In my 2016 Market Forecast post of December 29, 2015, I mentioned three ratio charts worth monitoring for 2016.

They show the strength/weakness of the:

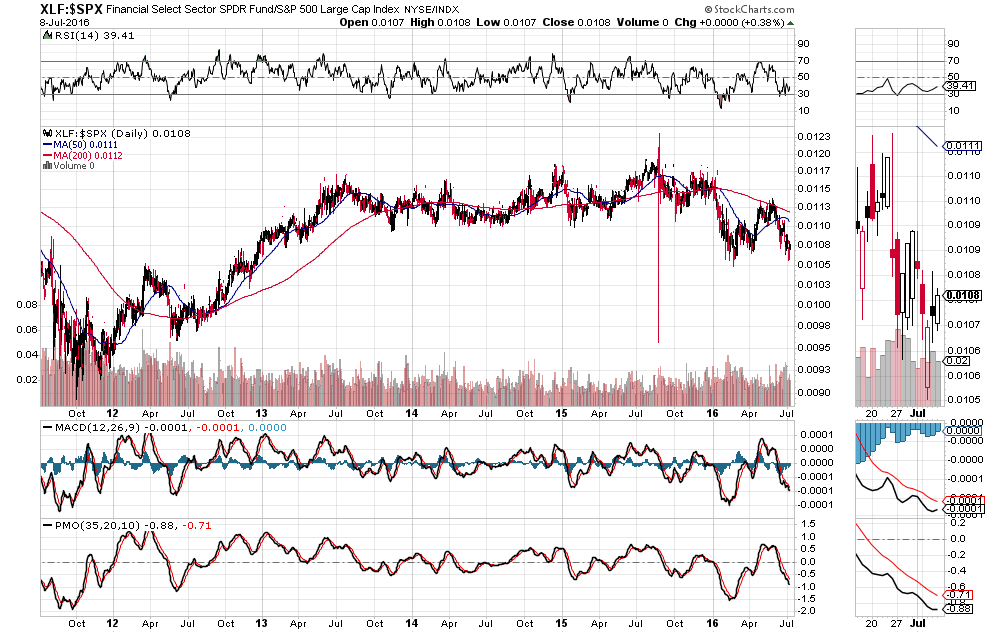

- XLF (U.S. Financials ETF) compared to SPX

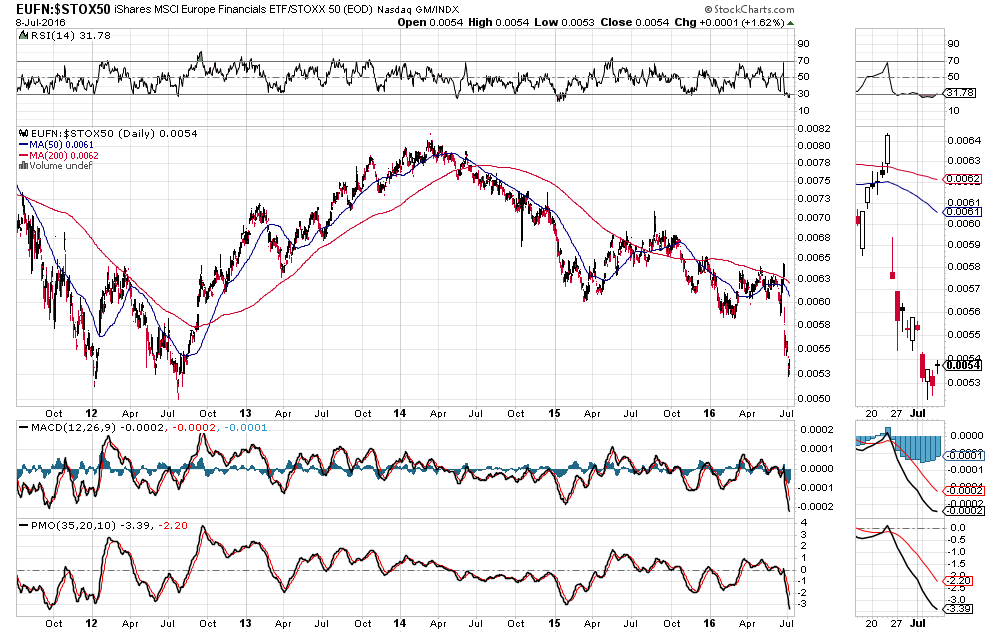

- EUFN (European Financials ETF) compared to STOX50

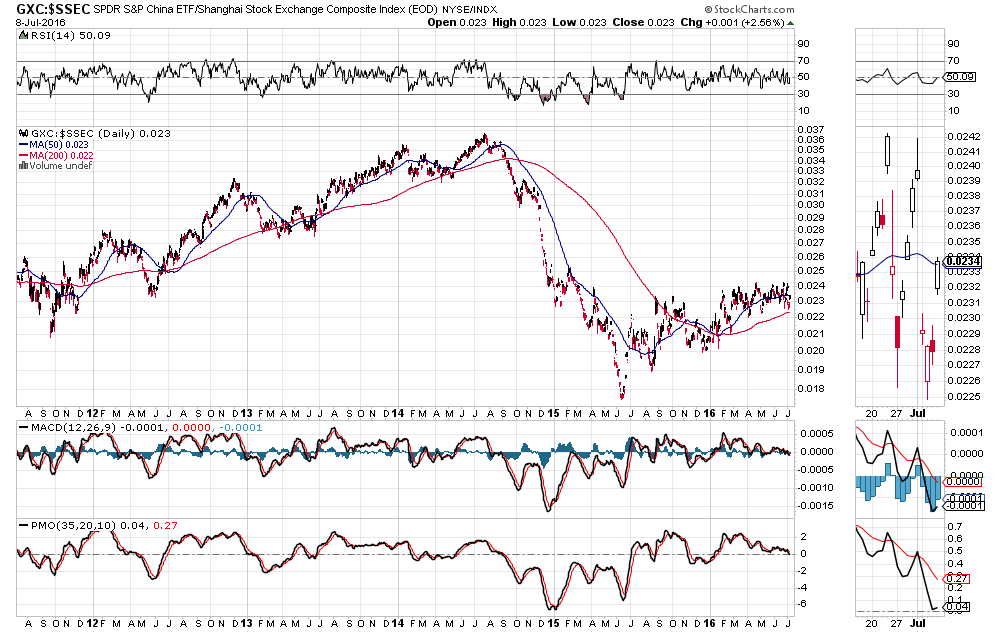

- GXC (Chinese Financials ETF) compared to SSEC

The following three updated Daily ratio charts show that U.S. and European financials are weak (and weakening) compared with their respective Major Indexes, so far, this year, while China's financials are also weak and mired in a long-term trading range, just above major support.

Even if U.S. equity markets do break out of their long-term, high-basing trading range (as described here), none of these three ratio charts fill me with much encouragement to project that such a rally could last very long if we see continued weakness, and, especially, a deterioration in these Financial ETFs compared with their Indexes.