Coauthored with Jackie Doherty, the senior contributing editor at Yardeni Research, Inc.

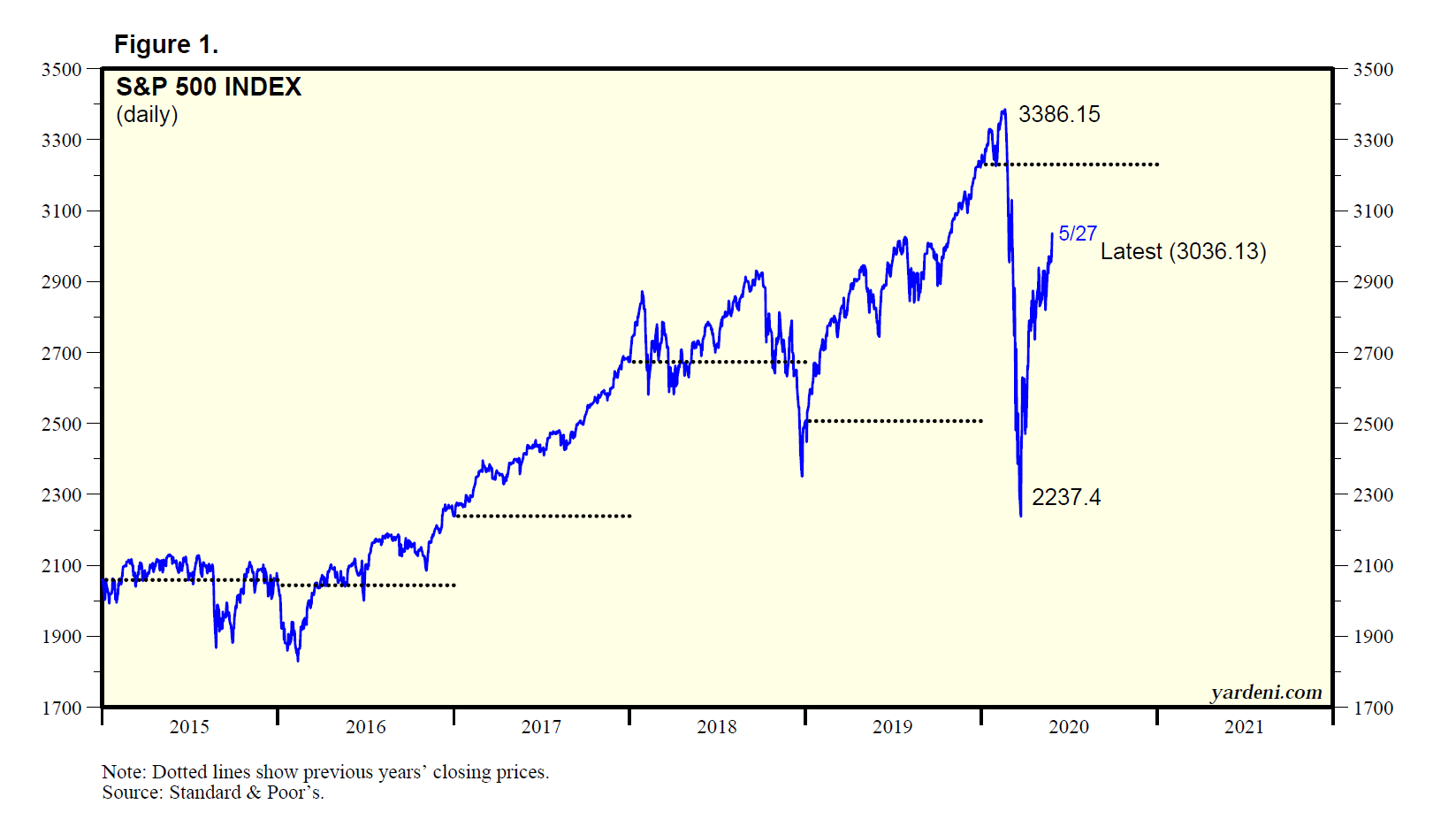

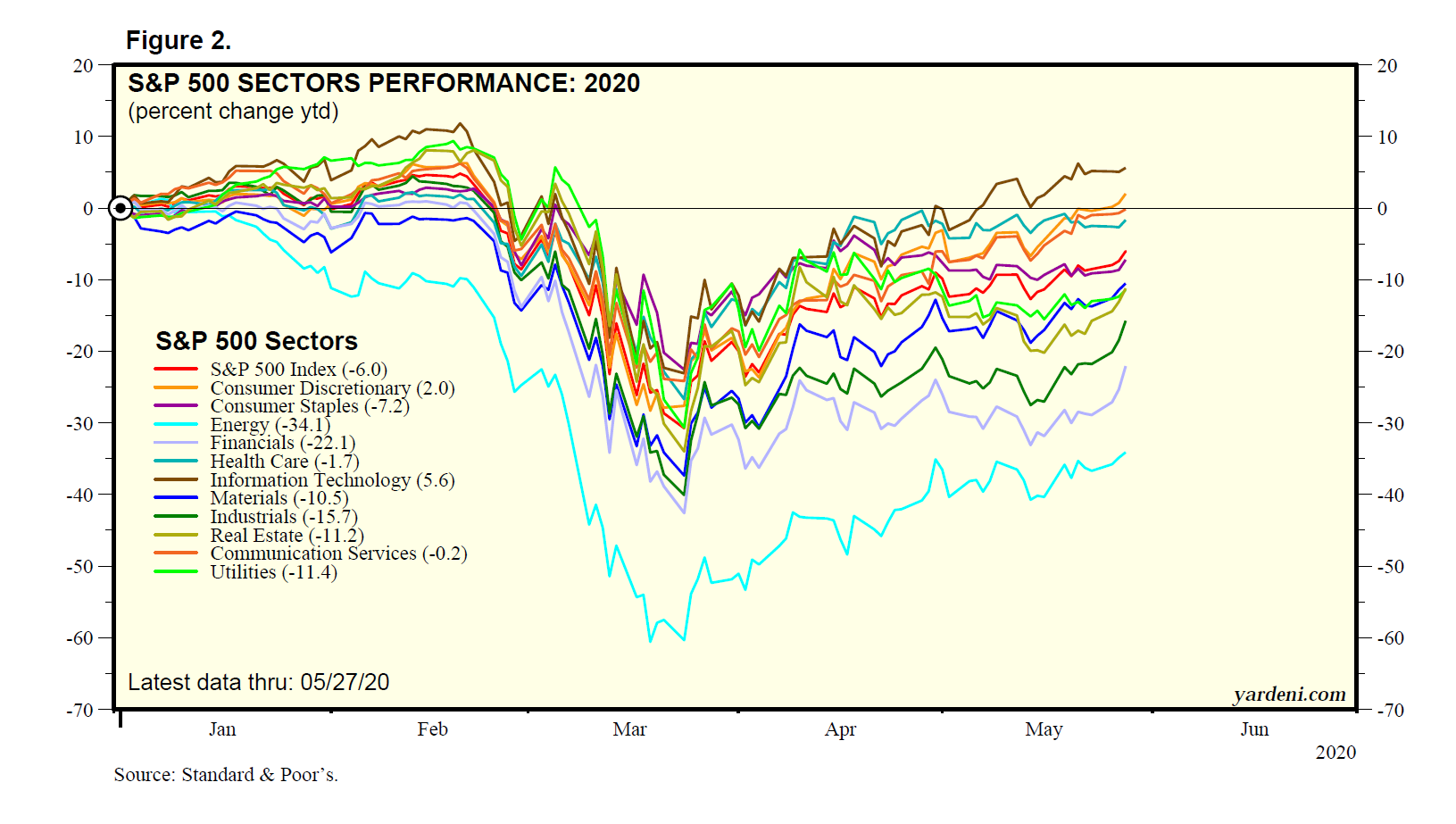

The major US equity market indexes continued to rebound, with the Dow Jones Industrial Average crossing back above the 25,000 marker on Wednesday, fueled by the slow reopening of the US economy in the wake of the COVID-19 shutdown. The S&P 500 is now up 35.7% from its March 23 low and is down only 10.3% from its February 19 high (Fig. 1). Investor confidence in the improving economic outlook helped some of the most cyclical sectors outperform on Wednesday, with the S&P 500 Financials up 4.3% and S&P 500 Industrials up 3.3% (Fig. 2). They both clearly outperformed the 1.5% increase in the S&P 500 yesterday.

