Investing.com’s stocks of the week

This post was written exclusively for Investing.com

After the Christmas Eve massacre that sent stocks plummeting, the astonishing recovery that followed has kept investors guessing, as a series of on-again/off-again recession fears and geopolitical wrangles sent yoyo-ing signals to a market that scrabbled to make sense of them. In the meantime, though, the S&P 500 continued its spectacular rally. And guess what? It's not finished climbing.

The S&P 500 set a new closing high on April 23, at 2,933.68. It was nearly four months after the December 24 rout that left the index at 2,351.10. Since then the S&P 500 has risen by over 582 points, or 24%. It's slipped marginally over the past two sessions, closing yesterday at 2,926.17, but the strongest signs are indicating that the ascent will continue.

The landscape for the stock market has improved dramatically over the past four months, with interest rates plunging and a global economy that is performing better than expected. Now, earnings are pouring in and, based on early indications, those earnings are outperforming too, due to sales growth and margin expansion. It is a stew of positive news brewing, which is a recipe for higher stock prices and more record highs.

Low Rates May Lead To Multiple Expansion

With the backdrop of low interest rates, which may be going even lower, the S&P 500 could continue to see its earnings multiple expand. Since December the U.S. 10-year Treasury yield has fallen by roughly 50 basis points to 2.5%. The lower rates are likely to push investors further out on the risk curve in search of higher returns. It would likely suggest that the S&P 500 can see its PE ratio rise, pushing equity prices higher.

Using data from Dow Jones S&P Indices, the average one-year earnings multiple for the S&P 500 comes to roughly 17.5. The current multiple based on 2020 earnings estimates is around 15.7. Even since 2012, the average PE ratio has been around 17, at 16.7. It could all lead to the S&P 500 rising towards 3,200.

Better Earnings

Earnings have been coming in better than expected this quarter. According to Dow Jones S&P, through April 18, 77% of the S&P 500 companies have already reported results, with 75.3% of them beating earnings estimates. Meanwhile, just 16.8% have missed, and about 7.8% have met forecasts. Although it is still early into earnings season, that is better than the average of approximately 70% beating estimates and 21% missing estimates since 2012. If this trend continues throughout the quarter, it would suggest earnings estimates may need to be adjusted higher, further helping to lift equity prices.

It isn't just earnings that are growing: revenues for these companies have risen too. According to the data, revenue for the first quarter is up over 4% versus last year. Meanwhile, margins have improved by 90 basis points sequentially to 11%. The better revenue and higher margins are helping to drive the better than expected earnings season. It would also suggest that companies are increasing prices and passing on rising costs to the consumer, a positive sign for the overall economy.

Better Economic Growth

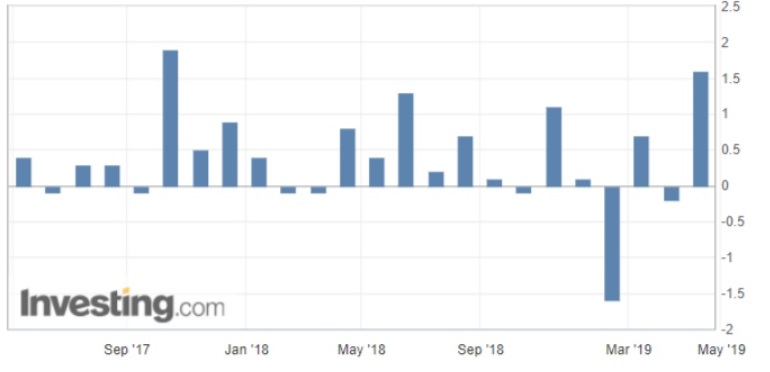

Even economic growth has proven to be better than some have feared. For example, China reported better than expected GDP growth for its first quarter coming in at 6.4% versus estimates for growth of just 6.3%. And the U.S. has shown just how strong its consumer continues to be. Last month retail sales were up 1.6% versus forecasts of 0.9%—their biggest jump in nearly 2-years.

Upward Growth Revisions?

If earnings and the global economy continue to grow at a pace faster than previously forecast, it may very well lead to upward growth revisions for the rest of 2019. That would provide a powerful boost for the equity market, helping to push stock prices further into record territory.

And the icing on the cake? Little has been said so far of how easing trade tensions between the U.S. and China could benefit global growth. A trade deal would likely be a big positive for stocks—couple that with all the above, and stocks may soar to levels thought to be nearly impossible just four months ago.