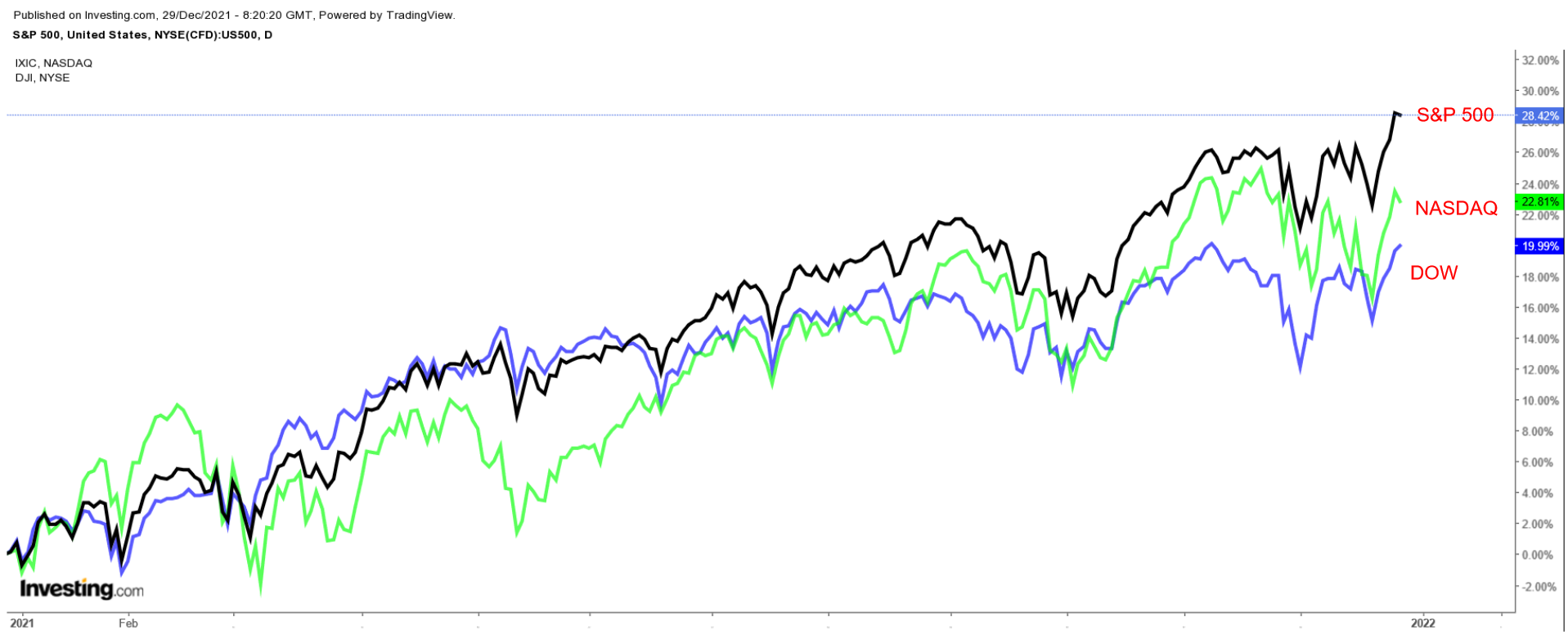

Despite risks related to the COVID health crisis and speculation that the Federal Reserve will tighten monetary policy faster than anticipated, 2021—albeit with two more trading days to go—has been another excellent year for U.S. stocks across the board. The benchmark S&P 500 has climbed 27.4% year-to-date, the tech-heavy NASDAQ Composite gained 22.5%, while the 30-stock Dow rose 18.9% so far this year.

With Wall Street closing the curtains shortly on a blockbuster year, we've put together a list of five stocks that have been leading the charge higher in terms of year-to-date performance in 2021.

On Thursday we'll publish Wall Street's biggest losers, so stay tuned.

1. AMC Entertainment

- Jan. 1 Opening Price: $2.12

- Dec. 28 Closing Price: $27.74

- 2021 Year-To-Date Gains: +1,207.5%

- Market Cap: $14.2 Billion

AMC Entertainment Holdings (NYSE:AMC) took the market by storm in 2021, thanks to its ‘meme stock’ status driven by soaring popularity amongst young traders on Reddit's r/WallStreetBets forum and Robinhood (NASDAQ:HOOD).

Investors have also been encouraged by signs of recovery in its core business, as movie-goers across the globe flocked back to its theaters in greater numbers amid easing pandemic-related restrictions.

Year-to-date, shares of the Leawood, Kansas-based movie-theater operator have scored a gain of about 1,207%, far outpacing the comparable returns of the S&P 500, making it the market’s top performer of 2021.

AMC stock—which started the year at $2.12 and soared all the way to a record high of $72.62 on June 2—ended Tuesday’s session at $27.74. At current levels, the world’s largest movie-theater chain, which saw its shares collapse 70% in 2020 amid the coronavirus pandemic, has a market cap of $14.2 billion.

