With little fresh news during the holidays and many pros on vacation, I expect a time of reflection and prediction. Publications hungry for content and TV producers needing to fill slots will highlight forecasts of any and all flavors. This happens every year, but the mid-week holidays are pushing it a little earlier than usual,

It is time to start the pundit forecasts for 2015!

Prior Theme Recap

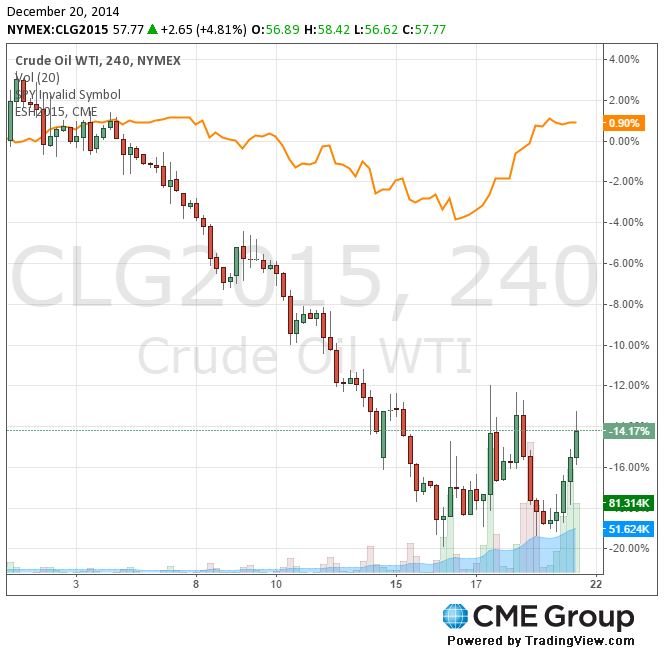

In my last WTWA I predicted continuing focus on Oil prices with special attention to whether the crash would affect Fed policy. This was one of my best forecasts, despite the two-part complexity. Declining oil prices dominated the news and weighed upon stock prices until the Fed announcement, when we saw a sharp change. When it comes to getting the story with one picture, it is tough to beat Doug Short’s weekly snapshot (with plenty of additional interesting charts in the post). Doug notes that the two-day rally was accompanied by strong volume.

Whenever we see a period like the last two weeks – a sharp decline and a sharp rebound – it is natural to feel like you should have “done something.” I’ll comment on that further in several of the sections in today’s WTWA.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

A Personal Note

Some readers express concern when I miss a week with the WTWA series. I enjoy the dialog with readers and appreciate the interest. I should do better in announcing and updating my plans.

With that in mind, here is the current plan. I am not taking a year-end vacation since it is an important time for reporting and planning. Some of my team will be off to warmer climes! I will take an extra day or two to celebrate with family and I may not sacrifice the weekend day required for the regular WTWA post. I will change plans if there are important events.

This Week’s Theme

We move from a time of increased volatility into the quietest period of the year. The trades still count, but there is less fresh news to consider. It is time for the financial punditry’s annual exercise:

What is your market forecast for 2015?

There are several obvious camps which I am highlighting for future scorekeeping. A few have already weighed in, and those links are included. More to come!

- Imminent crash. (Peter Schiff).

- Correction ahead

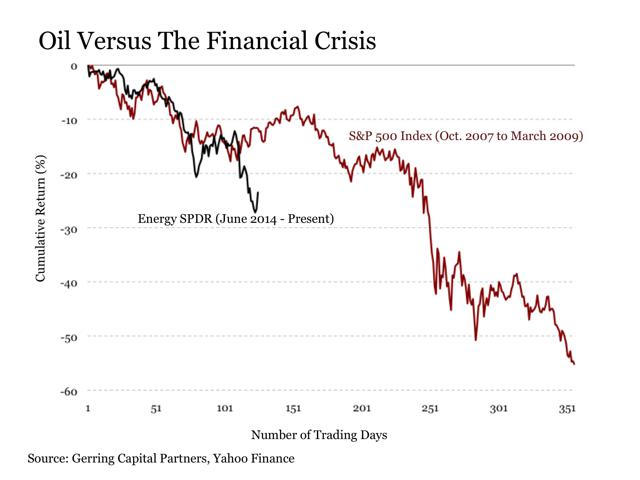

Eric Parnell explains his ideas about how a bear market starts. He uses a number of two-variable comparisons of past markets, like this one:

- A quiet year

Brian Gilmartin’s earnings-based analysis, suggests that 5-10% would be a good year.

