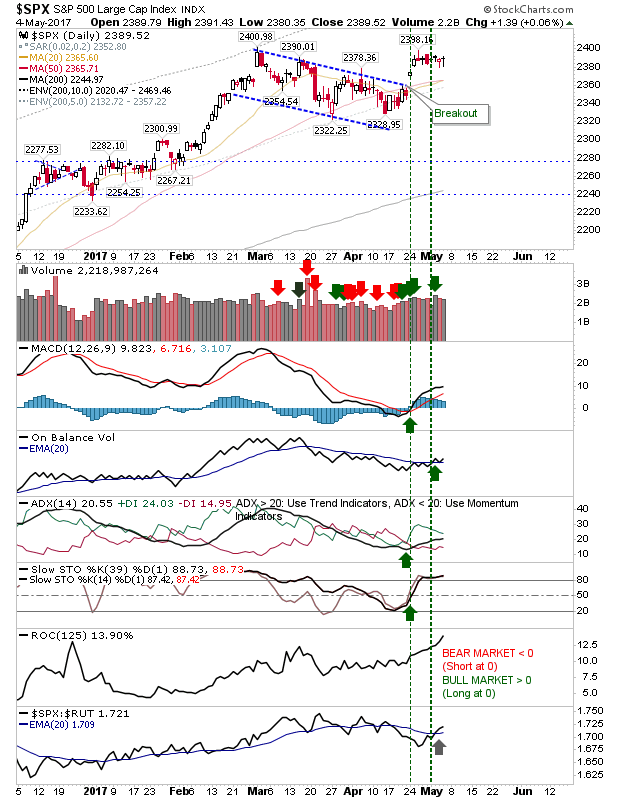

All lead indices are net bullish in technical strength as markets consolidated last week's gains. The S&P has posted a series of doji/hammer after emerging from a bullish 'flag' / downward channel.

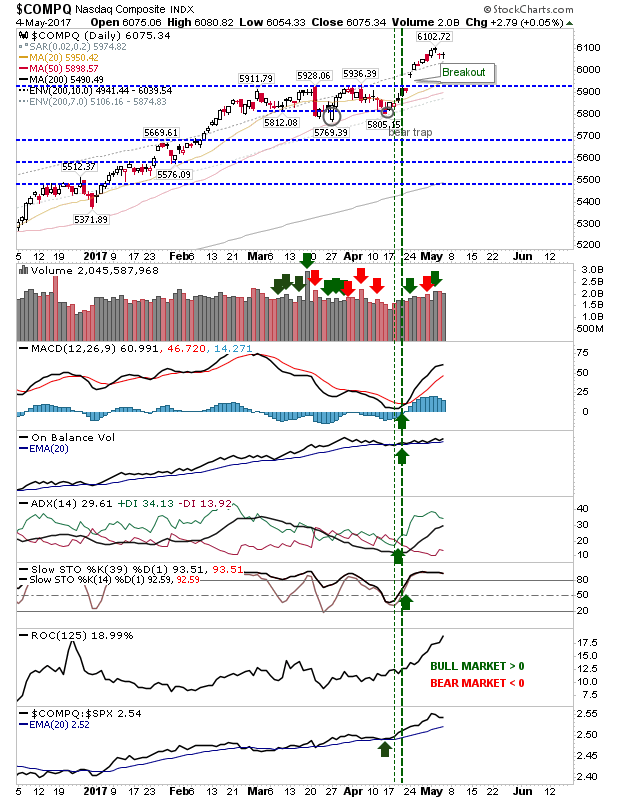

The NASDAQ gapped down Wednesday but held its ground in another narrow day of trading. Relative performance ticked down after significant outperformance against the S&P, but it still remains ahead of Large Cap stocks.

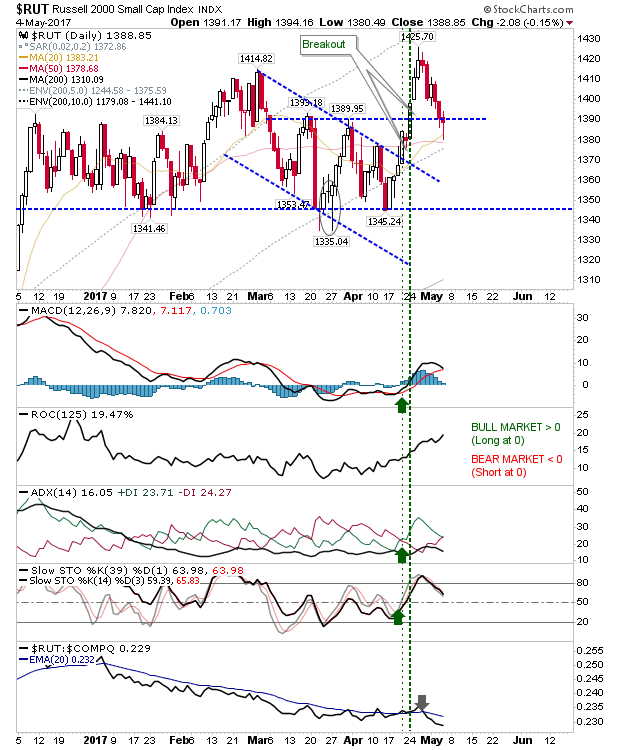

The Russell 2000 was on course to register the third day of losses in a row, but it did enough to come back to newly minted breakout support around 1,390. Technicals are still bullish, although +DI/-DI is about to generate a negative/bearish crossover.

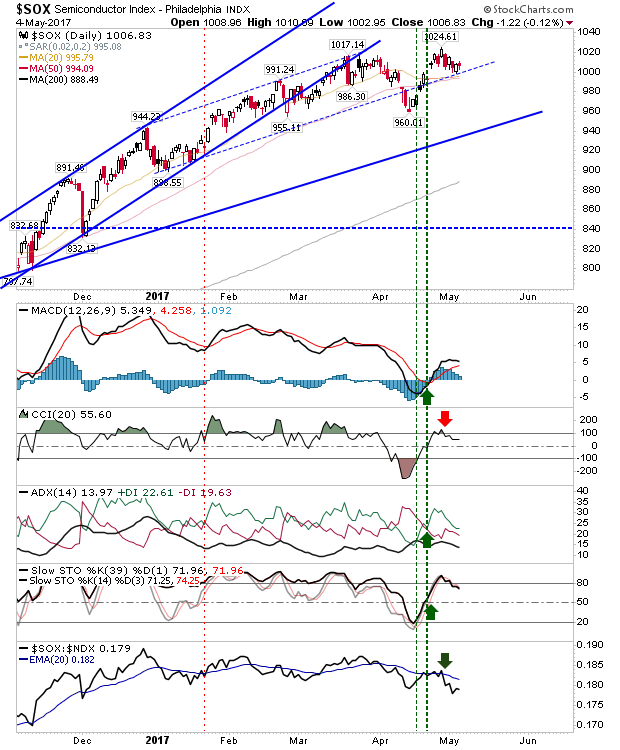

The Semiconductor Index is coming back off a retest of highs in what may become a double top, although a loss of 960 would be required to confirm. In the meantime, the index sits on what was former channel support with technicals easing lower – although such technicals look ready to accelerate down which may be the lead action for a loss of 960.

For Friday, shorts may have something to play for in the Semiconductor Index with a stop above 1,025. The Russell 2000 might go the other way; downside action looks to be tiring and the presence of support may be the kicker to start a new rally. Watch these indices closely over the next couple of days.