- The S&P 500 has rallied to new 2023 highs amid debt ceiling optimism.

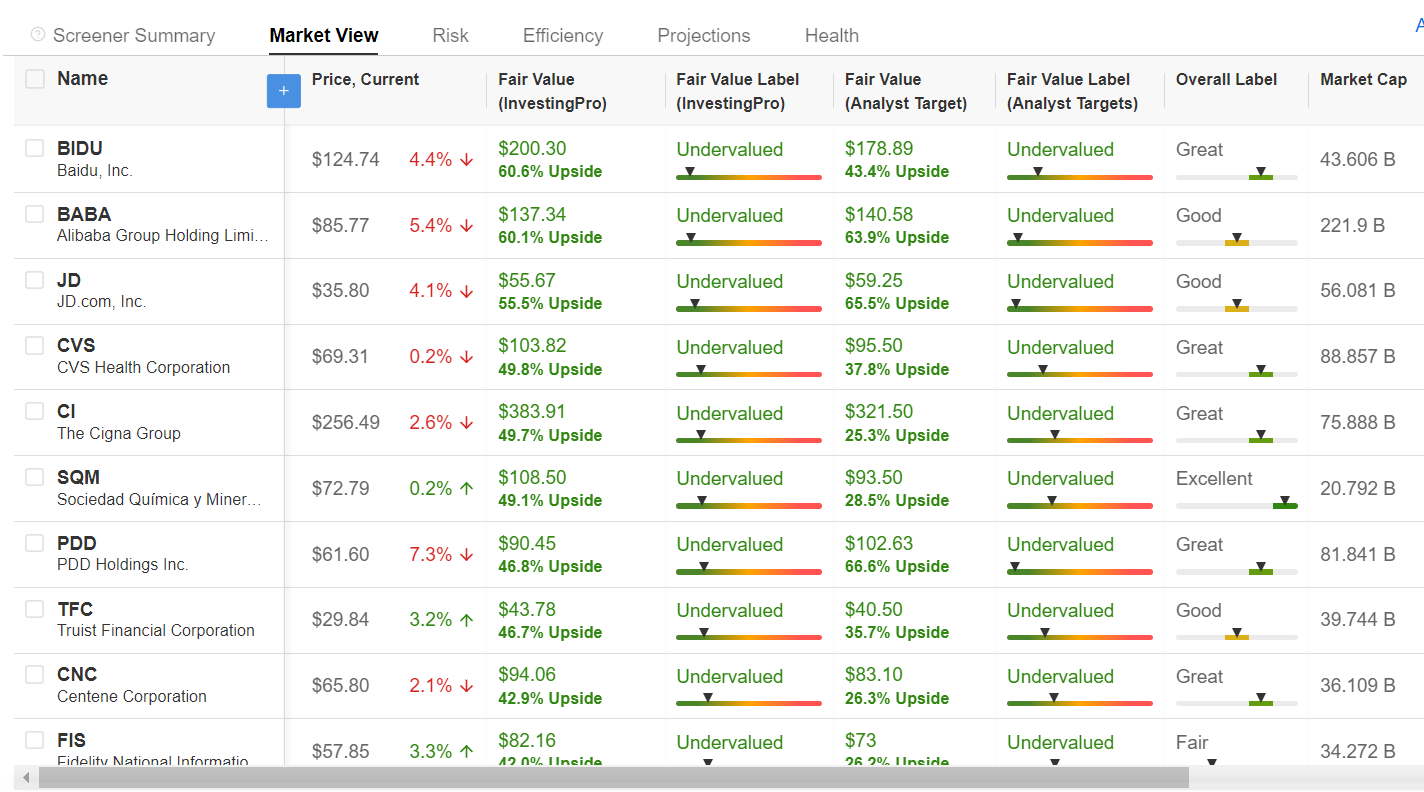

- I used the InvestingPro stock screener to search for undervalued stocks that analysts are still bullish on and have potential ‘Fair Value’ upside of at least 30%.

- Below is a list of 20 stocks in the S&P 500 which are expected to provide some of the highest returns in the coming months based on the InvestingPro models.

