Daily Briefing

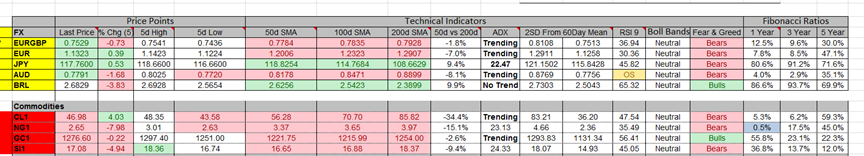

Currencies

- EUR/USD: The pair has formed a symmetrical triangle pattern on a 30 minute time frame. The next resistance is at 1.15 and the support is at 1.10.

- USD/JPY: The pair bounced from OUR Support level which was given in our analysis on Friday 30 Jan. The price is still below the 50day and 100 day moving averages on a 30 minute time frame. The next support is at 116.90 and resistance at 118.83.

- GBP/USD: The pair is trading below its downward trend line on a 30 minute time frame. The resistance is near the 1.5272 and support is at 1.4942.

Indicators

Indices

- Asian Markets closed mostly lower on the first trading day of the week. The Shanghai is the worst performing index during the session and it closed lower with a loss of 2.57%. The index is down nearly by 3.99% in the past 5 days.

- European stock futures are trading higher during the early hours of trading. The DAX index is the best performing index during the session and it is trading higher with a gain of 0.82%. The index is up by almost 0.28% in the past 5 days.

- US Indices futures are trading higher ahead of the ISM data. Most indices closed lower during the last session and the S&P 500 index was the worst performer with a loss of 1.30%.

TOP News

- Ryanair (NASDAQ:RYAAY)has smashed its forecast and has announced a share buy back programme.

- Germany Jan manufacturing data came ain at 50.9 which was below the expectations of 51.

- Italian Dec manufacturing PMI has beaten the forecast of 48.8 with the headline number of 49.9

Things to Remember

Stops are there to protect you, so make sure to use them.

Market Sentiment

- Gold: The precious metal is trading below its downward trend line on a 30 minute time frame. The next support is near the 1250 and the next resistance is near the 1300.

- Crude Oil: The black gold has broken its downward trend line on a 30 minute time frame. The near term support is at the $43.0 mark and the resistance is at 50.

- VIX: Volatility index increased nearly 11.78% on the last trading day.

News Agenda For Today

08:00 GMT

EUR – Spanish Unemployment Change

09:30 GMT

USD – Manufacturing PMI

15:00 GMT

USD – ISM Manufacturing PMI

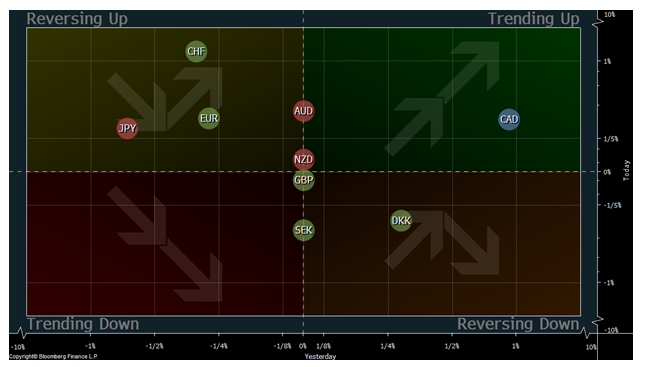

Trends

AUD and CAD are trading higher against the US Dollar and the SEK, GBP are trading lower against the USD.

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.