The strength of US Dollar still exists yet we are now seeing more hesitation from the market pushing the Dollar to a higher level.

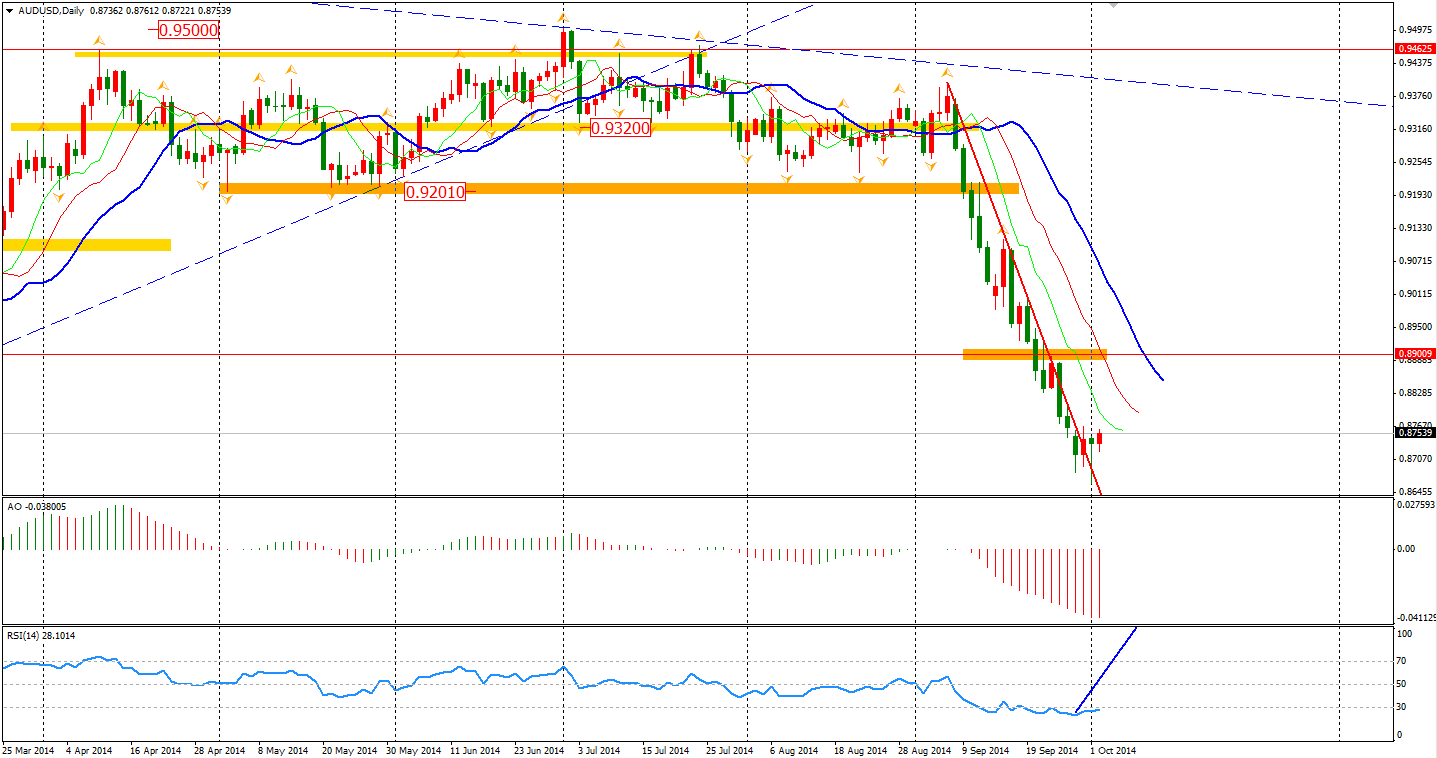

After the news that China’s official October PMI is 51.1 – the same as the previous one, the Aussie Dollar slumped to 0.87 in response to the disappointing retail sales. The growth was only 0.1% in August, missing the expected 0.4% showing a weakness in the domestic market recovery, especially in the depressed mining industry.