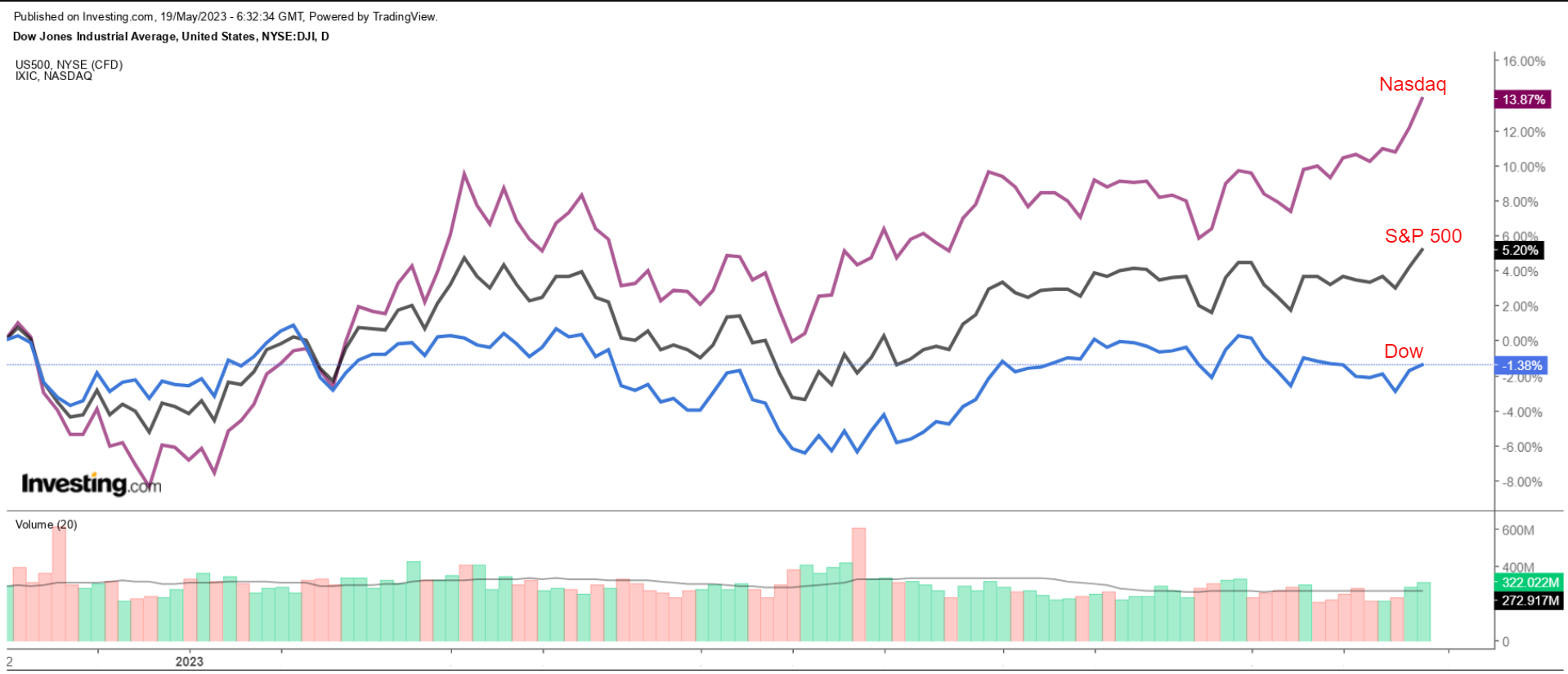

U.S. stocks have rallied this week, with the S&P 500 and the NASDAQ rising to fresh 2023 highs amid growing optimism that a U.S. debt ceiling deal will be reached in time to avert a catastrophic default.

House Speaker Kevin McCarthy is optimistic that congressional negotiators could reach a deal to raise the $31.4 trillion federal debt ceiling in time to hold the first vote on it next week.

As such, investors will continue to monitor the debt ceiling negotiations for signs that Democrats and Republicans might be inching closer to an agreement, with President Biden cutting short a trip to Asia to return to talks in Washington on Sunday.

So, while things are starting to look more promising on the debt ceiling front, there is still work to do, and still, room for twists in this saga before the Treasury runs out of cash as soon as June 1, which would trigger an unprecedented U.S. debt default.

The ongoing debt ceiling drama has managed to draw attention away from increasing uncertainty about the Federal Reserve's stance on interest rates.

