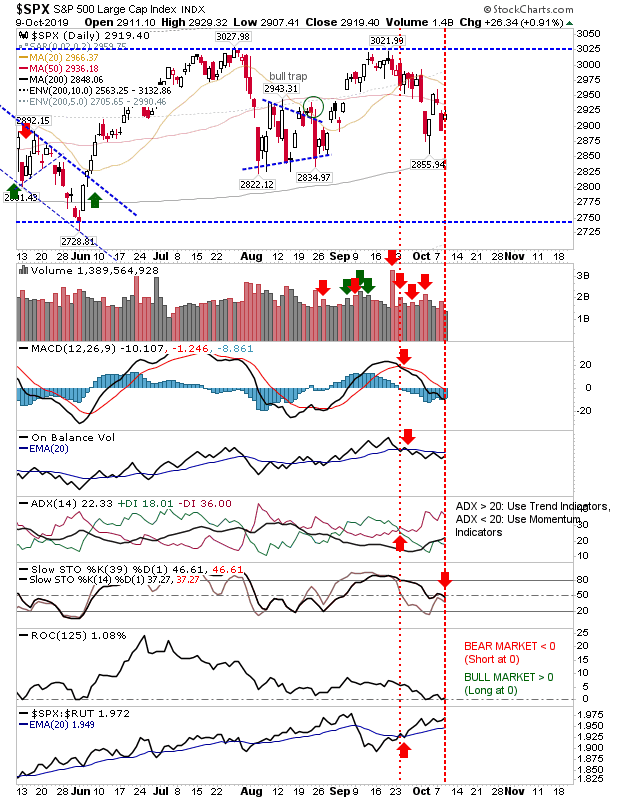

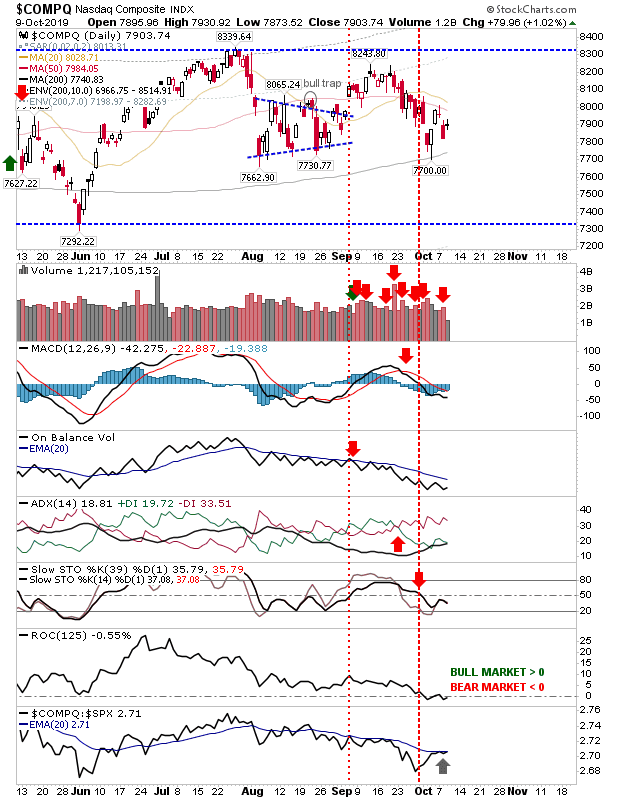

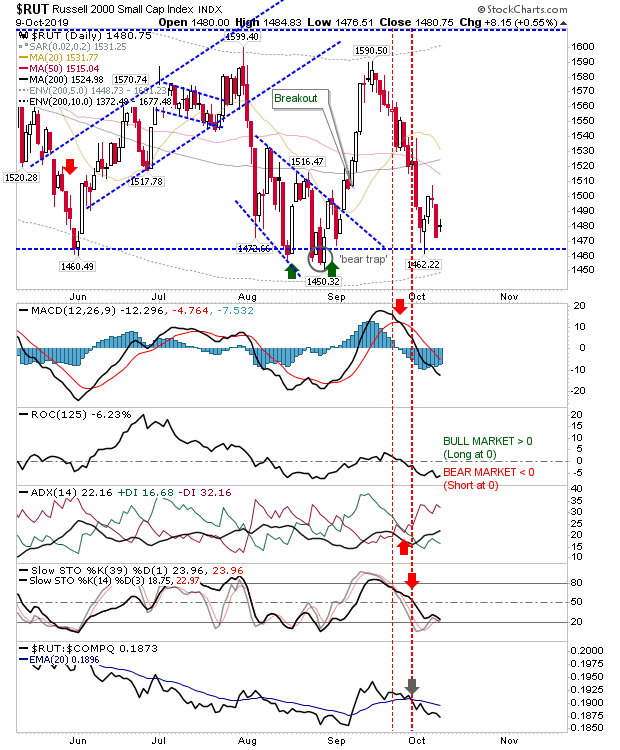

Markets are forming small pennants/coils as last week's losses shape into a set of inside days. For indices testing 200-day MAs, the reaction bounce has now stalled as markets search for the next move.

In the case of the S&P, yesterday's reaction to the bounce has been somewhat disappointing with an inside day which failed in its attempt to challenge overhead 50-day MA resistance. Technicals have also moved into net bearish territory. It looks like the next move is down, but a close above the 50-day MA would likely be enough to see a challenge on 3,025.

The NASDAQ is also coiling to a point where yesterday's doji sets up a possible swing trade opportunity—trade a break of the respective highs/lows and place a stop on the flip side. Based on bearish net technicals and the series of distribution days since the last consolidation breakout, the favored outlook is a new move lower, which would make 7,300 the next target down.

