Yesterday I wrote about the broad strength in the markets and the long-term view that they could move much higher, noting in particular the Nasdaq 100. It has been the leader lately and to see after such strength that it has lots of room to the upside goes against the common perspective.

Today the S&P 500 is in my focus. Each Saturday I illustrate my view on the S&P 500 with a long-term Elliott Wave chart leading the analysis. If you have read it you know there is a lot of room higher in the S&P 500 as well. It is the shorter view that I focus on today. The next step up on that wall of worry. It appears to have started Thursday.

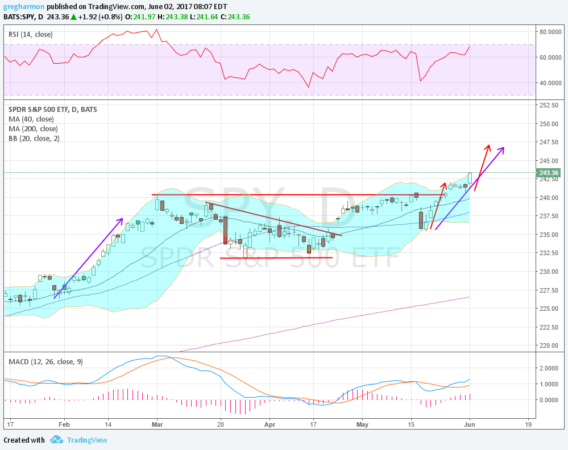

The chart above shows the short-term story in the S&P 500 ETF (NYSE:SPY). In February it moved higher after a year end pause that ran into January. A one-month move up that morphed into another consolidation at the start of March. It had been in that consolidation ever since. At the end of last week it cracked above, and held the break out earlier this week. Thursday the SPY moved decidedly higher. How high will the next step be?

There are two suggestions in the price action. The first is the move into the the consolidation measured back out of it. This gives a target to about 247. The second is a measured move from the recent May low to the consolidation this week added to the break out. This also gives a target near 247. There is no reason that the SPY need stop there, and the longer view remains positive. But for the shorter perspective, 247 seems a good target ahead of the next FOMC meeting in less than 2 weeks.