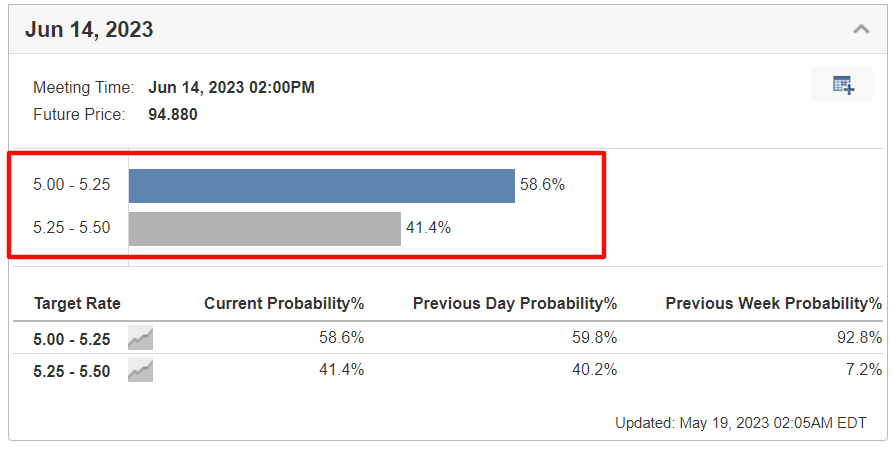

While recent data has indicated some slowing in the U.S. economy, it does not appear to be softening fast enough for the Fed to pause its rate hike cycle, and the market has even priced a 40% chance of a 25-basis-point hike in June, up from less than 10% last week.

Source: Investing.com

These Favored S&P 500 Stocks Have The Most Upside Potential According to InvestingPro

Amid the current backdrop, I used the InvestingPro stock screener to identify undervalued stocks that Wall Street analysts are still bullish on and have potential ‘Fair Value’ upside of at least 30%.

I first filtered for names with an InvestingPro ‘Fair Value’ upside greater than or equal to 25%. The fair value estimate is determined according to several valuation models, including price-to-earnings ratios, price-to-sales ratios, and price-to-book multiples.

I then scanned for companies that also enjoy potential analyst price target upside greater than or equal to 25%.

And those companies with a market cap of $20 billion and above made my watchlist.

Once the criteria were applied, I was left with a total of 24 companies. Each name boasts a ‘Strong Buy’ rating recommendation and offers significant upside potential based on their Investing Pro ‘Fair Value’ price targets.

Among the S&P 500, here are the top 20 stocks that are expected to rise the most over the next 12 months, based on InvestingPro ‘Fair Value’ price targets and analyst ratings:

- Baidu (NASDAQ:BIDU): InvestingPro Fair Value Upside: +60.6%

- Analyst Target Upside: +43.4%

- Alibaba (NYSE:BABA): InvestingPro Fair Value Upside: +60.1%

- Analyst Target Upside: +63.9%

- JD.com (NASDAQ:JD): InvestingPro Fair Value Upside: +55.5%

- Analyst Target Upside: +65.5%

- CVS Health (NYSE:CVS): InvestingPro Fair Value Upside: +49.8%

- Analyst Target Upside: +37.8%

- Cigna (NYSE:CI): InvestingPro Fair Value Upside: +49.7%

- Analyst Target Upside: +25.4%

- Sociedad Quimica y Minera de Chile (NYSE:SQM): InvestingPro Fair Value Upside: +49.1%

