In sharp contrast to Wednesday’s article covering the top five winning stocks of 2021, below, with just two more trading days to go this year, we highlight the five names which suffered the biggest annual losses in terms of year-to-date performance.

Surprisingly, four of the five are setting up for an explosive 2022, as they look to bounce back from this year’s significant declines.

1. Peloton

- Jan. 1 Opening Price: $151.72

- Dec. 29 Closing Price: $34.56

- 2021 Year-To-Date Performance: -77.2%

- Market Cap: $11.4 Billion

Widely viewed as one of the biggest winners of the 2020 COVID outbreak, Peloton Interactive (NASDAQ:PTON) fell out of favor this year as investors, rotating into stocks benefitting from the reopening economy, dumped PTON shares, even though they rallied throughout the pandemic.

After scoring a sizable gain of 434% last year, shares of Peloton have plunged nearly 77% in 2021 amid the ongoing impact of several negative factors plaguing the home exercise equipment specialist, giving it the dubious title of worst performing stock of the year.

Even more alarming, Peloton shares have now pulled back more than 80% since touching a record high of $171.00 on Jan. 14.

PTON stock, which began the year at $151.72, ended Wednesday’s session at a new 52-week low of $34.56, earning the New York City-based company a valuation of $11.4 billion.

Sentiment on the out-of-favor name—which sells stationary bicycles and treadmills that allow monthly subscribers to remotely participate in classes via streaming media—took a hit as progress on the vaccine front prompted states across the country to ease stay-at-home measures and social restrictions.

Despite the dramatic deceleration in growth, Peloton seems poised to rebound in the year ahead, considering the company’s leading position in the at-home fitness equipment sector and notable brand recognition.

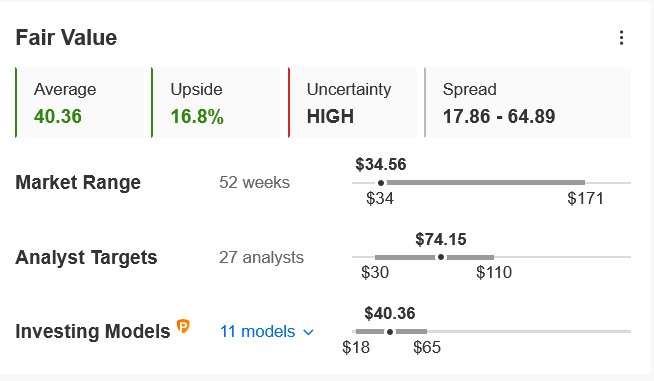

Indeed, the quantitative models in InvestingPro point to 17% upside in Peloton stock from current levels over the next 12 months to a fair value of $40.36/share.

Source: InvestingPro

2. Pinduoduo

- Jan. 1 Opening Price: $177.67

- Dec. 29 Closing Price: $54.01

- 2021 Year-To-Date Performance: -69.6%

- Market Cap: $67.6 Billion

Pinduoduo (NASDAQ:PDD) shares have suffered a tumultuous year as investors fret over the damaging impact of ongoing scrutiny by China’s ruling Communist Party. Chinese regulators have been intensifying efforts to rein in tech behemoths that play a dominant role in the country’s consumer sector.

Shares of the online marketplace platform—which jumped 370% in 2020 amid the shift to online shopping during the COVID pandemic—have significantly underperformed the broader market in 2021, falling almost 70% year-to-date to make them the second worst-performing name of the year.

Sentiment on the Shanghai-based e-commerce company turned bearish after Chinese authorities intensified a crackdown on its powerful tech sector and booming platform economy, including imposing hefty fines, and launching numerous antitrust investigations.

PDD stock, which now stands roughly 75% below its all-time high of $212.30, touched on Feb. 16, closed at $54.01 last night. At current levels, Pinduoduo has a market cap of $67.6 billion, making it the third largest e-commerce company in China in terms of annual revenue, trailing only Alibaba (NYSE:BABA) and JD.com (NASDAQ:JD).

