Street Calls of the Week

With Christmas fast approaching, trading looks to be slowing into narrow, light volume, range days. As such, there wasn't a whole lot to say about yesterday.

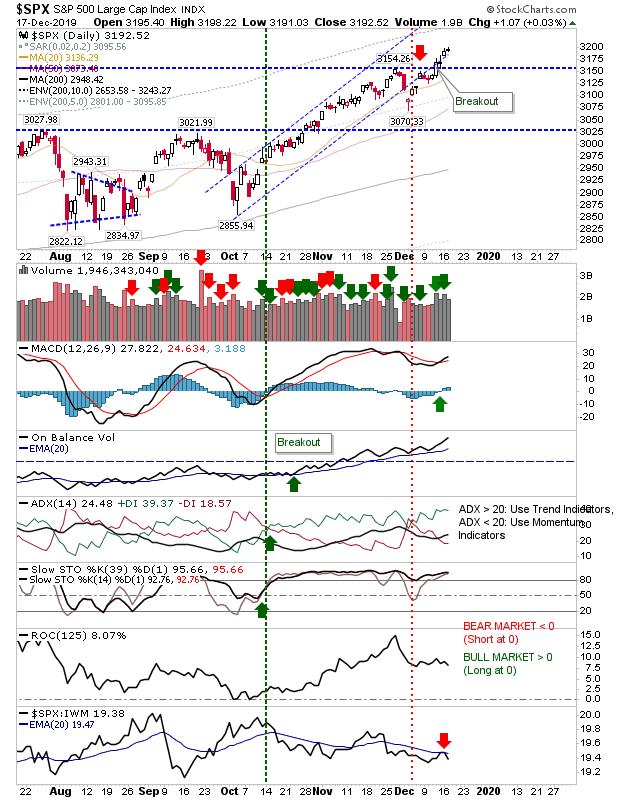

The S&P gained a single point, although relative performance against the Russell 2000 dropped away from its trigger line. It's a safe hold for now.

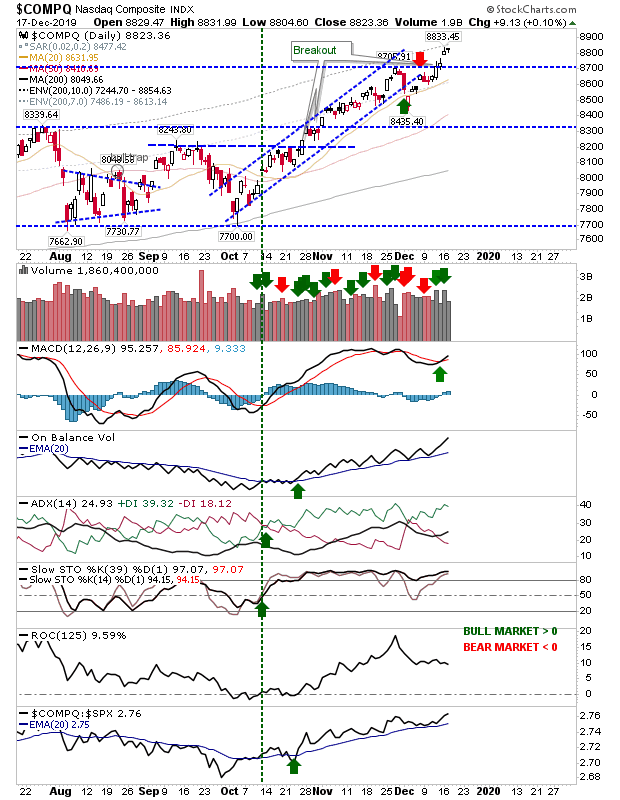

The NASDAQ was also quiet, although it did have the benefit of a relative outperformance against the S&P, which saw a little additional kick yesterday.

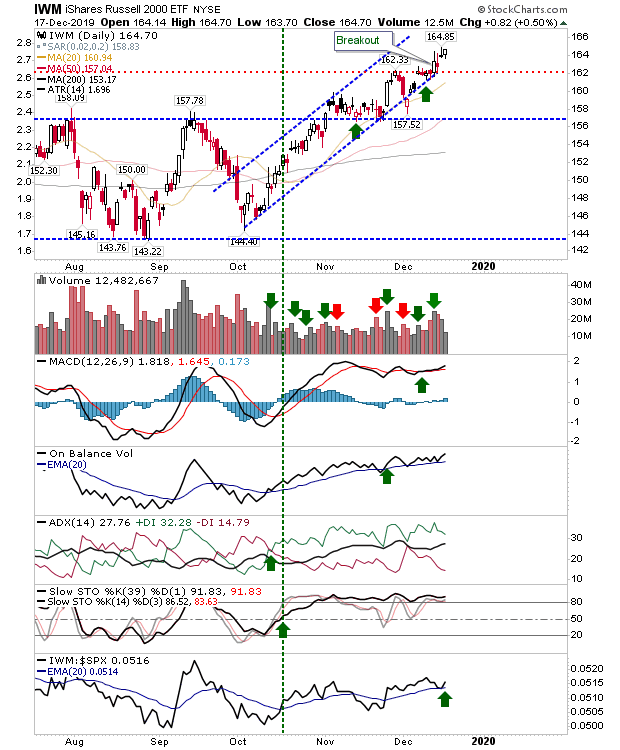

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) added to its rally which helped bounce relative performance against the S&P

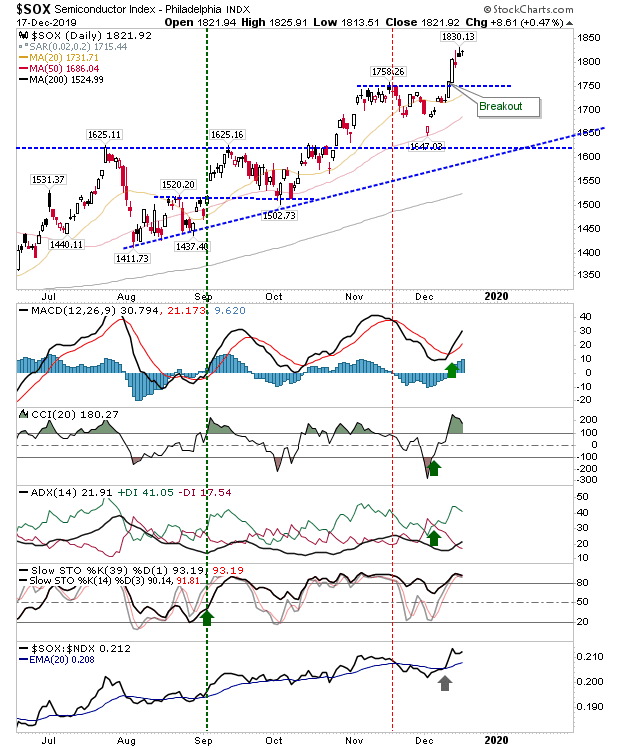

The Semiconductor Index held near highs but did little yesterday. Its CCI is very overbought so it might need another period of sideways action to take some of the heat out of this.

For the rest of the week I'm not expecting too much from indices, but there is always a chance for a surprise. Important will be holding existing breakouts into 2020.