Can US taxpayers afford to fund another government bailout of the US Banking Sector, if we see a catastrophic blow-off occur at the top of their respective parabolic spikes, especially...

- in the wake of the Biden administration's spending spree, to date, together with their monumental proposals of rebuilding or "re-imagining" America, post-COVID-19 pandemic, at a cost of $Trillions more (e.g., the "Green New Deal"),

- if negative consequences occur after Biden's proposed tax hikes are passed by Congress,

- as taxpayers try to cope with the rapidly-escalating costs associated with the unprecedented influx of hundreds of thousands of illegal immigrants flooding across the southern border each month (many of whom have COVID), as well as drug cartels and drugs, gangs, sexual predators, terrorists, and human traffickers, that began post-Biden election and is now described as a humanitarian crisis, a national health crisis, and a national security crisis by border agents, Governors, mayors, and sheriffs of bordering states and towns, as well as members of Congress...attributable to Biden's new border and ICE policies. It's being completely ignored by the President and Vice-President (VP Harris was put in charge of this issue by Biden), and neither one has even bothered to visit the border and speak to these front-line experts about this catastrophe,

- etc., etc., etc.

The National Debt is already over $28 Trillion, and rising fast, especially with President Biden's out-of-control spending agenda, costing trillions of additional dollars.

I can't predict the timing of such an event, or identify its catalyst, but I think we'll see another catastrophic blow-off top happen in the banking sector in the not-too-distant future...judging by the steepness of, and rabidness associated with, the current parabolic spikes. The risk is there..."caveat emptor."