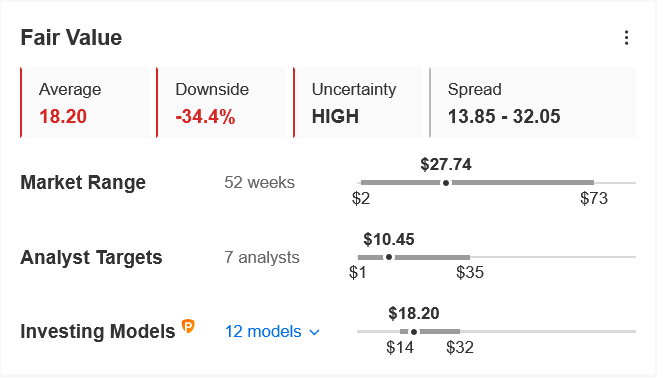

Looking ahead, we do not expect AMC to repeat its blockbuster annual performance in 2022 as retail-driven interest fizzles out amid lingering concerns surrounding the impact of the COVID Omicron variant on its business. Indeed, InvestingPro models predict a drop of roughly 34% over the next 12 months, bringing shares closer to their fair value of $18.20.

Source: InvestingPro

2. GameStop

- Jan. 1 Opening Price: $18.84

- Dec. 28 Closing Price: $146.46

- 2021 Year-To-Date Gains: +677.4%

- Market Cap: $11.1 Billion

Like AMC, GameStop (NYSE:GME) emerged as a popular name among retail investors on Reddit's WallStreetBets forum in 2021, sparking the epic ‘meme stock’ trading frenzy which saw its shares enjoy a remarkable run this year.

Widely considered as the original WSB darling, shares of the Grapevine, Texas-based videogame retailer have soared roughly 677% with just a couple of days remaining in the year, making it the second best-performing stock on Wall Street.

In addition to benefitting from its unique status as a social media meme stock favorite, GameStop—led by former Chewy CEO Ryan Cohen—has taken steps to position itself for a digital era by boosting its e-commerce business.

GME began trading at $18.84 on Jan. 1 and rallied to a record of $483.00 on Jan. 28. It closed at $146.46 on Tuesday, earning the gaming merchandise retailer a valuation of $11.1 billion.

With the ‘meme stock’ receding in the rearview mirror, we expect GameStop’s ascent to slow in the new year amid worries surrounding its business prospects. The company's most recent financial figures released on Dec. 8 failed to impress shareholders as losses widened significantly from the year-ago period.

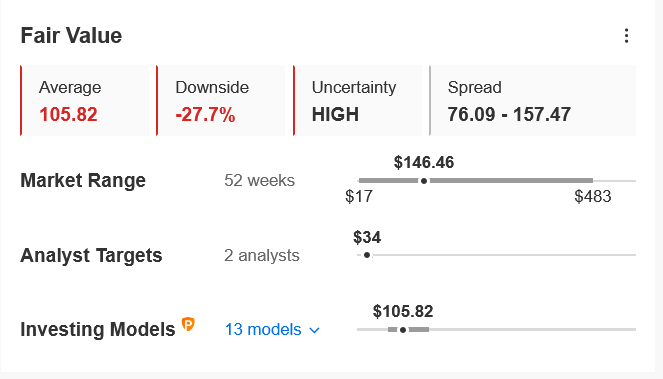

Not surprisingly, GME stock is currently overvalued according to InvestingPro models and could see a roughly 28% decline over the upcoming 12 months to its fair value of $105.82 a share.

Source: InvestingPro

3. Avis Budget Group

- Jan. 1 Opening Price: $37.30

- Dec. 28 Closing Price: $210.31

- 2021 Year-To-Date Gains: +463.8%

- Market Cap: $11.8 Billion

Avis Budget Group (NASDAQ:CAR) is a leading rental car provider to the commercial segment, serving business travelers at major airports around the world. Shares of the Parsippany, New Jersey-based company have easily outpaced the comparable returns of the broader market this year, benefitting from the economy reopening and the vaccine-led return to normalcy.

Year-to-date, Avis stock has soared a whopping 463.8%, making it Wall Street’s third best-performing name of 2021. Shares recorded a single-day gain of more than 100% on Nov. 2, after Avis topped estimates for earnings and revenue when it released third quarter financial results and boosted its stock buyback plan.

CAR—which began trading at $37.30 on Jan. 1 and surged to an all-time high of $545.11 on Nov. 2—settled at $210.31 last night. At current levels, the rental car specialist which operates the Avis brand, as well as Budget Rent a Car, Budget Truck Rental, and Zipcar, has a market cap of $11.8 billion.

Looking ahead, Avis remains a solid pick heading into the new year as the rental car giant continues to recover from its pandemic slump amid robust demand for rental vehicles thanks to an improving travel environment.

