Ugly Close

Even more unpredictable than trying to call the S&P 500 futures (ESU17:CME), is knowing what President Trump is going to say. After a good finish on Tuesday, the president went on national TV to talk about everything from white supremacy to building the border wall, and even went as far to talk about a possible government shutdown to secure the funding. Like most Americans, we want to see change, but it seems like he is continuing to lose his support base.

After popping and dropping all day, the ES and NQ looked like they were ok late in the day, but when the MiM ‘flipped’, both futures fell apart. The S&P 500 futures (ESU17:CME) settled at 2441.50, down -11.25 handles, or -0.46%, the Dow Jones futures (YMU17:CBT) settled at 21759, down -91 points, or -0.41%, and the Nasdaq 100 futures (NQU17:CME) settled at 5848.00, down -30.50 points, or -0.52%.

Choppy Trade

Yesterday, after Trump’s speech, the ES started to sell off, and by 7:30 am had traded all the way down to 2438.75. On the 8:30 CT futures open, the first print was 2440.00, and then in came a series of higher lows. At first the ES looked weak, but the Nasdaq 100 futures (NQU17:CME) weren’t going down. After a few dips, the NQ firmed up, while the ES was still resisting at, or just above, the vwap. The ES then sold off down to the 2441 area, before setting up a push to 2446.25, and a series of new highs all the way up to 2447.75.

The NQ was clearly leading the way again. It looked like there was some type of ‘buy NQ / sell ES’ trade going on, because the NQ fired higher, and the ES was dragging higher. As the MiM went to buy $350 million, the ES traded up to 2447.75 around 2:30, with total volume at around 1 million contracts traded. The MiM ‘flipped’ at 2:45 to $320 million to sell, and both the ES and NQ went sailing back down. The ES sold off back down to the 2441.00 area, and after making a late double top at 5867.50, the Nasdaq futures sold off all the way down to 5847.00.

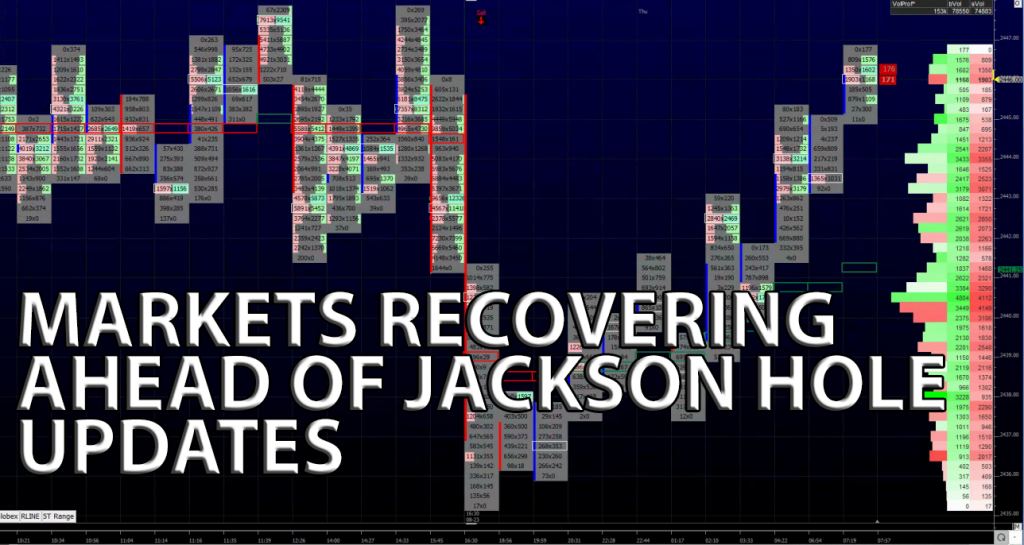

While You Were Sleeping

Overnight, equity markets in Asia were mixed, while most majors in Europe are currently trading higher this morning. Traders seem to be pretty optimistic about what they’re going to hear out Jackson Hole this morning, and it should create some positive follow through.

In the U.S., the S&P 500 futures opened last night’s globex session at 2440.25, and printed the overnight low at 2435.25 in the first few minutes of trading. From there, the ES traded in a steady grind higher for the rest of the night. As of 7:00am CT, the ES is trading just off the highs, with the last print coming in at 2443.00, up 4.75 handles, with 143k contracts traded.

In Asia, 6 out of 11 markets closed higher (Shanghai -0.48%), and in Europe 10 out of 12 markets are trading higher this morning (FTSE +0.52%).

Today’s economic calendar includes the Weekly Bill Settlement, Jackson Hole Economic Policy Symposium, Jobless Claims, Bloomberg Consumer Comfort Index, Existing Home Sales, EIA Natural Gas Report, Kansas City Fed Manufacturing Index, a 3-Month Bill Announcement, a 6-Month Bill Announcement, a 2-Yr Note Announcement, a 5-Yr Note Announcement, a 7-Yr Note Announcement, a 5-Yr TIPS Auction, Fed Balance Sheet, and Money Supply.

Our View

This week, the market is showing itself to be two sided. After a big down day, the S&P’s bounced back, but after a big up day, they give some back up. Above 2450 we are looking for buy stops that could help push the ESU up to last week’s 2474.50 high, but below 2440 we start to look at Monday’s 2415.75 low.

We think there are some stacked bids coming in between 2400 – 2410 that will keep the market up this week, and give dip buyers a real strategic place of value to position, but if 2400 is lost going into Labor Day, then the seasonals start to turn ugly, and that would be the worse case for the bulls.