- Modest growth

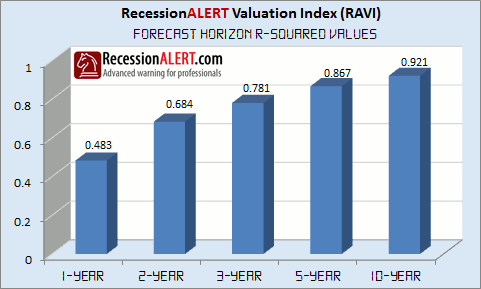

Dwaine Van Vuuren, whose excellent work we feature in our Quant Corner, has an interesting valuation model based “upon cyclically adjusted trailing S&P 500 earnings.” He updates the forecast every quarter. The current valuation target shows a return of 8.5% from today’s prices.

- Significant gains

Tom Lee has been bullish and right in recent years. He sees a 15% gain, which he sees as a contrarian call versus most street estimates. Sam Ro notes that strategists have recently been 5% lower than actual results.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

The news last week was very good.

- The Keystone Pipeline is first on the GOP Senate agenda next year. While there is still the threat of a Presidential veto, I expect a successful bipartisan coalition and compromise. The overall effects on oil prices are difficult to parse, and the President downplayed the effect in his press conference this week. It will be perceived as market friendly and will have an immediate effect on jobs. It will also provide downward pressure on overall oil prices via reduced transportation costs. While the oil is not just for North America, it will be cheaper at that point. My environmentalist friends should note that I am not citing this as desirable public policy. I am merely sticking to my rules concerning what is “market friendly”.

- FOMC decision. For some, this was not really news at all. Last week I provided a guide to the upcoming meeting, suggesting that many were following overly-simplified heuristics, especially the correlation of oil prices with stocks. Those with this mentality expected the Fed to react to the economic weakness implied by commodity prices rather than the trends in the actual data. As has regularly happened in the last few years, the economic Fed watchers did better than the traders, many of whom were “caught offside.” An interesting example is the official PIMCO viewpoint contrasted with the recently-departed Bill Gross. Ben Bernanke, speaking to “the firm’s internal forecasting session,” expects the Fed to look past the disinflationary evidence and begin to raise interest rates in mid-2015.

This was the clear message from the statement and the Yellen press conference. Confirmation comes from Bank of America via Myles Udland at Business Insider, with “7 Things we Know” after the meeting. This is an excellent summary.

- Confidence in the economy is higher. New Deal Democrat looks at three different surveys, emphasizing the expectations components. Check out the “surge in all three surveys.”

- Cuba. Normalizing relationships might be controversial in the realm of international politics, but the move seems to be good for economic activity. The WSJ has five things you should know about Cuba’s economy.

- Leading economic indicators show continuing strength, up 0.6%. Steven Hansen at GEI has the full story – charts and analysis. Doug Short compares the result to the ECRI indicators.

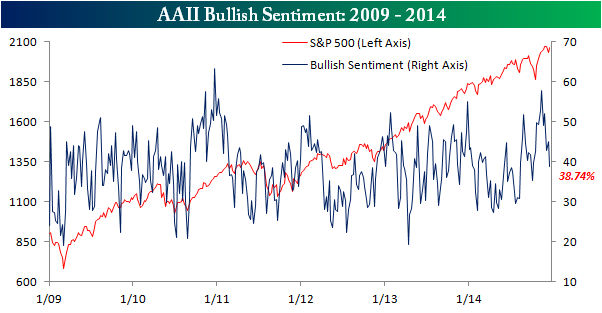

- Bullish sentiment is lower. This is favorable on a contrarian basis. Bespoke has the key chart.