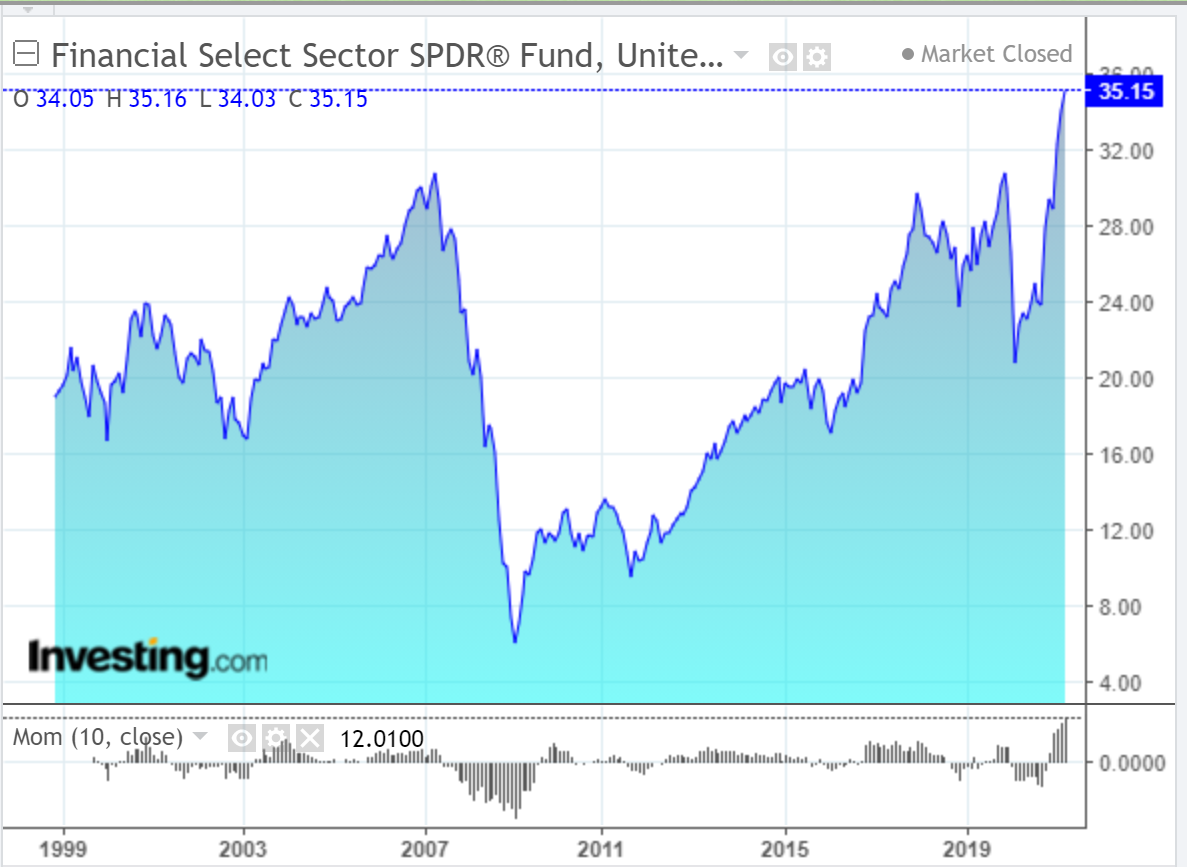

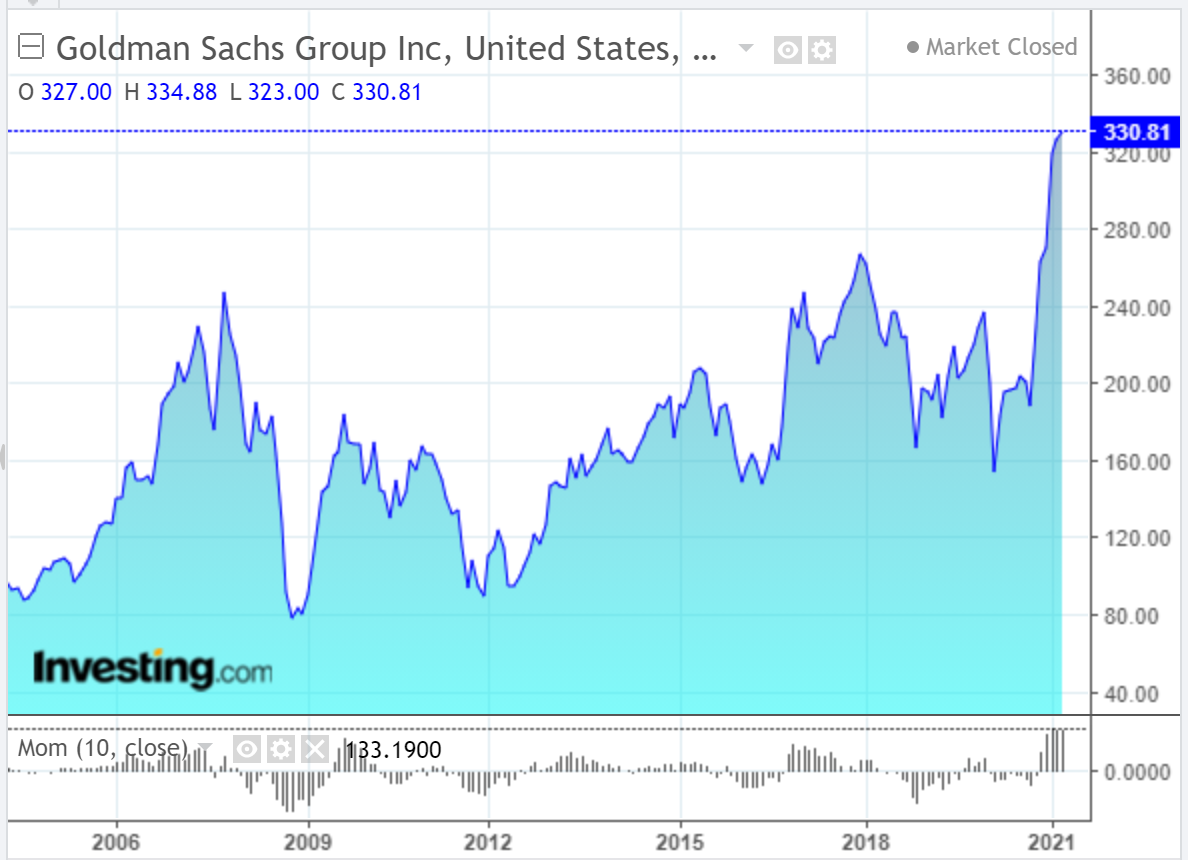

The following charts show that the rapid increases in the price of these bank ETFs (SPDR® S&P Regional Banking ETF (NYSE:KRE), Financial Select Sector SPDR® Fund (NYSE:XLF) and stocks (JPMorgan Chase (NYSE:JPM), Goldman Sachs (NYSE:GS)) formed during the full throes of the pandemic, from March 2020 (when the economy, jobs, healthcare, personal spending, etc., tanked, and hundreds of thousands of people died from the virus and other health problems resulting from mass lockdowns across the country and around the world).

