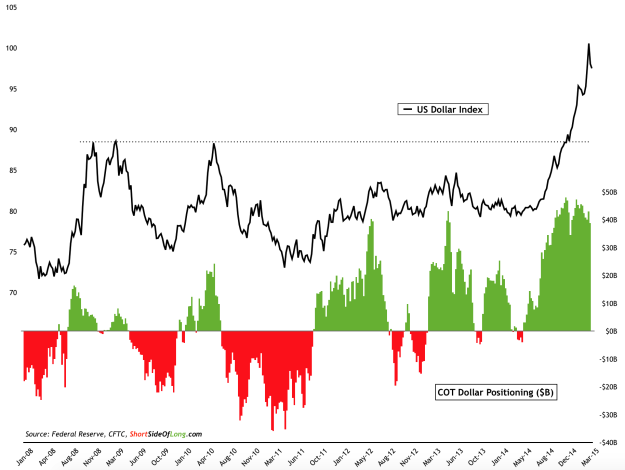

Chart 5: Possibility of a shake out as funds remain heavily long the USD

Source: Short Side of Long

It seems that the major infelction point on the US Dollar Index occurred during last week's FOMC meeting. Therefore, foreign currencies will now have a chance to regain at least some of the losses suffered in the last 9 months or so. This is true in particular for currencies that are being heavily shorted by hedge funds and other speculators. From a contrarian point of view, a short squeeze could now be playing out and rebounds might be swift and rather powerful, catching many off guard.