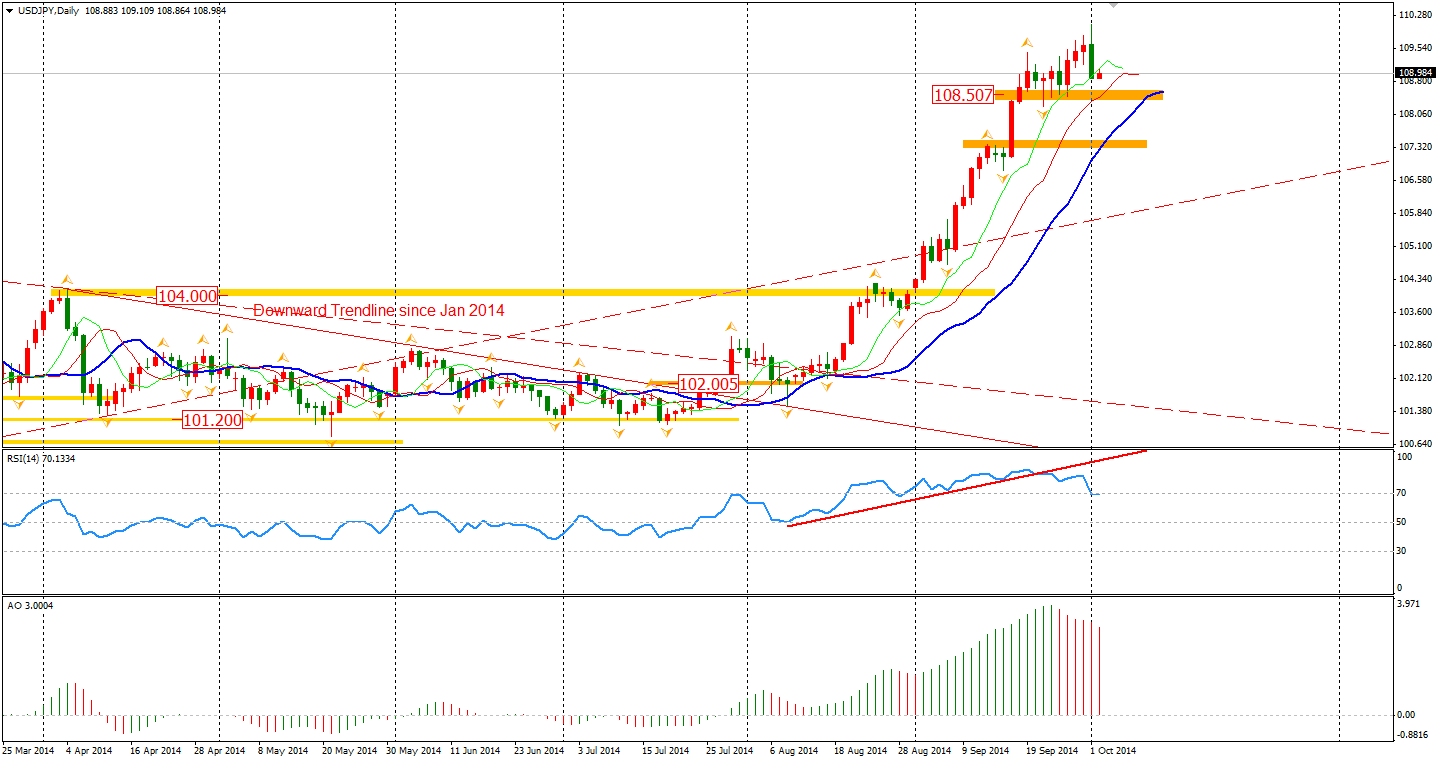

In the Asian trading session, another unmissable moment came from the USD/JPY. The dollar rose above 110 yen for the first time since August 2008. These two currency pairs reached the technical targets that we had forecasted a month ago. This meeting of targets suggests that the trend may be close to the end for now. The Dollar/Yen later fell from the 110 level and slumped to a 108.90 finish earlier today.