- Analyst Target Upside: +28.5%

- PDD Holdings (NASDAQ:PDD): InvestingPro Fair Value Upside: +46.8%

- Analyst Target Upside: +66.6%

- Truist Financial (NYSE:TFC): InvestingPro Fair Value Upside: +46.7%

- Analyst Target Upside: +35.7%

- Centene (NYSE:CNC): InvestingPro Fair Value Upside: +42.9%

- Analyst Target Upside: +26.3%

- Fidelity National (NYSE:FIS): InvestingPro Fair Value Upside: +42.0%

- Analyst Target Upside: +26.2%

- Charles Schwab (NYSE:SCHW): InvestingPro Fair Value Upside: +41.5%

- Analyst Target Upside: +29.0%

- PayPal (NASDAQ:PYPL): InvestingPro Fair Value Upside: +40.4%

- Analyst Target Upside: +51.8%

- Marathon Petroleum (NYSE:MPC): InvestingPro Fair Value Upside: +39.1%

Analyst Target Upside: +32.9%

- BioNTech (NASDAQ:BNTX): InvestingPro Fair Value Upside: +37.0%

- Analyst Target Upside: +61.2%

- Bank of New York Mellon (NYSE:BK): InvestingPro Fair Value Upside: +37.0%

- Analyst Target Upside: +31.5%

- U.S. Bancorp (NYSE:USB): InvestingPro Fair Value Upside: +35.7%

- Analyst Target Upside: +42.7%

- Charter Communications (NASDAQ:CHTR): InvestingPro Fair Value Upside: +35.6%

- Analyst Target Upside: +27.3%

- United Rentals (NYSE:URI): InvestingPro Fair Value Upside: +34.3%

- Analyst Target Upside: +30.6%

- Warner Bros. Discovery (NASDAQ:WBD): InvestingPro Fair Value Upside: +29.0%

- Analyst Target Upside: +57.3%

- Li Auto (NASDAQ:LI): InvestingPro Fair Value Upside: +28.9%

- Analyst Target Upside: +30.8%

Source: InvestingPro

Source: InvestingPro

For the full list of the 24 stocks that met my criteria, start your free 7-day trial with InvestingPro now!

If you're already an InvestingPro subscriber, you can view my selections here.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

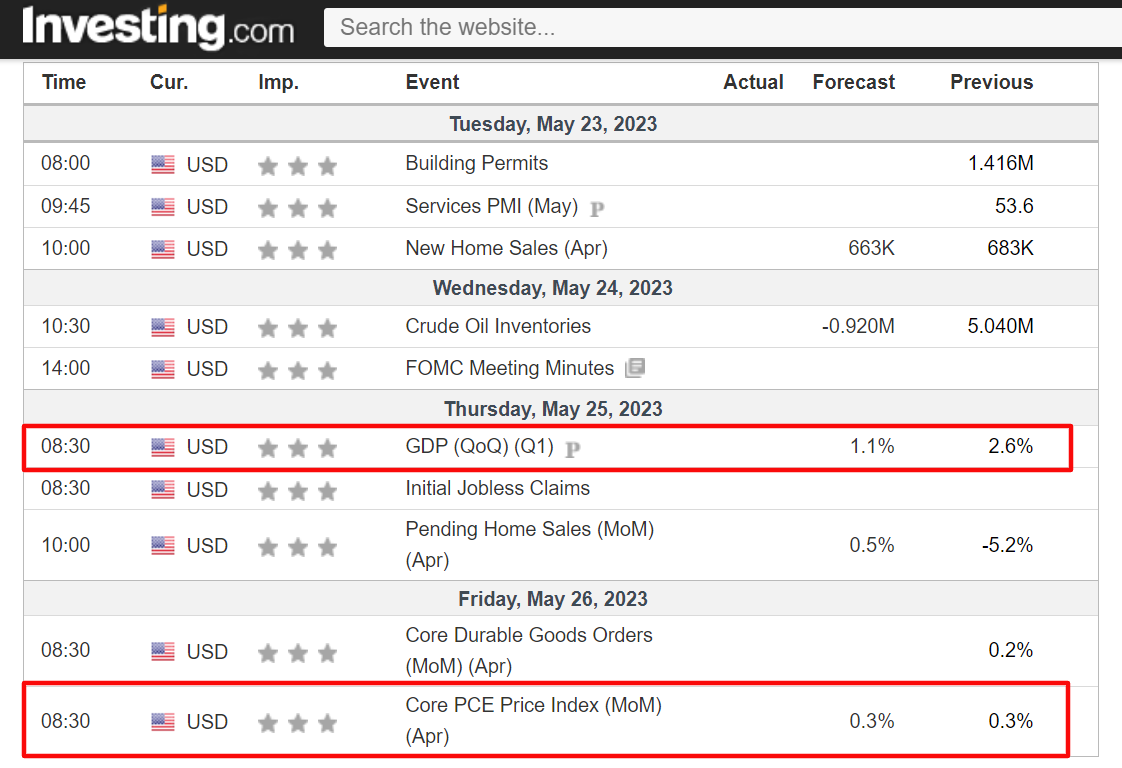

*Next Week: PCE Price Index, GDP & Nvidia Earnings

Market players should prepare themselves for fresh CBOE Volatility Index next week amid a plethora of market-moving events.