- More fifth birthdays than ever before. Bill Gates reports good news you might otherwise miss, including fewer kids dying from preventable illnesses. Check out his full list.

The Bad

Once again, the bad news was pretty minor. Readers are invited to nominate ideas in the comments, but remember that we are focusing on recent developments, not a list of continuing macro concerns. Last week I mentioned Art Cashin, who had (yet another) good quip about people who had a cup of coffee and “suddenly noticed” something. I share his skepticism about delayed reactions. So it proved at the end of the week.

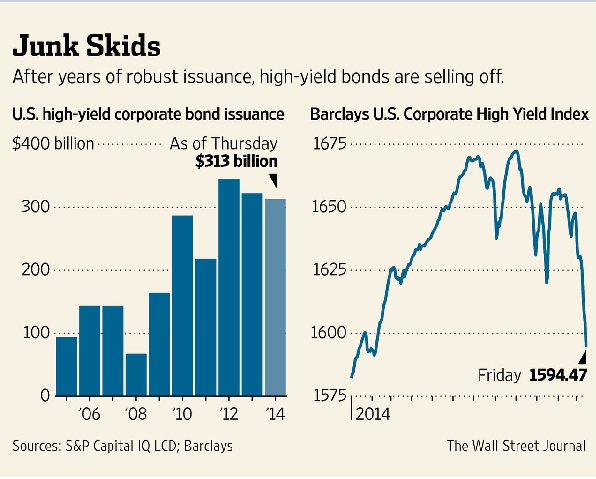

- Junk bonds. While the default risk centers on small energy companies, investors are learning that the impact is broader. Funds that face redemptions must sell what they can, often not the worst bonds. They are often the most illiquid. Higher quality bonds get sold only because there is a market. Buyers are aware of the problems and prices decline. For us veterans, it is reminiscent of 1998 and the Long Term Capital Management contagion. At the moment it is bad for owners of junk bonds, related bond funds, and even variable rate securities. It is difficult to anticipate the risks in the current skepticism about stocks and reach for yield. (WSJ).

- Fed policy is still more hawkish that the Street understands. The implied path of rate increases is more aggressive than the Fed funds rate, mostly because traders are skeptics about the economy. Tim Duy has been on target, and he sees a more aggressive Fed. If the economy and earnings cooperate, this should not be troublesome, but it bears watching.

- Housing starts and building permits lagged expectations. Calculated Risk notes the miss and puts the data in context.

Mixed Message

The story about the collapsing ruble is playing out in different ways. Some think that it is pushing Russian investors toward the US. Some see a threat to US stocks. Yet another camp thinks that this means extra pressure on Putin to compromise on the Ukraine issues. This may be the single most important issue over the next few weeks.

The Ugly

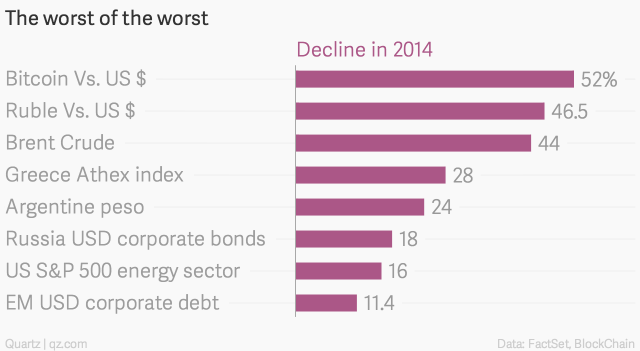

The worst of 2014, from Matt Phillips at Quartz.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger.

This week’s award goes to Jeffrey Bartash of MarketWatch, citing the economics team at Merrill Lynch. Their research explains Why Wall Street should pay less attention to Philly Fed, Empire State.