The Fed’s ultra-easy monetary policies continue to stimulate rebalancing out of bonds and into stocks, boosting forward P/Es faster than forward earnings are dropping. In addition, the gradual reopening of the US economy confirms that we are making progress in our battle with COVID-19. Social distancing should continue to keep a lid on new infections if we keep our distance from others and wear masks. If we are very lucky, a vaccine may be available later this year or early next year.

Nevertheless, investors also should keep an eye on the battle brewing between the US and China. The Trump administration laid out its approach to the country’s relationship with China in a remarkable report that was sent to certain congressional committees on May 21. It throws in the towel on expectations that China will behave according to the global norms of a developed country, stating that we must be “clear-eyed” in our assessment of China and how it has behaved. It also lays out the Trump administration’s return to “principled realism,” acknowledging the strategic competition between the countries. Finally, it proceeds to list the actions the administration has taken to protect the US from China.

Individually, the ideas and actions listed in the report are nothing new to those who have followed the deterioration of US/China relations over the past couple of years. Indeed, Vice President Mike Pence foreshadowed much of the report in an October 4, 2018 speech. But what the document does very effectively is connect economic, military, and political dots to present a picture of a Chinese government behaving badly under the leadership of the Chinese Communist Party (CCP) and a US government, under the Trump administration, acting to protect its interests. Any doubt that the US and China have entered a cold war will fade after reading this document.

In many ways, the report is a US declaration of a cold war with China that accuses the Chinese government of starting this war many years ago on US interests, in particular, and on the post-WWII global order based on free trade with open markets, in general. The report implicitly declares that it is China, not the US, that has upset this order. Here are some of the highlights:

(1) Seeing China more clearly. The Trump administration’s report, United States Strategic Approach to the People’s Republic of China, first reviews the relevant past developments. It notes that US policy was based on hopes that deepening engagement with China would spur the economic and political opening of that country, leading it to become a responsible global citizen with a more open society. However, China did not become a more open society. Its reforms have stalled or reversed. Instead, China has chosen to “exploit the free and open rules-based order and attempt to reshape the international system in its favor. … The [Chinese Communist Party’s] expanding use of economic, political, and military power to compel acquiescence from nation states harms vital American interests and undermines the sovereignty and dignity of countries and individuals around the world.”

(2) Chinese misdeeds aired. The Trump administration doesn’t hold back when enumerating China’s various wrongdoings. After joining the World Trade Organization (WTO) on December 11, 2001, Beijing failed to continue opening its markets. Instead, the report contends China exploited the benefits of WTO membership by becoming the world’s largest exporter, while protecting its domestic markets. The country’s economic policies have led to “massive industrial overcapacity that distorts global prices and allows China to expand global market share at the expense of competitors operating without the unfair advantages that Beijing provides to its firms.”

In addition, the People’s Republic of China (PRC) does not treat companies operating in China fairly. It forces US companies to transfer technology to Chinese partners, restricts US companies’ ability to license their technology on market terms, directs and facilitates acquisition of US companies and assets to obtain cutting-edge technology, and conducts and supports unauthorized cyber intrusions into US networks to steal sensitive information and trade secrets.

The administration casts aspersions on China’s One Belt One Road projects, which it believes the country uses to advance its interests around the world and reshape international norms. These projects are “characterized by poor quality, corruption, environmental degradation, a lack of public oversight or community involvement, opaque loans, and contracts generating or exacerbating governance and fiscal problems in host nations.”

The report continues its criticisms by noting China’s failure to reduce pollution: China has been the world’s largest greenhouse gas emitter; it exports polluting coal-fired power plants to developing countries; and it is the world’s largest source of marine plastic pollution.

The administration criticized the CCP’s methods of leadership at home. The CCP has purged political opposition; prosecuted bloggers, activists and lawyers; arrested ethnic and religious minorities; censored the media and others; and enacted surveillance and social credit-scoring of its citizens. Beijing has detained more than a million Uighurs and other minorities in indoctrination camps and persecuted people based on religion. And now China is exporting the technology and techniques it uses to control its citizens to other authoritarian states.

