We had the profit taking sell-off and then the bounce but is now the time for shorts to come in more aggressively? After Monday's gapped gains there was a significant slow down in the market advance. This action presents an opportunity for shorts to attack.

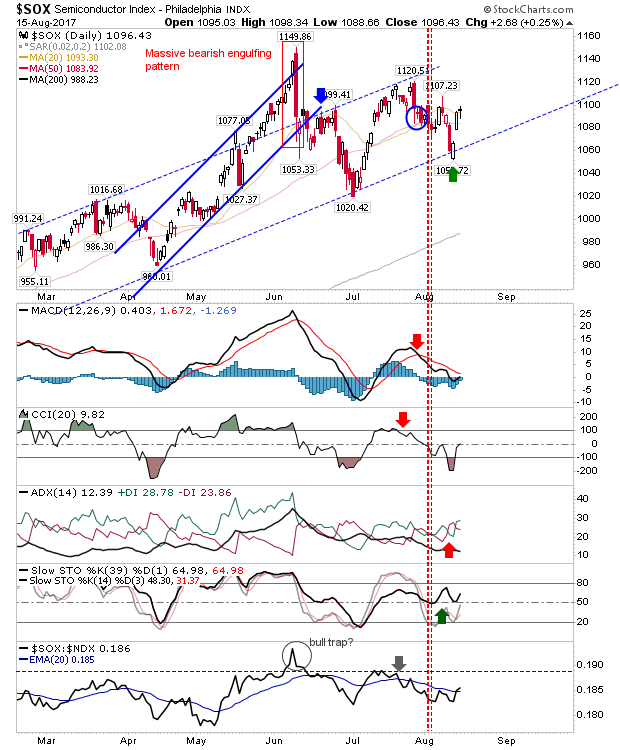

The Semiconductor Index is one of the most attractive indices for shorts. The massive June bearish engulfing pattern remains dominant and offers guidance going forward. Tuesday's doji has the makings of a bearish harami cross. Technicals are bearish and aligned in shorts favor.

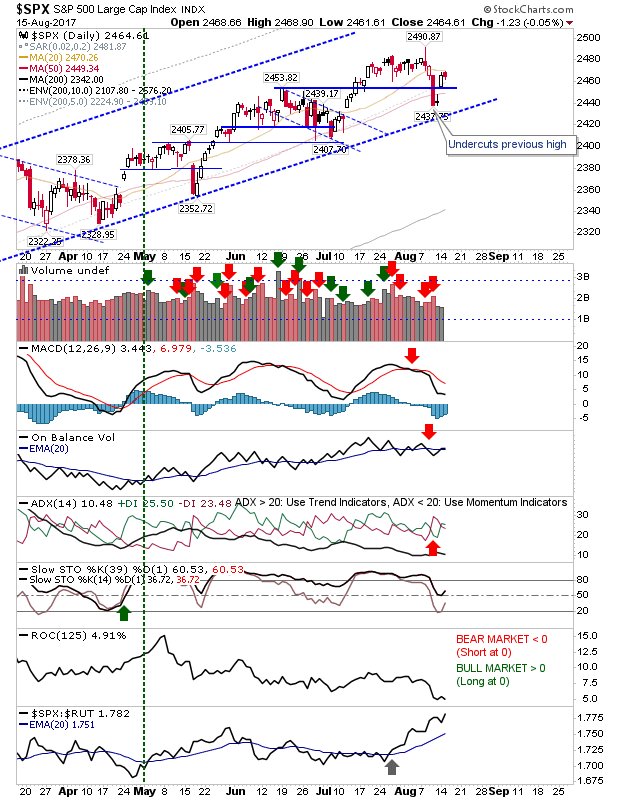

The S&P managed to return above support but the 'bearish cloud cover' is a potential concern for longs. An aggressive short could use the high for stop placement but the index is not as attractive as the Semiconductor Index.

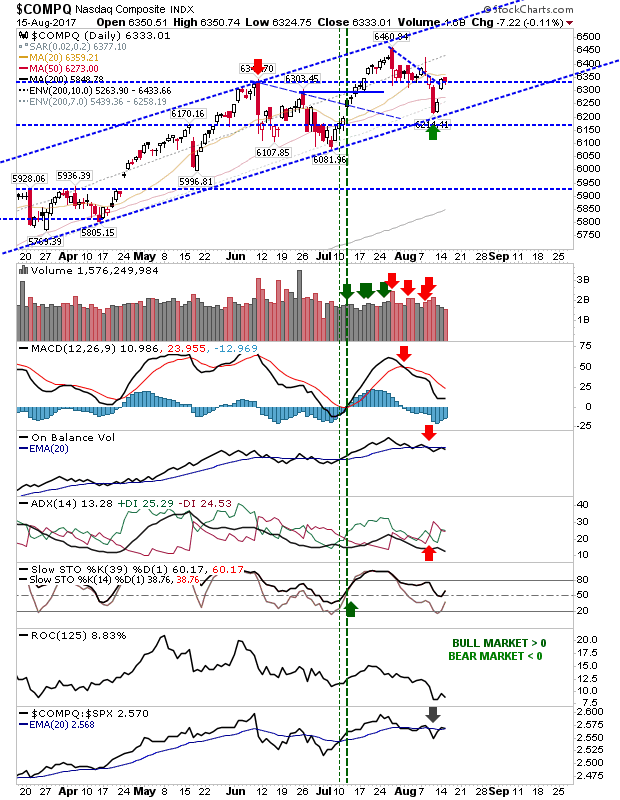

The NASDAQ has stalled at bounce former support turned resistance. Bearish technicals do offer a chance for shorts to take a punt on Tuesday's "bearish cloud cover"; stops go on a break of Tuesday's high.

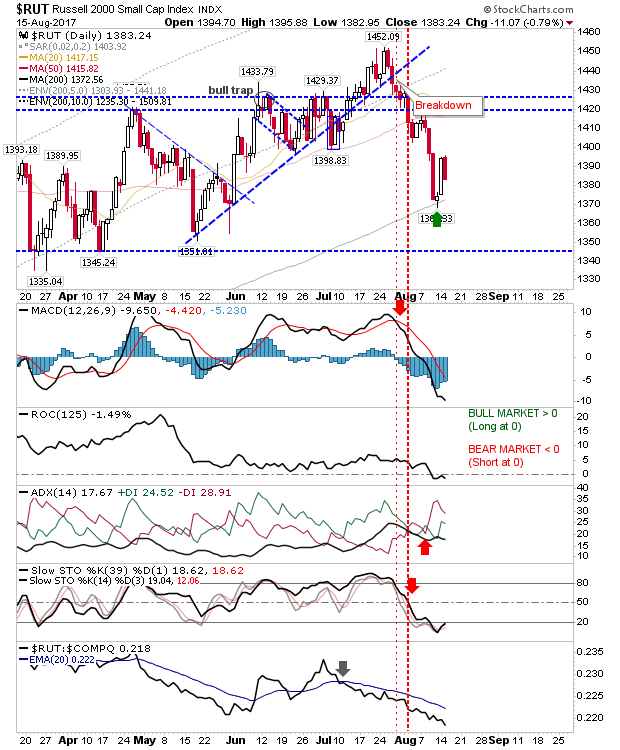

The Russell 2000 is struggling, Monday saw a good bounce but Tuesday it gave up a large chunk of those gains. I'm not sure there is a shorting opportunity here (the risk:reward isn't great) but the index looks ready to generate further losses.

If shorts are going to profit then Tuesday looks to be one of those days where the risk:reward is in their favour.