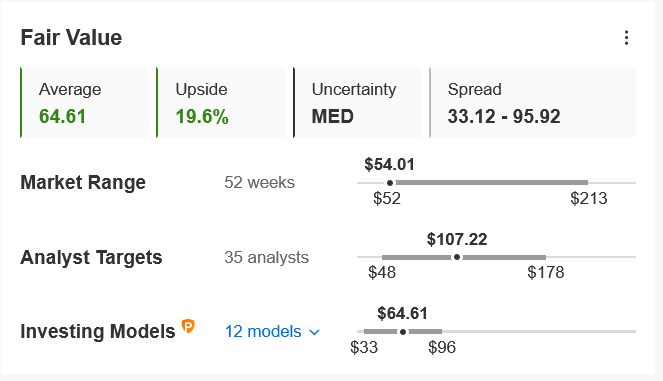

Despite the recent selloff, Pinduoduo could be poised for a comeback year in 2022 as the worst of Beijing’s anti-tech regulatory crackdown appears to be over and the e-commerce giant further aligns itself with the priorities of China President Xi Jinping. With a fair value of $64.61 per share, InvestingPro models forecast roughly 20% upside in Pinduoduo stock over the next 12 months.

Source: InvestingPro

3. Teladoc Health

- Jan. 1 Opening Price: $199.96

- Dec. 29 Closing Price: $90.05

- 2021 Year-To-Date Performance: -54.9%

- Market Cap: $14.4 Billion

With investors increasingly turning away from companies in the "stay-at-home" trade due to the easing COVID outbreak, shares of Teladoc Health (NYSE:TDOC) struggled mightily in 2021 amid receding demand for its virtual healthcare platform.

Teladoc scored a remarkable gain of 138% in 2020. The company, which uses telephone and video-conferencing software to provide on-demand remote medical care, has seen its stock plunge about 55% year-to-date amid a sell-off in companies which rallied throughout the pandemic.

TDOC stock started trading at $199.96 on Jan. 1, ending yesterday’s session at $90.05. Shares now stand nearly 70% below their all-time high of $308.00 reached on Feb. 16. At current valuations, the Purchase, New York-based telehealth pioneer has a market cap of $14.4 billion.

Even though the company's full-year revenue and membership guidance failed to impress investors, we believe Teladoc is well-positioned to remain the leader in the fast-growing telehealth services space.

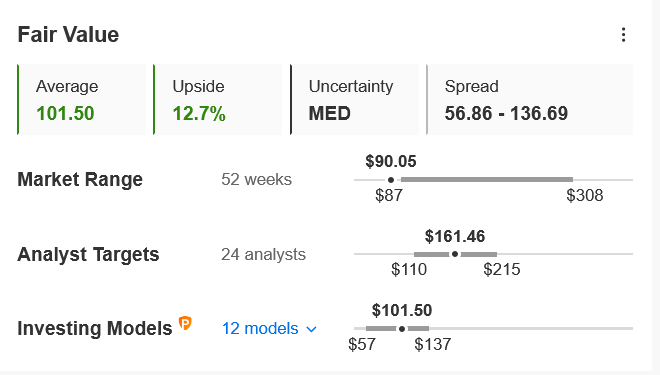

According to the InvestingPro model, TDOC stock is undervalued now and could see an increase of almost 13% from current levels over the next 12 months to its fair value of $101.50 per share.

Source: InvestingPro

4. Coupa Software

- Jan. 1 Opening Price: $338.91

- Dec. 29 Closing Price: $159.23

- 2021 Year-To-Date Performance: -53.1%

- Market Cap: $11.9 Billion

Another notable winner of the COVID-19 outbreak, shares of Coupa Software (NASDAQ:COUP) fell out of favor this year as progress on the vaccination front prompted states and countries to ease lockdowns and government-mandated stay-at-home measures.