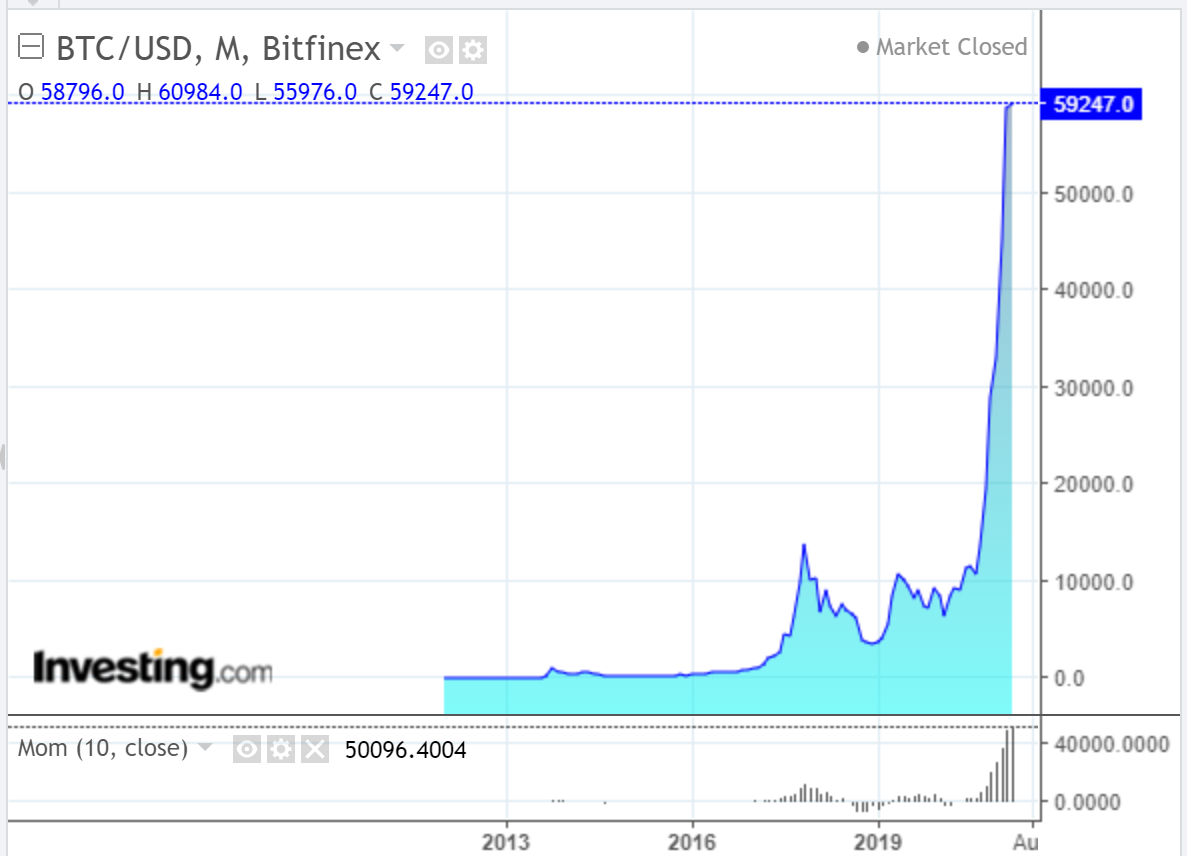

Time will tell whether these parabolic price rises were attributable to sound judgement based on assumptions of a quick, sustainable economic rebound, or whether it was shaky speculative investing based on an overestimation of a rapid recovery...e.g., did they invest heavily in Bitcoin (check out the parabolic increase from March 16, 2020 to the high in March of this year..."The Emperor wears no clothes!").