Regular readers know that I downplay these results. It is nice (finally) to have some support. I mistakenly took my CNBC feed off of mute to hear their “experts” calling describing the most recent report as “crashing” from the prior high. The prior high was described as an anomaly when it occurred. There is no report that will satisfy those on a mission. No one seems to understand that a diffusion index compares one month to another. There are several other problems with this regional survey.

The result is that the regional Fed surveys are usually ignored and often misinterpreted.

Quant Corner

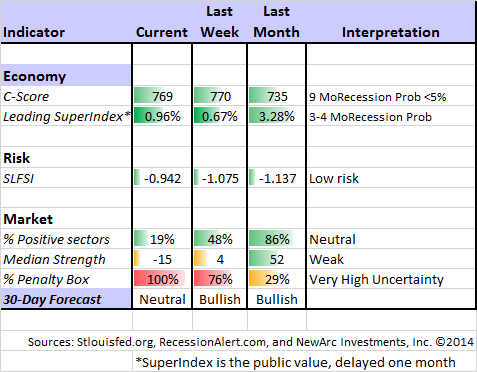

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. Georg’s BCI index also shows no recession in sight. Georg continues to develop new tools for market analysis and timing. Some investors will be interested in his recommendations for dynamic asset allocation of Vanguard funds. Georg has a new method for TIAA-CREF asset allocation. He has added a method for Vanguard Dividend Growth Funds. I am following his results and methods with great interest. You should, too.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators.

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully.

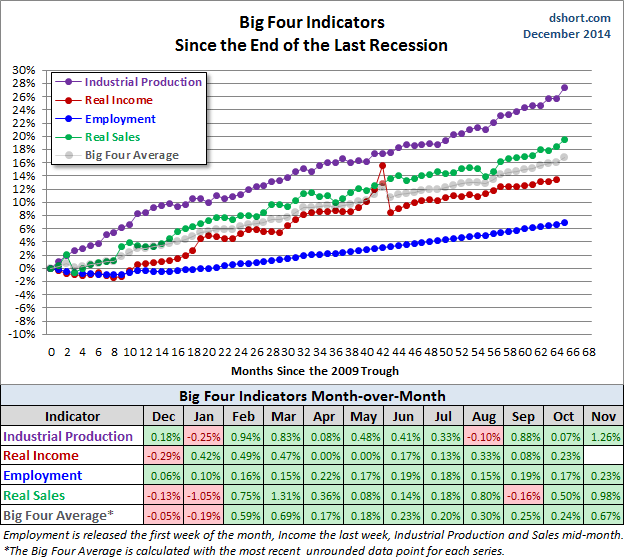

We now have the final 2014 update to Doug’s Big Four – the indicators most important to the official recession-dating process. See the complete article for more charts and analysis of each. The end-of-year economic strength is clear if you emphasize the most important indicators.

The Week Ahead

With the holiday schedule over the next two weeks, the regular data releases will follow a different pattern. With markets closing early on Wednesday, all of the action will come over the course of 2 ½ days.

The “A List” includes the following:

- Initial jobless claims (W). The best concurrent news on employment trends, with emphasis on job losses.

- Michigan sentiment (T). Final read for December. Recent highs maintained?

- Personal income and spending (T). Wage gains and lower gas prices finally showing up?

- New home sales (W). Important read on an important sector.

The “B List” includes the following:

- Existing home sales (M). Less important than new homes, but all things housing remain important for continuing economic strength.

- Durable goods (T). Strength expected in this volatile series.

- GDP for Q3 (W). This is old news, but the final revision does provide a baseline for evaluation.

- Crude oil inventories (W). For the moment at least, this announcement is getting plenty of attention.

The speech schedule is extremely light. There will be another vote on the Greek Presidency.