For the Russell 2000 this spells more trouble. The only potential saving grace was yesterday's doji, which could rank as a bullish harami cross—which if true—should see higher prices today. However, it could be the spreading weakness in Large Caps and Tech Indices which ultimately brings this down. Indicators are not yet oversold.

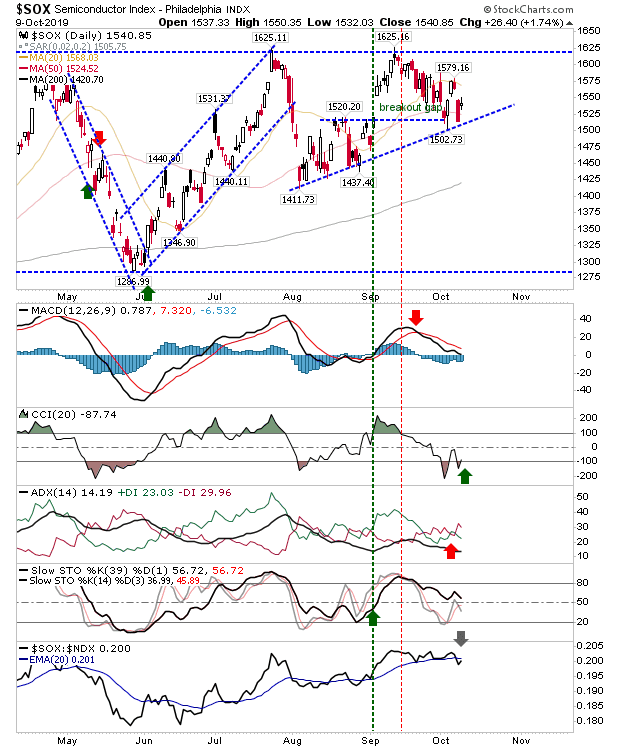

The Semiconductor Index closed the breakout gap earlier last week and now is caught in a bit of a no-mans land. Rising support has held, but for how long after five tags of support? Technicals are mixed, so no one side has an advantage over the other. It remains to be seen how the Semiconductor Index and NASDAQ can influence one another.

For today, it will likely be up to the Russell 2000 to determine which way other indices will go. Expectations are for lower prices based on supporting technicals, but if 50-day MAs can be cleared by the NASDAQ and S&P it would give a solid basis for a return challenge on 52-week highs.