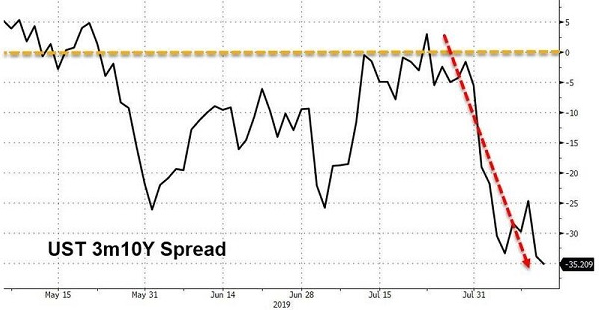

Mainstream pundits have been telling stock investors throughout 2019 that it does not matter if long maturity Treasury bonds yield less than short maturity Treasury bonds. They have been explaining that you should ignore the fact that, for the most part, that the 10-year yield has been offering less than the 3-month yield since mid-May.

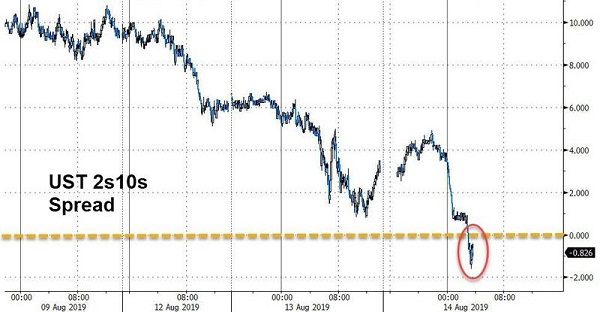

However, financial institutions often rely on borrowing money at lower short-term rates and lending at higher longer-term ones. When the spread between short and long flattens, they struggle to find avenues of profitability. When the relationship between short and long flips on its head, public financial companies look to minimize risks altogether.

That’s where we are today with the inevitable inversion of the closely monitored 2s and 10s.

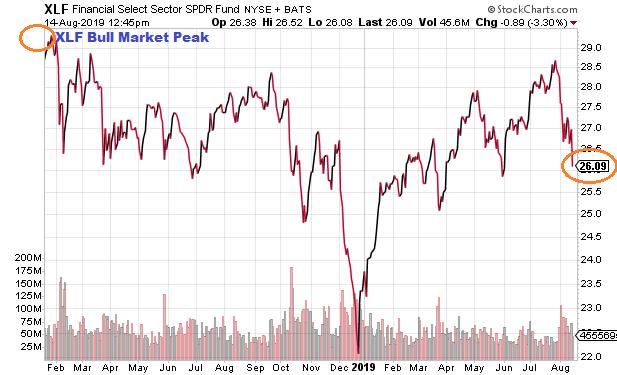

There are those who will try to tell you that “spread lending” isn’t the only aspect of financial services. Yet those who have shared the faith in a diverse financial-service sector have not been rewarded for that faith in 19 months.

Specifically, consider the Financial Select Sector SPDR Fund (NYSE:XLF). It has experienced a bearish backdrop since January of 2018.

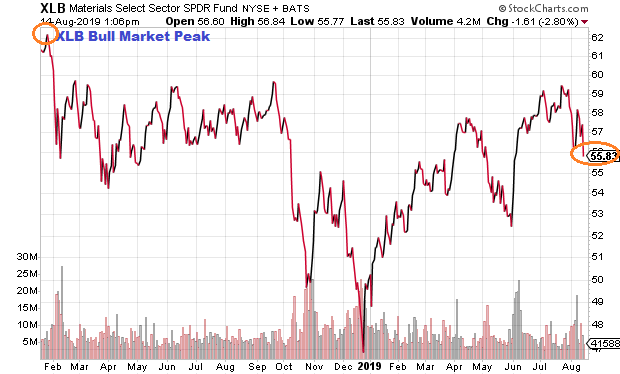

The bearish backdrop over the last 19 months is hardly confined to the influential financial segment. A similar pattern has been seen in energy stocks as well as Materials Select Sector SPDR Fund (NYSE:XLB).