The report discusses Beijing’s attempts to compel or persuade Chinese nationals and others living in the US to steal technology and intellectual property from companies and academic institutions. It notes that the country is attempting to intimidate neighboring countries by “engaging in provocative and coercive military and paramilitary activities in the Yellow Sea, the East and South China Seas, the Taiwan Strait, and Sino-Indian border areas” and that it is compelling companies such as Huawei and ZTE (HK:0763) to cooperate with Chinese security services, creating security vulnerabilities in foreign countries.

(3) US response. Going forward, the Trump administration intends to respond to the PRC’s “actions rather than its stated commitments.” The Department of Justice and the FBI are working to identify and prosecute China’s attempts to steal trade secrets, hack systems, engage in economic espionage, disrupt US infrastructure and supply chains, and subvert American policy.

The US will counter foreigners seeking to influence US policy and respond to CCP propaganda in the US. “We are working with universities to protect the rights of Chinese students on American campuses, provide information to counter CCP propaganda and disinformation, and ensure an understanding of ethical codes of conduct in an American academic environment.” And it will prevent Chinese companies from accessing US technology “through minority investments to modernize the Chinese military.” The US is looking to prohibit the import of counterfeit items, including drugs. And it will use tariffs and work with the European Union and Japan to counter abusive trade practices, including industrial subsidies and forced technology transfers.

The US continues to improve our own military capabilities, help arm our allies, and encourage China to negotiate new arms-control agreements and enter strategic-risk-reduction discussions. “The United States military will continue to exercise the right to navigate and operate wherever international law allows, including in the South China Sea (NYSE:SE).” We will maintain strong unofficial relations with Taiwan and, as Beijing increases its military, the US will assist the Taiwan military to maintain a credible self-defense to deter aggression. It reinforced prior US calls to respect the rights of Uighurs, Muslims, Tibetan Buddhists, and others being persecuted.

The report noted that the US will criticize China if it doesn’t uphold its international commitments to Hong Kong. Interestingly, the administration’s accusations about China’s role in spreading COVID-19 were not mentioned in the report.

(4) No retreat. In many ways, the conclusion of the 16-page report appears on page 8: “Similarly, the United States does not and will not accommodate Beijing’s actions that weaken a free, open, and rules-based international order. We will continue to refute the CCP’s narrative that the United States is in strategic retreat or will shirk our international security commitments. The United States will work with our robust network of allies and likeminded partners to resist attacks on our shared norms and values, within our own governance institutions, around the world, and in international organizations.”

In all, the report made clear that the administration has reevaluated how the US understands and responds to China. The US/China cold war passes the duck test: If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

(5) Bad ending for Hong Kong. Given the events unfolding in Hong Kong, the report takes on even more weight. Protesters returned to Hong Kong’s streets Wednesday after China announced it would write a new national security law for Hong Kong that would prohibit “splittism, subversion, terrorism, any behaviour that gravely threatens national security and foreign interference,” a May 27 FT article explained. The proposal was expanded on Tuesday to also prohibit activities that would seriously endanger national security, which could be interpreted as preventing activists’ protests. If the proposal becomes a law, it would be the first time China bypassed Hong Kong’s legislature and public consultation process to impose a law carrying criminal penalties.

President Trump responded on Tuesday, saying “he is preparing to take action against China this week” over China’s proposed national security laws for Hong Kong, a May 26 Reuters article reported. No details were given. But on Wednesday, Secretary of State Mike Pompeo reported that the US no longer considers Hong Kong autonomous from China. The new designation could change Hong Kong’s favorable trade relationship with the US and open up Chinese officials to sanctions, a May 27 CNBC article reported.

“Hong Kong and its dynamic, enterprising, and free people have flourished for decades as a bastion of liberty, and this decision gives me no pleasure. But sound policy making requires a recognition of reality,” Pompeo said, according to CNBC. “While the United States once hoped that free and prosperous Hong Kong would provide a model for authoritarian China, it is now clear that China is modeling Hong Kong after itself.”

(6) No market impact, so far. It’s interesting to recall that the stock market’s 20% correction in late 2018 was partly attributed to Pence’s belligerent October 4, 2018 speech presenting a litany of complaints about China. The speech was similar to the administration’s latest assessment and set the stage for Trump’s escalating trade war with China until a “Phase 1” deal was reached in January of this year. This time, the market seems totally unfazed by the rapidly deteriorating relations between the US and China. We will continue to monitor the situation to see if this becomes the market’s next worry.