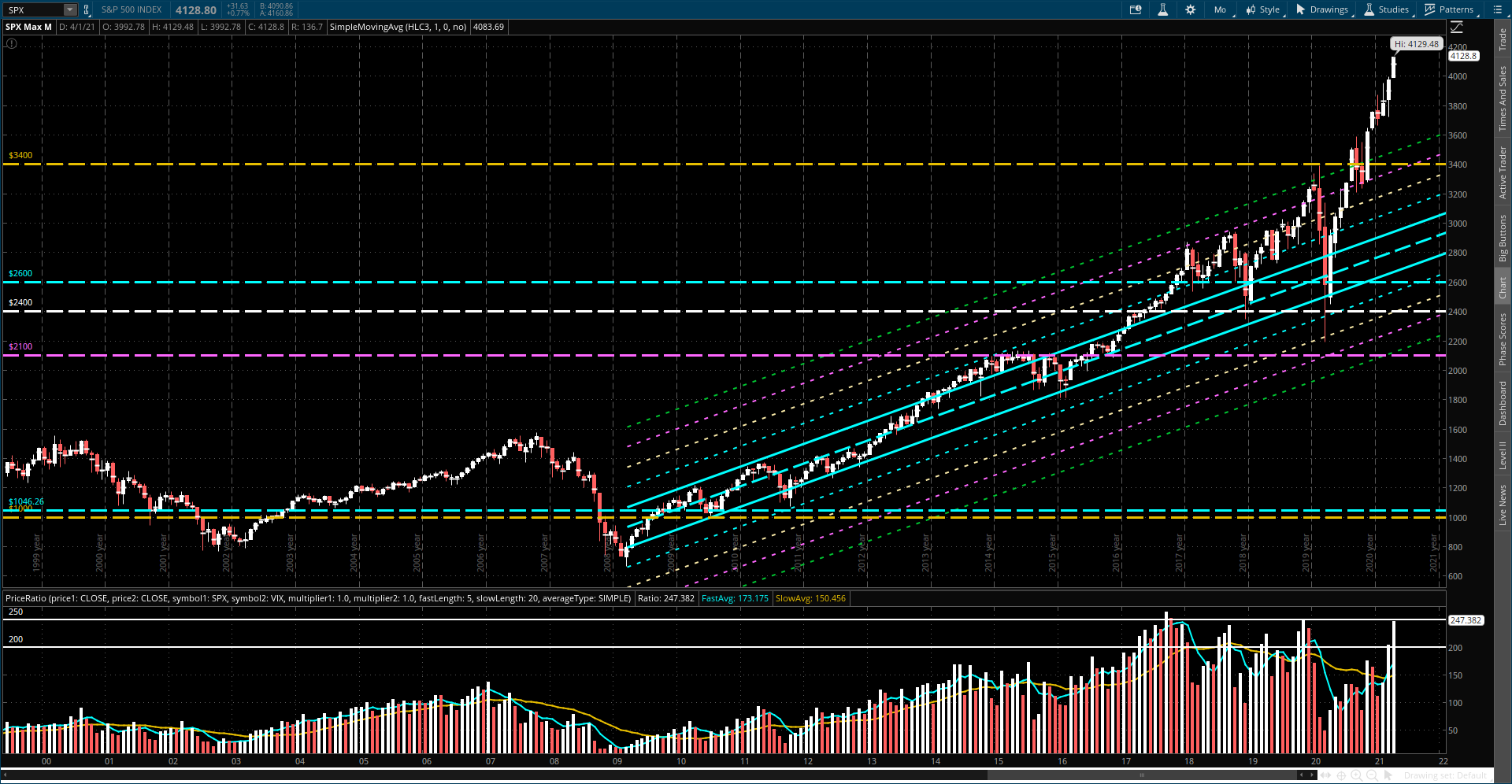

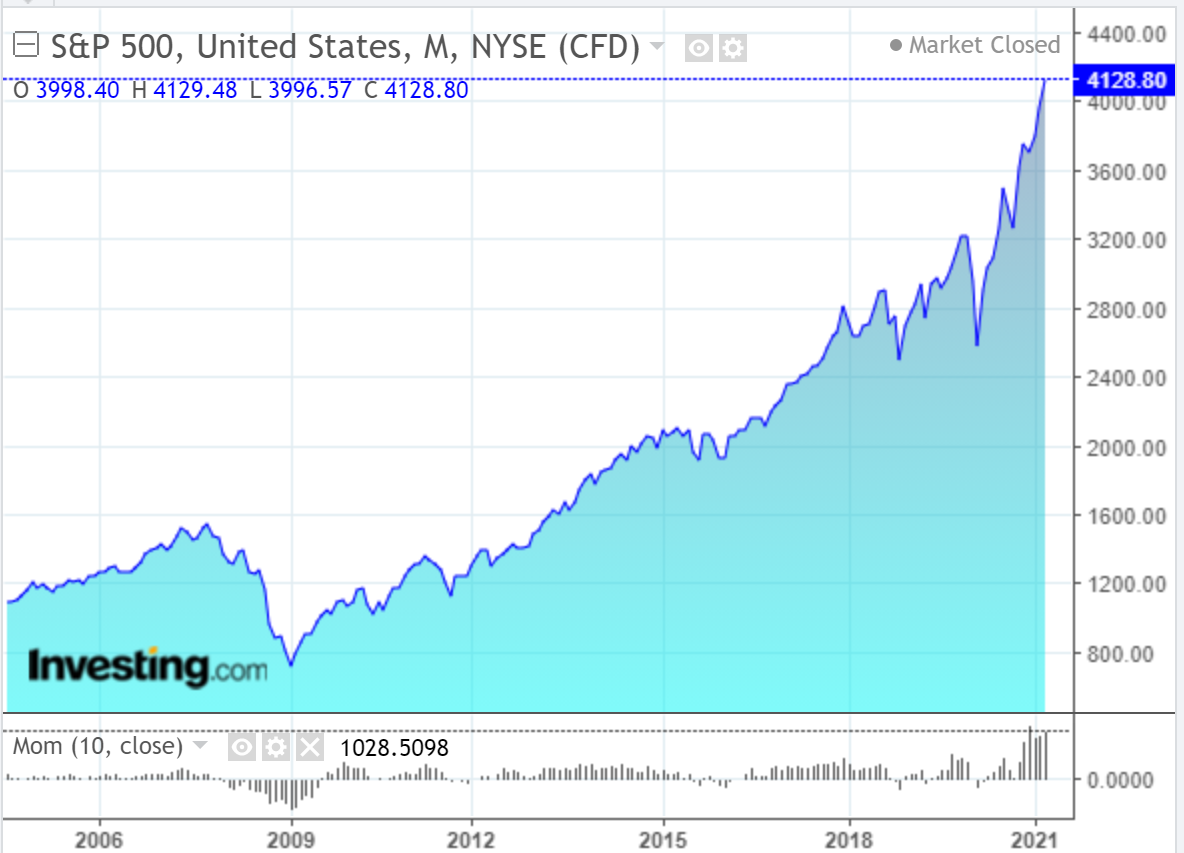

The following monthly chart of the S&P 500 Index (SPX) contains the SPX:VIX ratio in histogram format at the bottom.

Typically, over the past four years, when the price on this ratio reached its current level, the SPX, either paused and consolidated, or pulled back...sometimes dramatically.

Furthermore, the SPX has spiked far above the +5 standard deviation of the long-term uptrending regression channel...a sign of extreme equity frothiness.

Keep an eye on this ratio for clues as to strength or weakness in the SPX in the coming weeks.

In the meantime, I expect volatility to increase, as FOMO (fear of missing out) traders spike prices even higher, before we see any kind of substantial pullback or parabolic plunge.