S&P 500 posts best gain since 2015

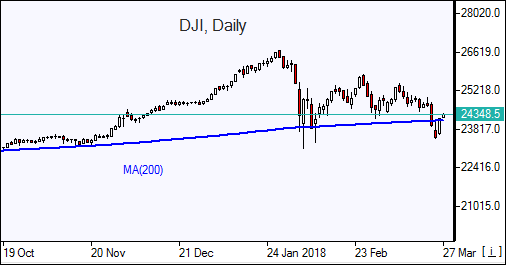

US stock indices bounced back Monday erasing Friday’s losses. The S&P 500 rose 2.7% to 2658.55 led by technology stocks up 4%. The Dow Jones industrial jumped 2.8% to 24202.60. The Nasdaq composite index rallied 3.3% to 7220.54. The dollar weakening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 89.044. Stock indices futures indicate higher openings today.

Trade war concerns eased on reports that the US and China are conducting talks to avert a global trade war. Reports indicated US Treasury Secretary Steven Mnuchin and US trade representative Robert Lighthizer were discussing with Liu He, a Vice Premier of China, a reduction of Chinese tariffs on US automobiles, more Chinese purchases of US semiconductors and greater access to China’s financial sector by U.S. companies. Economic data were positive: the Chicago Fed national activity index for February came in at 0.88, up from 0.02 in January.

Euro climb weighs on European stocks

European stocks ended lower on Monday as the euro’s climb against the dollar accelerated. British Pound extended gains against the dollar. The Stoxx Europe 600 index fell 0.7%. The DAX 30 dropped 0.8% to 11787.26. France’s CAC 40 lost 0.6% and UK’s FTSE 100 slid 0.5% to 6888.69. Indices opened 1% - 1.4% higher today.

The euro rose sharply after hawkish comments by German central bank President Jens Weidmann. In his comments Weidemann, who is on the European Central Bank’s rate setting committee, supported faster end to ECB’s current stimulus measures, and mentioned that the prospect of a rate rise in 2019 remains a realistic possibility. In economic news, the final reading of France’s gross domestic product for the fourth quarter was in line with expectations at 2.5% year over year.

Asian stocks recover

Asian stocks are advancing today following reports the US and China had started negotiating to improve American access to mainland markets. Nikkei jumped 2.4% to 21264 helped also by continued yen slide against the dollar. Chinese stocks are higher: the Shanghai Composite Index is up 1% and Hong Kong’s Hang Seng Index is 0.5% higher. Australia’s ASX All Ordinaries is up 0.7% with Australian dollar pulling back against the US dollar.

Brent steady

Brent futures prices are little changed today. Prices fell yesterday: May Brent crude settled 0.5% lower at $70.12 a barrel on Monday.