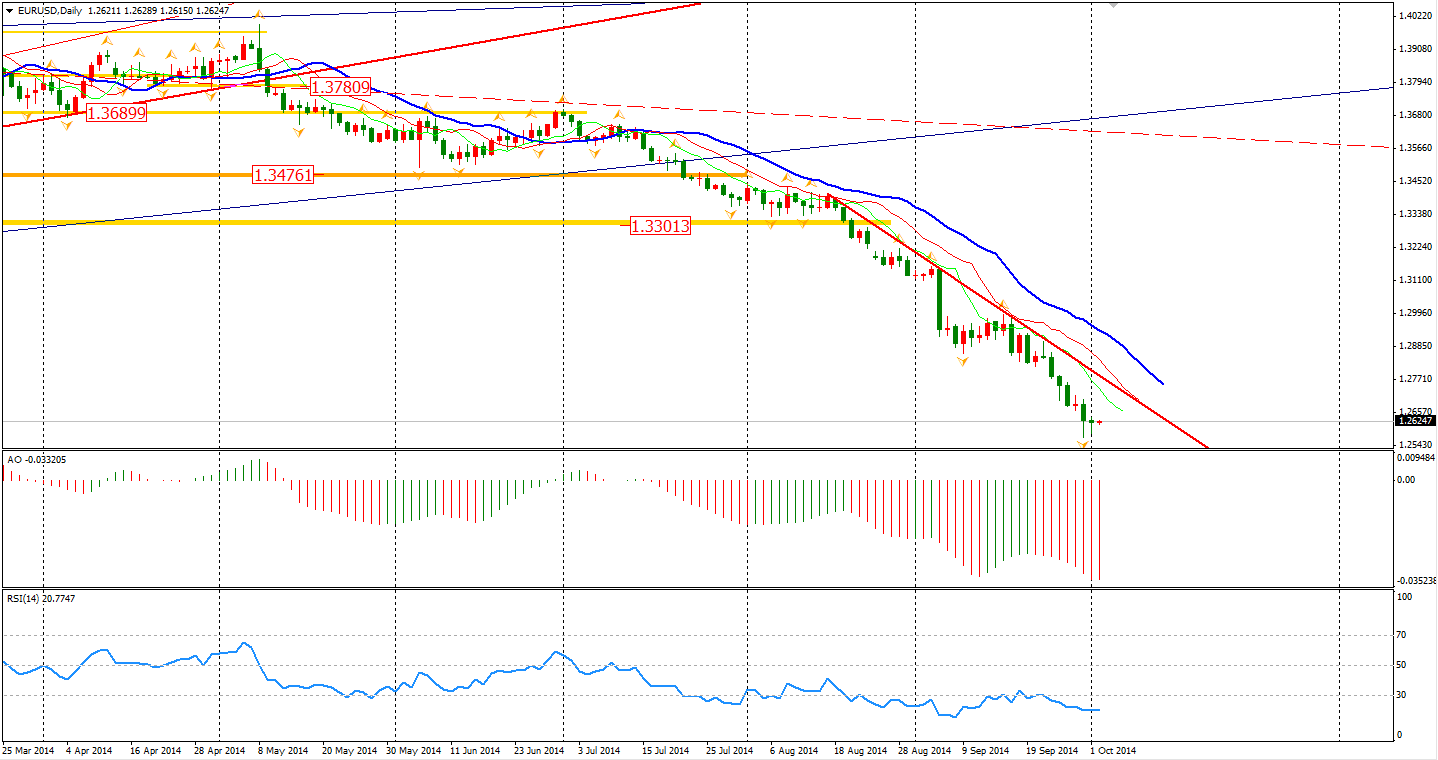

Similar worrisome signs are showing in Europe as well. Eurozone factories expanded at the slowest pace in 14 months, with manufacturing contracting in Germany, France, Austria and Greece. The figure has added extra pressure on the ECB to make moves on averting deflation. However, it seems like market participants are waiting for the decision tonight, and the Euro/Dollar consolidated near its recent lows of around 1.26.

The Asian stock markets were mixed on Wednesday as the Chinese markets were closed for the ‘golden week’ holiday. The Nikkei Stock Average lost 0.56%. The ASX All Australian 200 bounced 0.78% to 5334. In European stock markets, the UK FTSE was down 0.98%, the German DAX slumped 0.97% and the French CAC Index lost 1.15%. U.S. stocks slumped on downbeat economic data. The S&P 500 lost 1.32% to 1946. The Dow edged down 1.40% to 16805, while the NASDAQ Composite Index dropped 0.1.32% to 4422.

On the data front, Australia Building Approvals and Trade Balance will be released at 11:30 AEST. The UK Construction PMI will be at 18:30. ECB monetary decision will be released tonight and the US weekly Unemployment Claims will be at 22:30.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Disappointing Data Pared Stocks And The Dollar

Published 10/01/2014, 10:01 PM

US Disappointing Data Pared Stocks And The Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.