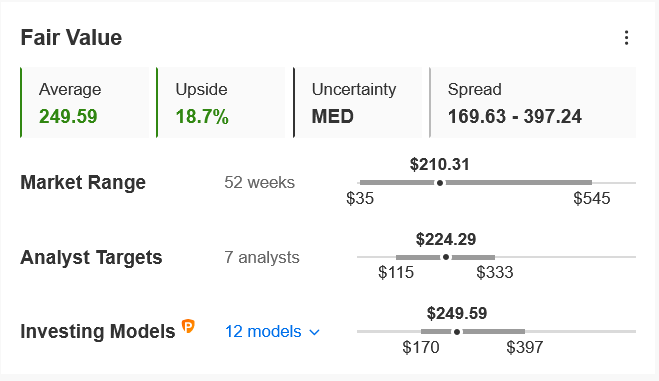

According to the InvestingPro model, despite strong YTD gains, CAR stock is undervalued at the moment and could see a gain of about 19% from current levels over the next 12 months to its fair value of $249.59/share.

Source: InvestingPro

4. Upstart Holdings

- Jan. 1 Opening Price: $40.75

- Dec. 28 Closing Price: $148.97

- 2021 Year-To-Date Gains: +265.5%

- Market Cap: $12.2 Billion

Upstart Holdings (NASDAQ:UPST), which utilizes artificial intelligence tools in evaluating personal loan applications for banks and is widely considered as one of the leading online lending marketplaces, has had an astonishing year. At one point, shares of the San Mateo, California-based AI lending platform operator, which held its initial public offering in December 2020, rose more than 800%. But, a general sell-off in the high-growth tech sector knocked some of the wind out of the high-flyer’s sails.

Despite the recent volatility, Upstart shares are up 265.5% year-to-date, making them the fourth best-performing stock of 2021, thanks to surging demand for its AI-driven credit-checking services.

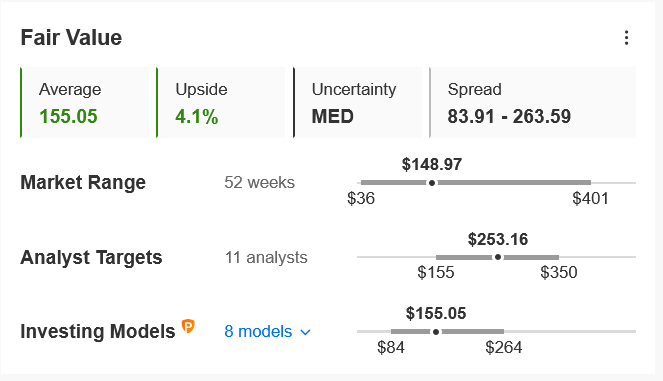

UPST began the year at $40.75 and climbed to a record of $401.49 on Oct. 15. It ended Tuesday’s session at 148.97. At current levels, the fintech company has a market cap of $12.2 billion.

Upstart looks poised for further gains in 2022. The current operating environment is fueling demand from small banks and credit unions for its innovative services that facilitate determination of a potential borrower's creditworthiness.

In fact, InvestingPro models point to an increase of nearly 4% in UPST stock over the next 12 months, bringing shares closer to their fair value of $155.05.

Source: InvestingPro

5. Devon Energy

- Jan. 1 Opening Price: $15.57

- Dec. 28 Closing Price: $44.50

- Year-To-Date Gains: +185.8%

- Market Cap: $30.1 Billion

One of the country’s largest independent shale oil and gas producers, Devon Energy (NYSE:DVN) has been a standout performer in the thriving energy space this year, reaping the benefits of higher energy prices and improving global demand.

Shares of the Oklahoma City, Oklahoma-based company have jumped roughly 186% year-to-date, with investors encouraged by ongoing efforts to return more cash to shareholders in the form of higher dividend payouts and stock buybacks.

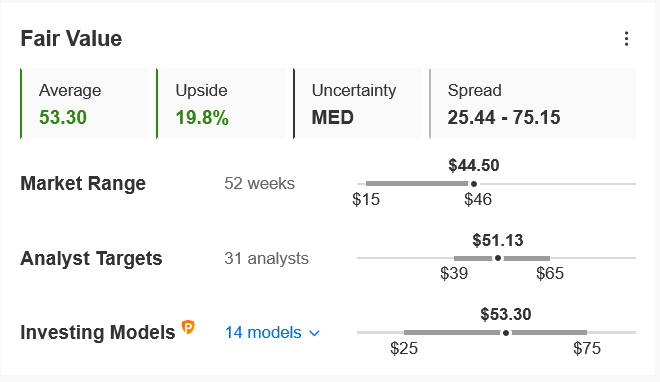

DVN lost 37% in 2020 amid the coronavirus pandemic, yet closed at $44.50 last night, within sight of its recent five-year peak of $45.56 touched on Nov. 24. At current levels, the energy firm—which has outperformed other notable names in the sector, such as ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX)—has a market cap of $30.1 billion.

Due to its robust year-to-date gains, Devon remains one of the best names to own in 2022 for investors who want to play the ongoing recovery in the U.S. oil and gas sector. The low-cost oil and gas producer is poised to continue to benefit from its stellar Permian operations, while taking advantage of strong oil and gas prices, which will help fuel future profit and sales growth.

A look at the quantitative models in InvestingPro shows us that an almost 20% upside in Devon stock from current levels over the next 12 months to a fair value of $53.30 per share are likely.

Source: InvestingPro

On Thursday, we'll publish the five top stock market losers of 2021.