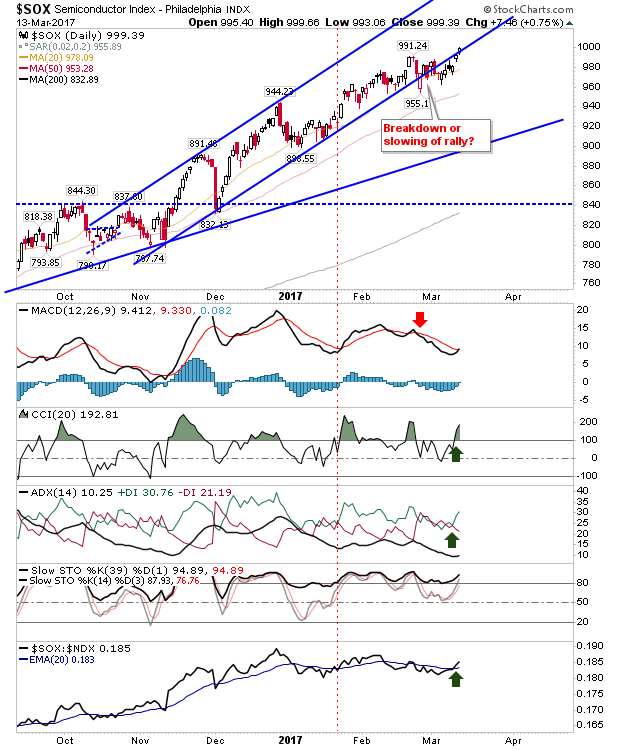

Not a whole lot to say about yesterday. The Semiconductor Index gained nearly 1% as it pushed a new multi-year high, but most of the gains were achieved by the open and it didn't add too much after that. However, it did keep shorts at bay for another day (resistance remains former channel support).

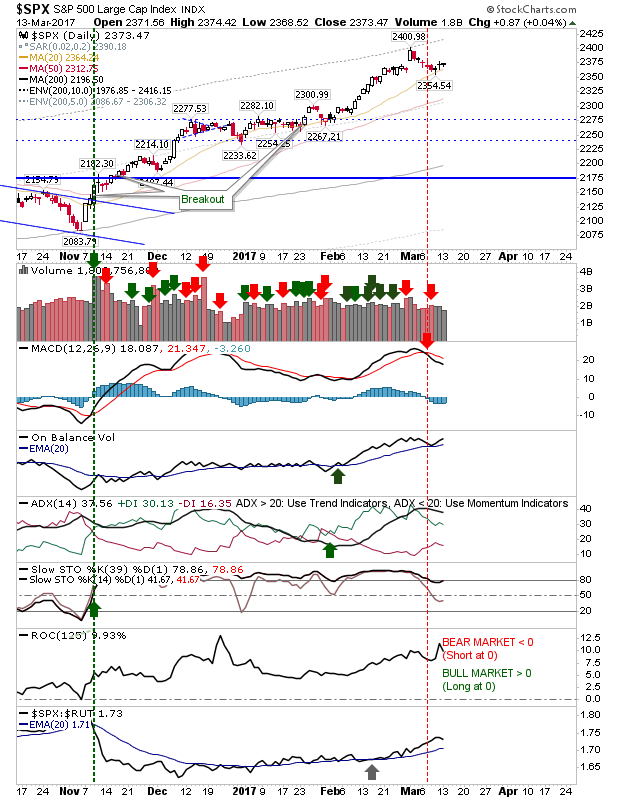

Aside from Semiconductors, there wasn't too much to add. The S&P had one of the least exciting days in a long time. Technicals were unchanged by the very flat day.

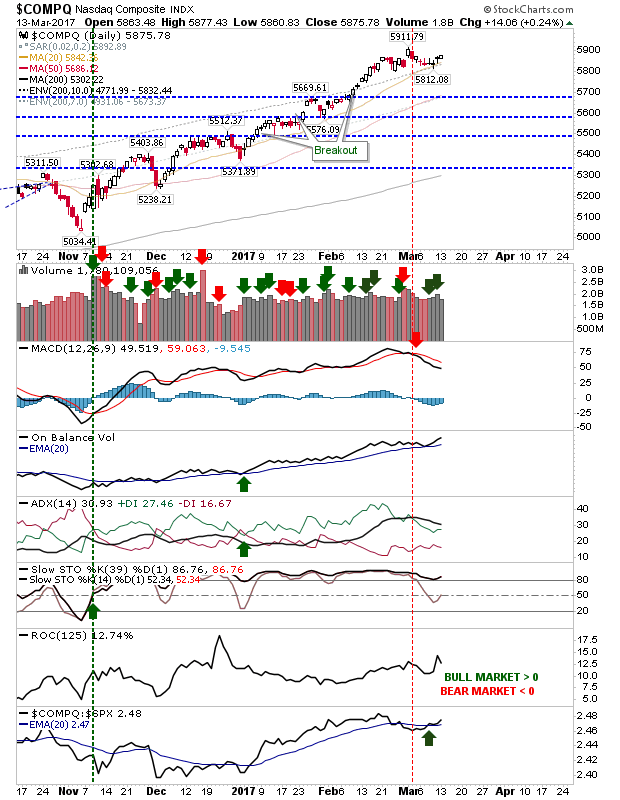

The NASDAQ made slightly bigger gains, but not enough to change the technical picture, nor the context of where the index stands now.

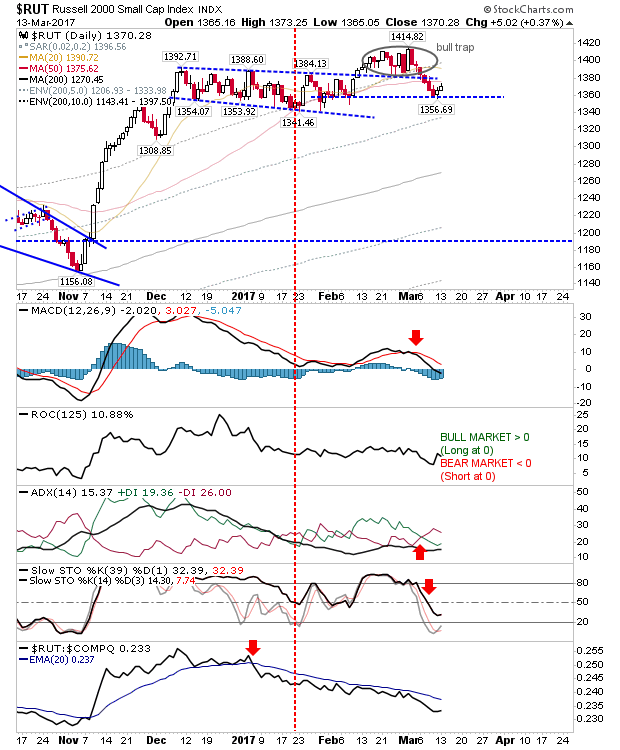

The Russell 2000 didn't quite make the same gains as the Semiconductor Index, but it kept with the notion of building support at the swing low.

If bears are to strike I would expect a big one-day sell-off; a hectic first half-hour of trading which doesn't recover. The bullish outlook is likely going to be more like yesterday with small, insignificant gains, which add up over time. My bias expects a bearish sell-off, but I have been wrong on this rally for too long.