One questions how important the overnight U.S. trading session will be in defining the price action and technical set-up in global equities in the near-term.

There is no doubt about it the bears have gained an advantage, but whether we see a more lasting trend lower is obviously yet to be seen. The stage is set though for a move 2-5% lower and the bulls will absolutely need to step in today and tonight or risk assets should go lower from here.

One just has to look at the tape, not just in the S&P 500, but Dow, Russell 2000 (small caps) and Dow Transports, and it wasn’t just the FOMC minutes that had been noted. House Speaker Paul Ryan also suggesting the Senate doesn’t have a plan on tax reform and that tax reform may take longer than health care reform certainly caused a second leg to the late session sell-off.

Any hope of tax reform materialising in August is actively being priced out of markets here.

On a positive note, earlier in U.S. trade we saw the ADP private payrolls report detailing 263,000 jobs created in March, well ahead of the consensus of 185,000 jobs and this should go some way to mitigating a poor payrolls report on Friday. We also saw a below consensus services PMI index at 55.7, but this had little impact on equity markets, which had a strong open despite this print.

The highlight though and what is being widely talked about on the desks has been the FOMC minutes. It should not surprise that the Federal Reserve (Fed) are talking openly about normalising its balance sheet, it is just another sign of confidence in the economy and we heard “nearly all” participants believing balance sheet reduction should be tied to economic and financial conditions. “Several” even calling for an explicit target for the fed funds rate at which normalisation would begin. “Most” Fed members are calling for reinvestments of maturing mortgages and U.S. Treasurers to start “later this year”, so the markets have had to do somewhat of a re-think here as they were likely of the view the process of allowing its massive $4.5 trillion balance sheet to gradually reduce would materialise in late Q1 2018.

The reaction here has been quite punchy and it’s interesting that there were no real discussions about a lesser need to hike rates if the balance sheet is also being used as a policy tool – a theme Bill Dudley has been pushing of late. One should note that the market is seeing this as a more medium-term concern with the probability of a June rate hike actually increasing a touch to 56%.

If we look at the U.S. 5-Year Treasuries the yield fell from 1.90% to 1.83%, with the U.S. 10-Year again eyeing a break of the key 2.30% area. U.S. 10-year ‘real’ (or inflation adjusted) Treasury yields fell five basis points (bp), so it’s no surprise that gold gained $13 in this run. USD/JPY, which had found buyers easy to come by given the good jobs print, fell 90 odds pips fairly quickly and on the daily chart is eyeing a break of the recent double bottom. A break here of ¥110.00 would be a significant development.

The fact the Fed minutes showed members viewing stocks prices as “quite high” seems to also have been noted, although selling stocks purely on this comments seems a stretch. The valuation argument has been an issue investors have been talking about for some time and we have noted that the S&P 500 trades on 18.25 time’s forward earnings, a near 20% premium to the seven-year average of 15.32x. Still, having the Fed showing a concern about valuations at a time when the moves higher in equities have been hugely influential in easing financial conditions is very interesting.

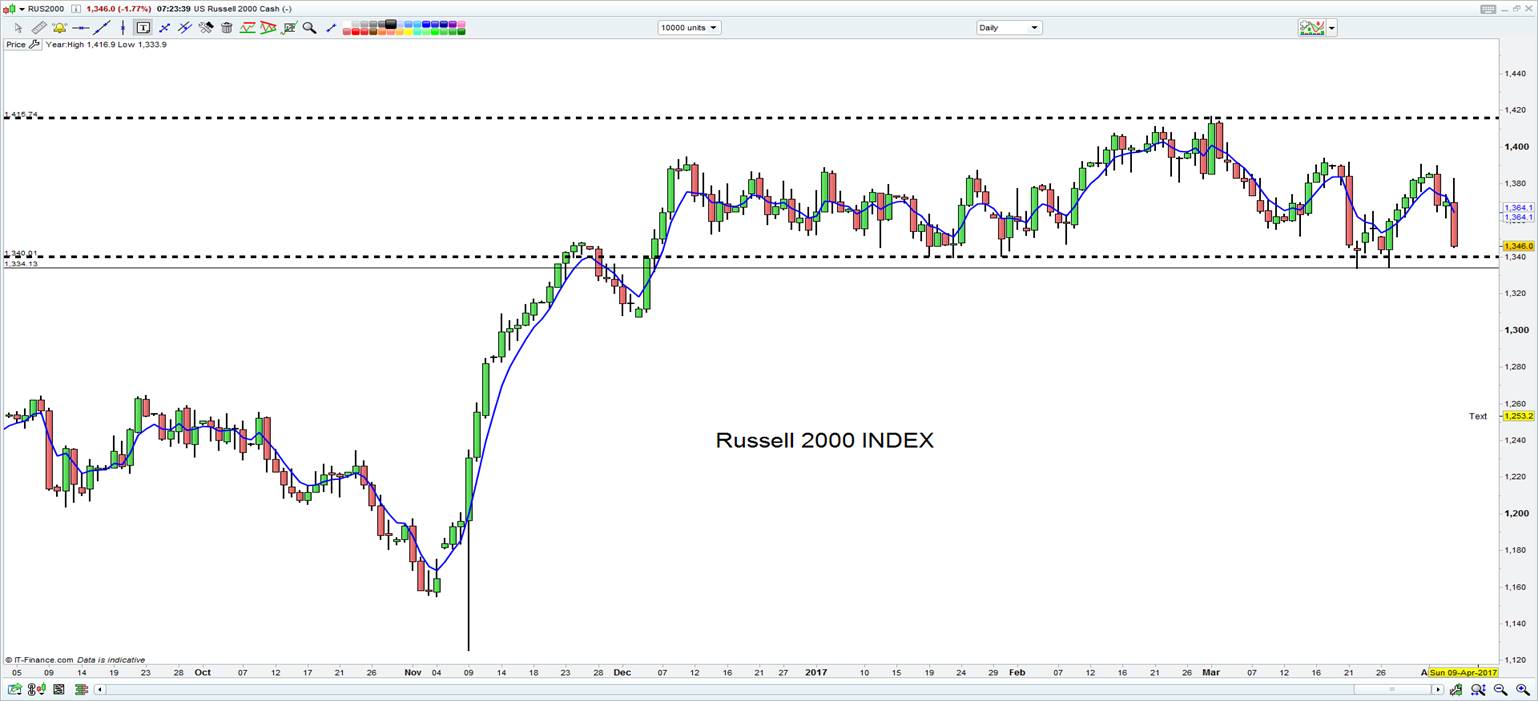

So Asia-based traders will not be enthused by the late session sell-off in the large cap markets and the buyers will be asking whether the selling extends through into tonight’s session. This is a question I would be asking and we could see the bid dry up somewhat in Asia today, and therefore stocks could see selling from the open. One market I would be focusing on is the Russell 2000 and a strong underperformance (the index fell 1.2%) from small caps is never good. What’s more, the index is threatening to break the 1420 to 1340 trading range it’s been in since early December – a break here would open up a great opportunity for shorts.

Our call though for the ASX 200 sits at 5858, so an open some 18 points lower and this is exactly in-line with the fall in SPI futures. BHP’s American Depository Receipt (ADR) is suggestive of a stock opening 1% lower, despite iron ore closing up 2.5%. One suspects this was largely priced in yesterday. Gold stocks look interesting, but I would expect a flat open here, as we should see with the Aussie banks too.