Just 4 weeks ago the top was in. Markets were going to break down to massive new lows. It looked like the end of the world. The FBI had reopened the Clinton email investigation and the thought of a Trump Presidency roiled markets. Or so the talking heads said. Turns out new evidence was just copies of old news and despite that, Trump did win. The markets did race lower, for about 2 hours, until they rebounded. Post the election, a rally ensued in the stock markets and led to new all-time highs for the Dow Jones Industrials, S&P 500 and Russell 2000.

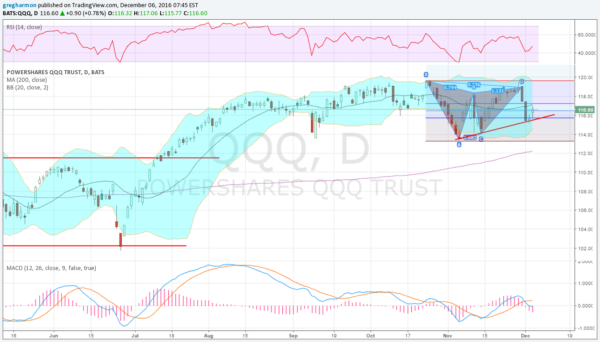

But something was missing. The Nasdaq 100 ETF (NASDAQ:QQQ) has not made a new all-time high. Well not yet at least. It got really close last week but could not make that last push higher. In fact it fell back sharply. But it could now be in position to break that barrier and reach to new highs. The chart below shows why.

It should not surprise anyone that as the Nasdaq 100 ETF approached its prior all-time high from March 2000 that it stalled. The Tech Bubble and Crash was THE market phenomenon for over 8 years before the Financial Crisis. And with only two crashes to talk about it stayed in every investor’s mind. So to have a 4 month consolidation around that prior high is nothing, over 17 years later.

The shorter term picture though is now showing some promise for a push higher. After making a slightly lower low during that early November move down, it popped and then fell back to a higher low. The rise that followed set up a bearish Bat harmonic pattern that reached its Potential Reversal Zone last week. Wednesday triggered the reversal and it fell over two days, retracing 61.8% of the pattern, the target for a reversal. Friday the bleeding stopped and Monday it pushed higher and it continues Tuesday in the pre-market as I write this.

This bounce came at a second higher low, and along a rising trend support line. With the reset to the momentum indicators the QQQ is now ready for another assault at the all-time highs. Very weak sentiment for technology stocks sets up well to support this. After a few tech sectors leading lower the Index is really not off that much and when sentiment hits lower extremes a sharp move can happen in the opposite direction.

I am not guaranteeing a new all-time high for the QQQ now or even before the end of the year. a 6 month or more consolidation at the current levels would not be out of the questions. look at how long the S&P 500 moved sideways before turning higher. But the new all-time high in the QQQ will come.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.