The procurement software vendor’s stock—which jumped 131% in 2020—tumbled 54% in 2021 amid concern that some of the tailwinds it enjoyed from COVID-related restrictions will fade as more employees return to working from the office.

Furthermore, worries over soaring inflation and rising bond yields sparked a selloff in fast-growing technology stocks, with investors instead piling into value names, which are typically companies that are more sensitive to economic cycles.

COUP stock began the year at $338.91 and climbed to a record high of $377.04 on Feb. 19. It closed at $159.23 on Wednesday, earning the San Mateo, California-based enterprise software company a valuation of $11.9 billion.

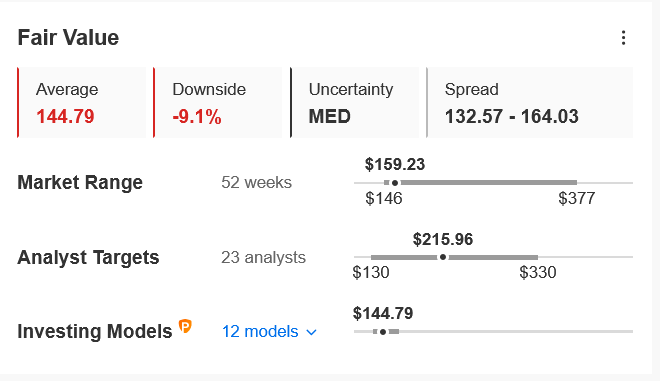

With persistent worries over a slowdown in its core business, Coupa looks primed to extend its selloff in the new year, considering the weakening demand for its cloud-based enterprise offerings. While analysts are a little more optimistic, the quantitative models in InvestingPro point to additional downside of 9% from current levels to a fair value of $144.79 per share.

Source: InvestingPro

5. Alibaba

- Jan. 1 Opening Price: $232.73

- Dec. 29 Closing Price: $112.09

- 2021 Year-To-Date Performance: -51.8%

- Market Cap: $303.8 Billion

Alibaba Group (NYSE:BABA) shares collapsed in 2021, losing more than half their value during Beijing’s year-long crackdown aimed at strengthening regulations for companies with consumer-facing platforms and improving data privacy. The stock, which has fallen around 52% year-to-date, ended Wednesday’s session at $112.09, not far from a recent two-year low of $108.70 touched on Dec. 3. Shares now stand roughly 65% below their record high of $319.32 hit in October 2020.

At current levels, the Hangzhou, China-based tech behemoth has a market cap of $303.8 billion.

Like Pinduoduo, Alibaba could finally see shares bottom in the year ahead, making China’s most valuable company a prime candidate to enjoy a comeback year in 2022.

Despite the year-long antitrust campaign, Alibaba displayed ongoing strength in its core e-commerce business. Outside of its core retail segment, cloud revenue has increasingly become another major growth driver for Alibaba, as it tries to solidify its spot as a global leader in the cloud-computing space, along with U.S. rivals like Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL).

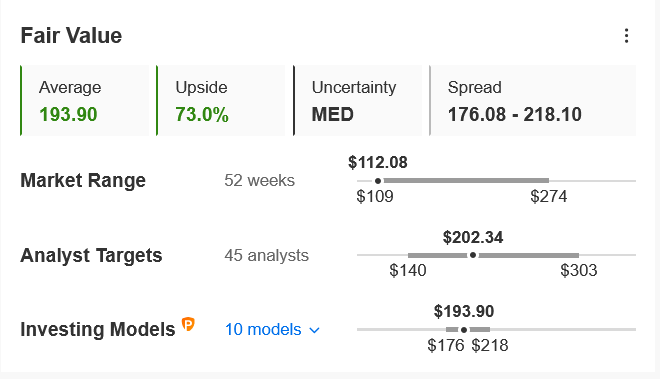

Not surprisingly, Alibaba is extremely undervalued according to InvestingPro models, which forecast roughly 73% upside in BABA stock over the next 12 months, bringing shares closer to their fair value of $193.90.

Source: InvestingPro