The next holiday week will also have an abbreviated calendar highlighted by the ISM report on Friday. Few will be around the day after New Year’s Day, and the employment data will come a week later.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix shifted gears on Monday, adding an inverse ETF to hedge the position. While the trading profile was still net long for the week, the trend had clearly changed to a “no man’s land” for risk and reward. We have fewer positive sectors and an explosion of ETFs in the penalty box, reflecting high uncertainty. Our current positions are slightly long and including Chinese A-Shares (DB X-trackers Harvest China (NYSE:ASHR)). Last week I described Felix’s bullish call is a close one, and it is now better described as neutral.

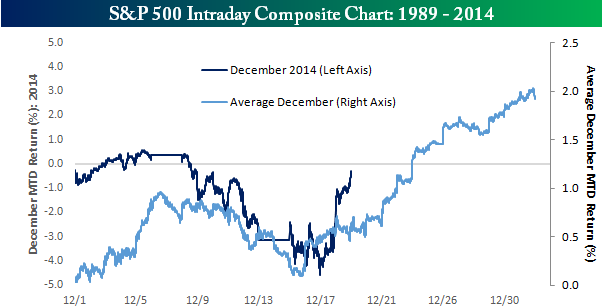

Bespoke highlights and discusses the strong seasonal pattern, despite the weak start to December.

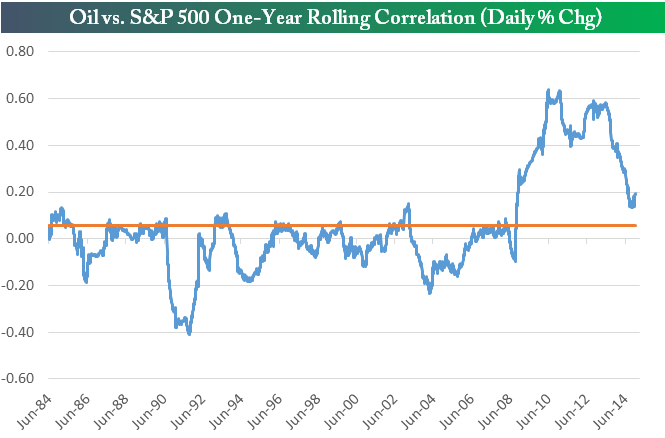

The oil-stock correlation, emphasized by many traders, is suspect. It broke down last week, as shown in the chart below. Look especially at the last few days of trading.

Bespoke provides a longer perspective showing the decline in the correlation. The emphasis on this relationship is a mistake of recency bias.

You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are directed at spotting these major declines. A key element is staying focused on data rather than noise. I took a closer look at the most recent scary themes in Keeping Investors Scared Witless. If you missed it, please take a look. I also recently offered some crucial facts about energy, providing some perspective on the oil price decline and associated opportunities.

Other Advice

Here is our collection of great investor advice for this week:

Stock Ideas

Eddy Elfenbein, CNN/Money’s best buy-and-hold blogger, is out with his eagerly awaited choices for 2015. Eddy locks in the choices for a full year. There are always great ideas, and you have the choice of selling during the year – if you dare!

Chuck Carnevale has a first-rate, introspective post: The Dividend Growth Investor’s Version of “A Christmas Carol.” Chuck reviews a number of past picks and tracks the results of his strong methods. We never invest in a stock without first checking in with FastGraphs. The list of stocks might not be the right choices for today, but understanding the process will help your future stock picking.

Aron Pinson asks, Is Google the Next Apple at $400? Good question! Many have found it difficult to get aboard with this stock, just as they have with Apple. Meanwhile, it is important to have some growth stocks in your portfolio.