A number of comment providers will say, “So what? The overall U.S. economy is strong and the S&P 500 is still near all-time highs.”

My reply? The rest of the world’s top economies have never quite recovered from the 2008 financial collapse. In fact, governments are still providing extraordinary amounts of stimulus (a.k.a. “easy money”).

Is it working? Not if stock markets represent confidence. Nearly 12 years since the inception of the global financial system’s breakdown, U.S. investors have only seen gains in U.S. stocks.

12 years of losses for U.S. investors in international equities? Indeed, the Vanguard FTSE All World ex US (NYSE:VEU) has only lost money since October of 2007. The real stock bull — the only definitive stock bull — is the one that U.S. investors have experiences stateside.

Another way to look at it? The “new” international stock bear began 19 months ago in January of 2018.

It is worth noting that the 10 leading economies are: (1) United States, (2) China, (3) Japan, (4) Germany, (5) United Kingdom, (6) France, (7) India, (8) Italy, (9) Brazil, (10) Canada. Excluding the U.S., every one of the top economies is noticeably frail.

Recently, China’s economy has struggled with the ongoing trade war. Yet the country’s real estate bubble and debt accumulation has been worrisome for quite some time. Whereas U.S. stocks have nearly doubled since the start of the 2008 financial crisis, Chinese stocks on the Shanghai Composite have been CUT IN HALF.

The world’s third largest economy, Japan, suffers from an aging population and a shrinking workforce. Meanwhile, the Bank of Japan has never been able to leave zero percent interest rate policy. U.S. stock investors have not benefited from an allocation to iShares MSCI Japan ETF (NYSE:EWJ) since the Great Recession began.

The world’s fourth largest economy, Germany, relies heavily on its exports. Weak economies across Europe have adversely impacted Germany for years. More recently, tariff disagreements as well as Brexit uncertainty in the United Kingdom have been devastating. U.S. investors who may have believed in iShares MSCI Germany (NYSE:EWG) for more than a decade have been sorely disappointed.

The United Kingdom is a “hot mess.” In the 2nd quarter, its economy shrank (0.2%). Meanwhile, Britain’s protracted withdrawal from the European Union has wreaked havoc. U.S. investors who stayed away from iShares MSCI United Kingdom (NYSE:EWU) have been fortunate.

Things have been bleak for the others on the top economy list as well. Unemployment is near a 45-year high in India. French unemployment has remained stubbornly high since 2008’s global financial catastrophe. Italy, has been in and out of recession since 2008. Materials-rich Brazil faces pressures from a worldwide slowdown in demand. And U.S. investors have not profited by investing in an oil-n-gas-heavy mix of Canadian corporations.

What does one learn from assessing the world’s various predicaments? That the U.S. has been the exception, not the rule.

Granted, the U.S. economy may have the potential to lift other economies out of the doldrums. Resolution on the trade-war front could go a long way toward improving economic prospects globally. What’s more, the Fed may decide to aggressively cut its overnight lending rate to “un-invert” the yield curve.

On the flip side, both Europe and Asia were battling difficulties long before Americans began googling the word “tariffs.” It is quite possible that the world’s troubles will spread to our shores, causing U.S. stocks and other asset prices to drop dramatically.

In the meantime, my near-retiree and retiree client base has experienced far less portfolio volatility and drawdown. We have done well with assets such as iShares Core Treasury Bond (NYSE:GOVT), iShares AAA-A rated Corporate Bond (NYSE:QLTA), VanEck Vectors Preferred Securities ex Financials (NYSE:PFXF), iShares Core U.S. REIT (NYSE:USRT), iShares MSCI USA Minimum Volatility (NYSE:USMV), Vanguard Dividend Appreciation (NYSE:VIG) and Vanguard MegaCap (NYSE:MGC).