It is magical! Whatever the topic of current interest, there is no shortage of pundits.

The current energy experts were recently (it seems like only yesterday) the leading authorities on the Fed, Europe, Ukraine, Libya, deflation, hyperinflation, stagflation, and of course, Ebola.

The current crop of experts confidently talks about an oil glut, the motives of the Saudis', and the demise of the US energy industry. The nearly universal perception is that there is no bottom in oil prices.

I wonder how many experts could actually pass a test. Suppose that CNBC used this to qualify experts. My guess is that they would have no content! If you can even give ballpark estimates on these questions, you will beat the pundits on television.

Pop Quiz

Pop quizzes were universally hated by my students, but were infallible at finding those who did not know basic facts.

- What country was the world’s largest overall producer of energy? The largest consumer?

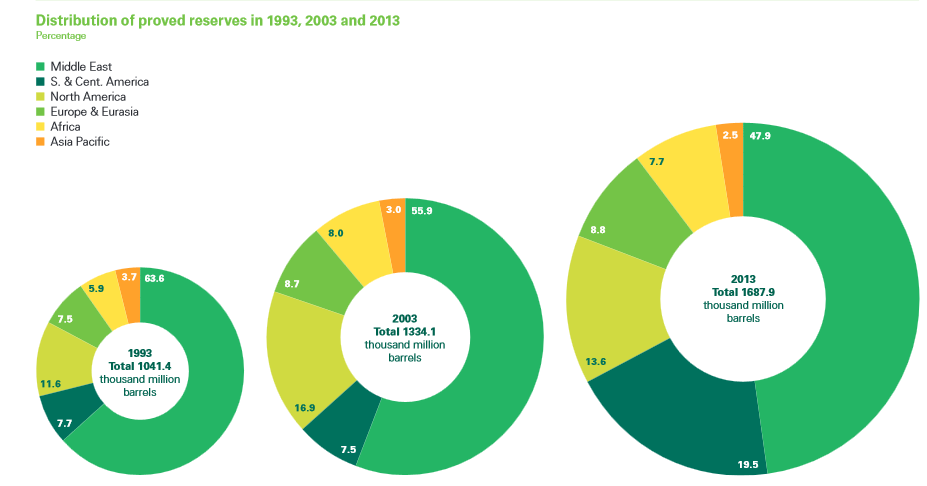

- What region has the largest proven reserves?

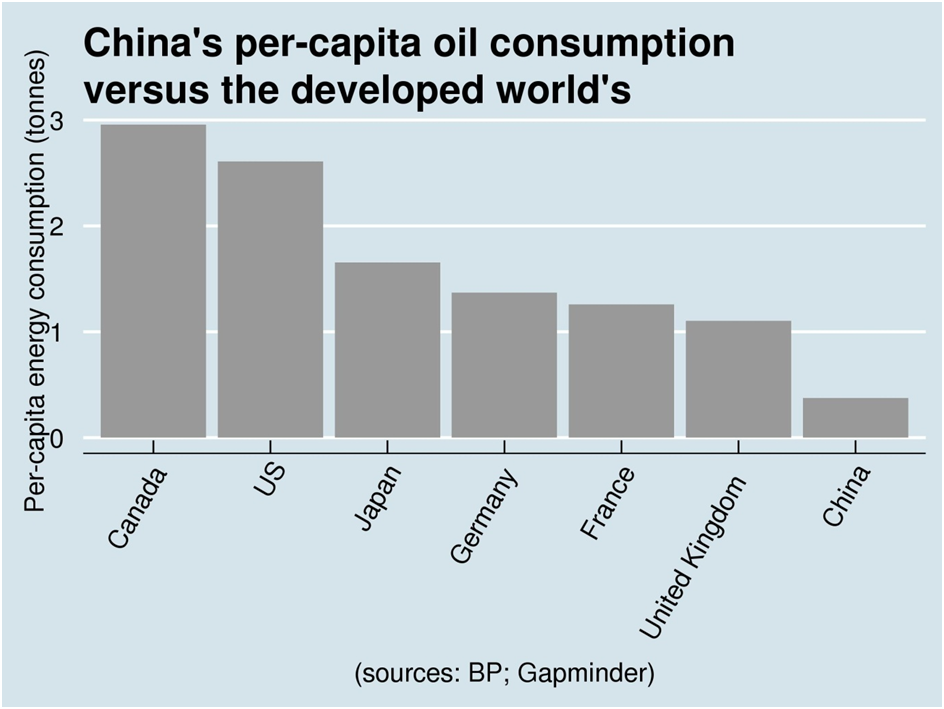

- How does Chinese consumption per capita compare with Europe? With the US?

- How many car drivers are there in China? What is the growth rate?

- What is the change in demand for oil in 2014?

- What is the daily oil consumption? How much is the supply/demand imbalance?

Answers

- China — on both fronts. And just getting started.

- The Middle East — by far.

3. China is 1/2 the consumption of Europe — generally frugal and with shorter travel distances. 1/4 of the consumption of the US.

4. 300 million. A growth rate of about 900% over the last ten years. There are plenty of new highways and car dealers. The growth rate will surely slow, but there are still about a billion drivers to come. How about India?

5. An increase of about 0.7% and a bit more in 2015. I suspect that most “experts” are projecting declines.

6. Daily oil consumption is around 92.5 million barrels/day. This is a useful number to keep in mind when someone says that a few million barrels is a “glut.”

Conclusion

One of our authoritative sources on oil prices is Prof James Hamilton at Econbrowser. He has a great post on the “glut” with plenty of charts and excellent analysis.

Prof. Hamilton contrasts the current oil prices with the cost of production, showing that oil is not so cheap. He has meaningful advice for producers:

Here’s my advice to anybody who’s contemplating selling $85 oil at $66 a barrel– don’t do it. If you can wait a few years, that $85 oil will be worth more than it costs to produce. But selling it at a loss in the current market is a fool’s game.

While he does not write with investors in mind, I frequently draw upon his excellent work. His analysis of the supply/demand relationship, crucial in analyzing the 2008 period, does not square with current trading.

It is not unusual for short-term trading to diverge from long-term fundamentals. Taking advantage of this tries the patience of everyone. [Full disclosure. Some of my programs have had relatively modest holdings in energy stocks, but anything at all was too much. It is not the first time I have held an unpopular position, and it will not be the last.]

Additional Source material from the authoritative BP Statistical Review, which should be required reading for pundits.

I have some specific ideas to exploit divergences. More to come.