On the economic calendar, most important will be the personal consumption expenditures (PCE) price index, which is the Federal Reserve’s favorite inflation gauge. In addition, there is also important first quarter GDP data, which will provide further clues as to whether the economy is heading for recession.

Elsewhere, the earnings calendar includes another heavy dose of retailers, with Best Buy (NYSE:BBY), Lowe’s Companies (NYSE:LOW), Costco (NASDAQ:COST), Dollar Tree (NASDAQ:DLTR), Kohl’s (NYSE:KSS), Burlington Stores (NYSE:BURL), Dick’s Sporting Goods (NYSE:DKS), Ulta Beauty, Inc. (NASDAQ:ULTA), and AutoZone (NYSE:AZO) all reporting.

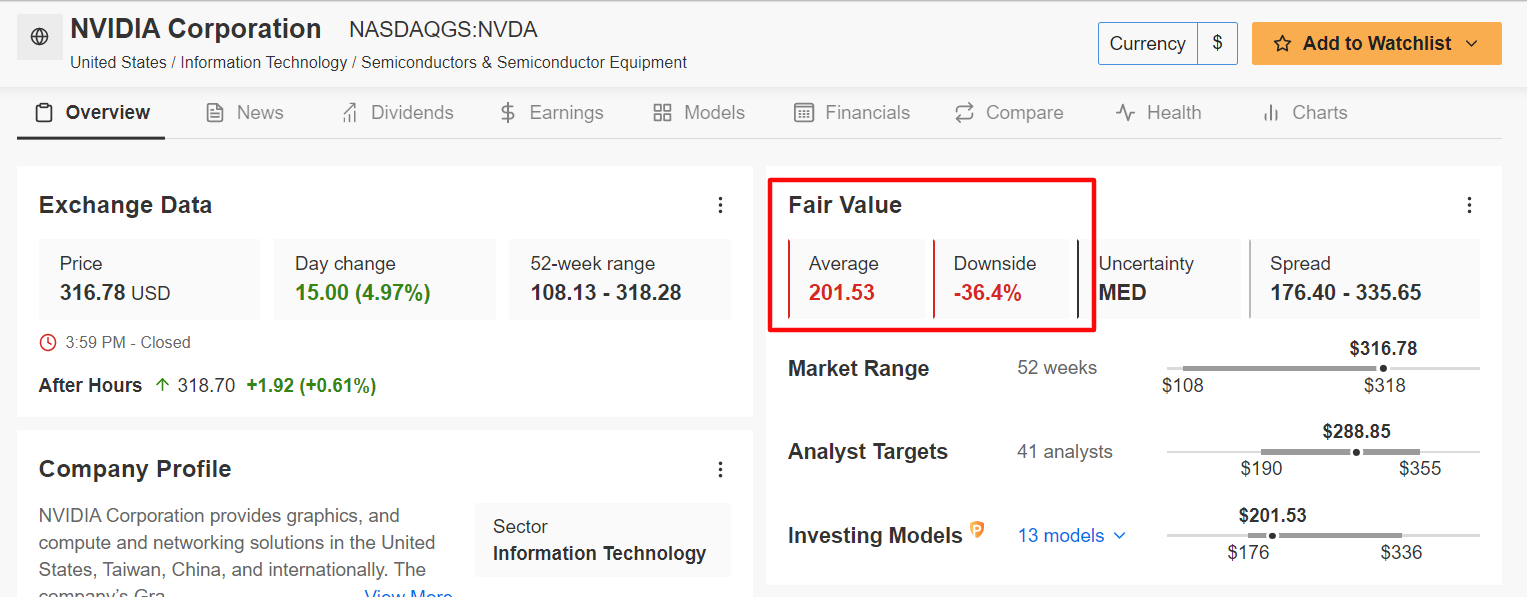

And there could be some more fireworks among the mega-cap tech stocks, as market darling NVIDIA Corporation (NASDAQ:NVDA) also gets set to deliver results next week. Shares of the Santa Clara, California-based tech giant, which have more than doubled since the start of the year, are extremely overvalued heading into the print, with a potential downside of more than 36%, according to InvestingPro.

Source: InvestingPro

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you time and effort. Try it out for a week for free!

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF. I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.