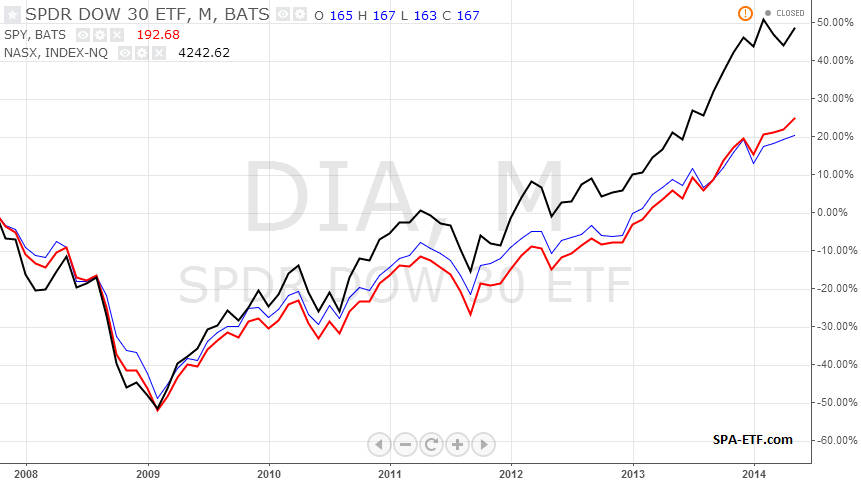

The NASDAQ has led the market since the current bull market began almost 5 years ago. It has outperformed the Dow and the S&P 500 by almost 30% since the market bottom in 2009.

US Market Comparison - 5 Year Bull Run

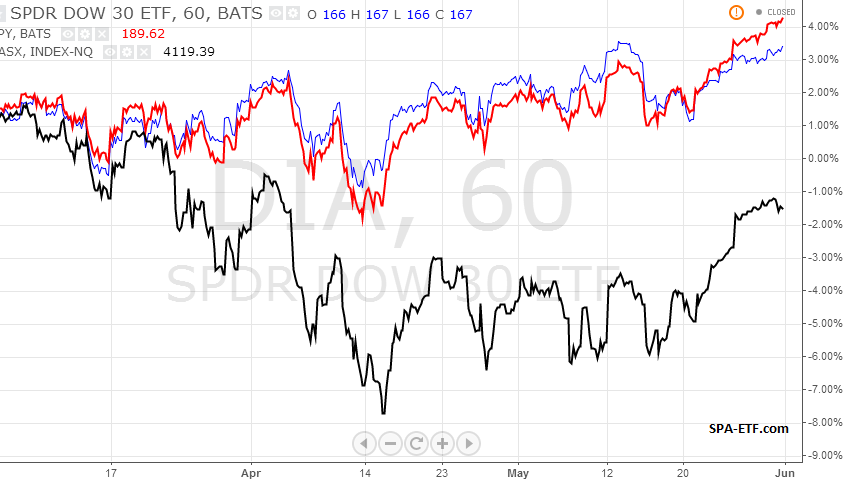

NASDAQ Year to Date Performance

Both the S&P 500 and Dow nearly reached thier all time highest in the last month. The S&P 500 has also outperformed the NASDAQ by 5% in the last 3 months. NASDAQ leadership has faltered. Given the weakness seen in the Biotech stocks and Social Media names like Twitter Inc (NYSE:TWTR) which as halved since January, negative sentiment has put biotechnology and the entire technology-stock-heavy index under pressure.

Is the lag indicative of underlying market weakness where prior leadership is faltering, or simply a change in leadership from sector rotation on what has worked out to be more promising sectors?

From reviewing industry sector returns year to date, I see investors heavily into Utilities, Energy and Healthcare are having a pretty good year. The major lagging area, not surprisingly given this past week's weak GDP number, is consumer discretionary—one of the few parts of the market in negative territory year to date.

Given the low volatility environment and de-escalation of geopolitical risk in Eastern Europe, investors are cautiously moving back to international stocks led by Emerging Markets.

With the pick up in sentiment we should not be throwing caution to the wind, but gradually adding where we are seeing value. The bull market has run for 5 years now and we have not had a 10% correction in more than 700 days. Risk could increase as every day is a day closer to the end of Fed tapering.