Energy Stocks

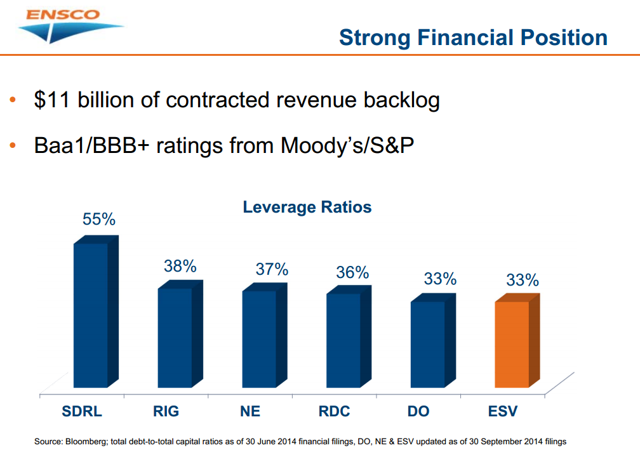

There is special interest in energy and many of the names are beaten down. Some of this is unfair. I want to give special attention to the sector this week, including some extra links and ideas. Is it time to buy right now? Read and decide. Several of the articles are from Seeking Alpha, which has had excellent coverage of the sector, as well as individual stocks involved.

- Beware of experts on oil prices. (Ben Casselman at fivethirtyeight).

- A history of bad forecasts. Funny, but true! (Myles Udland at BI).

- Four oil stocks to “buy now” via Mark Hulbert.

- Why you should not sell your oil stocks at a loss. (Aristofanis Papadatos)

- Oil doomsayers were wrong.

- Finding safe oil dividends.

- Supply and demand in oil. Is the glut real?

- The best driller for the recovery? (Rupert Hargreaves).

Nine oil “gushers” from Philip van Doorrn (some overlap with Hulbert, above).

Ten favorites of short sellers. (BI)

Investor Psychology

Investors make many decisions that are not justified by the fundamentals, as we know from the growing body of research on behavioral finance. Here are two important themes:

- Hoping to “get even.” Suppose you buy a stock and it then declines. “If only it gets back to even,” you might say. In fact, if the stock rebounds that might be exactly the wrong time to sell. Whether to sell on the decline, just hold, or buy more depends upon your fundamental analysis and the changing circumstances. YCharts has a good discussion and some examples.

- Smart people worry too much. This creates the wrong bias for investing for the intelligent investor. Josh Brown explains the challenge from the perspective of the investment advisor. He is right.

- Headlines influence your opinions – whatever the facts.

- Young investors need to start early.

Investment Scams

The hits just keep on coming! Check out the top investor threats for 2015 courtesy of Chuck Jaffe at MarketWatch.

Final Thought

What are my market predictions for 2015? I am working on my own annual preview article. I will not make a specific market forecast, but I will examine trends that I think offer the best risk/reward balance. I remain constructive on stocks since we are still in the middle part of the business cycle. I will also try, as I do in my weekly to distinguish between investors and traders.

What I write is intended to be helpful, educational, and thought-provoking. It is not individual investment advice. Many have written that they have found my posts helpful in keeping them on course with their own programs. I am absolutely delighted to learn this. It encourages me to tee it up every weekend for another edition of WTWA. But please keep in mind that your own situation is special. No one can or should provide general advice in the abstract.

With this in mind, I want to direct my final thought both to the recent market as well as the week ahead.

Concerning recent times, investors experienced a taste of a market correction, but not the worst that might happen.

- If you bailed out of your investment program, you made a mistake. You either expect too much from market timing, or you have taken on risk beyond your tolerance. You are probably also checking your account balance far too often. Cut back on your risk and relax. You now have to decide when to get back in. There is a right time to sell – when a stock no longer qualifies on fundamental criteria. Otherwise you are “confusing volatility and risk,” as Josh Brown explains.

- If you think you should have “bought the dip” on Tuesday, you might be using some hindsight. There are always some trading methods that react to “oversold” conditions. Oversold sometimes gets more oversold. Then you panic and bail at an even worse time. The oil price decline offered many opportunities before last week, and they were all wrong. 2008 was similar. You do not need to be a hero to succeed with your investments. There will be a time to get aggressive.

- If you stuck with your program and enjoyed time with your family, you have the right size and the right approach to risk.

Concerning the week(s) ahead, I expect a time of declining volatility on low volume – a good opportunity to sell calls against your strong positions. That is what the market is giving right now, and we should take it!