As I discussed this past weekend:

“Immediately Wall Street spun this very negative news [failure to pass health care reform] into the ‘positive’ as noted by Margaret Patel via Wells Fargo Asset Management:

‘It looked like the market was worried that the Trump agenda would get completely bogged down in the health care issue, and now that they’ve taken the health care issue off the table, I think the market is more optimistic that they can do other things that are more doable that are not so complicated, such as regulatory reform and lowering taxes.’

This “shift in sentiment” was the same as we saw on election night as the general expectation of “a Trump election will crash the markets,” to “a Trump election is great for the markets,” fueled the post-election surge in the markets.

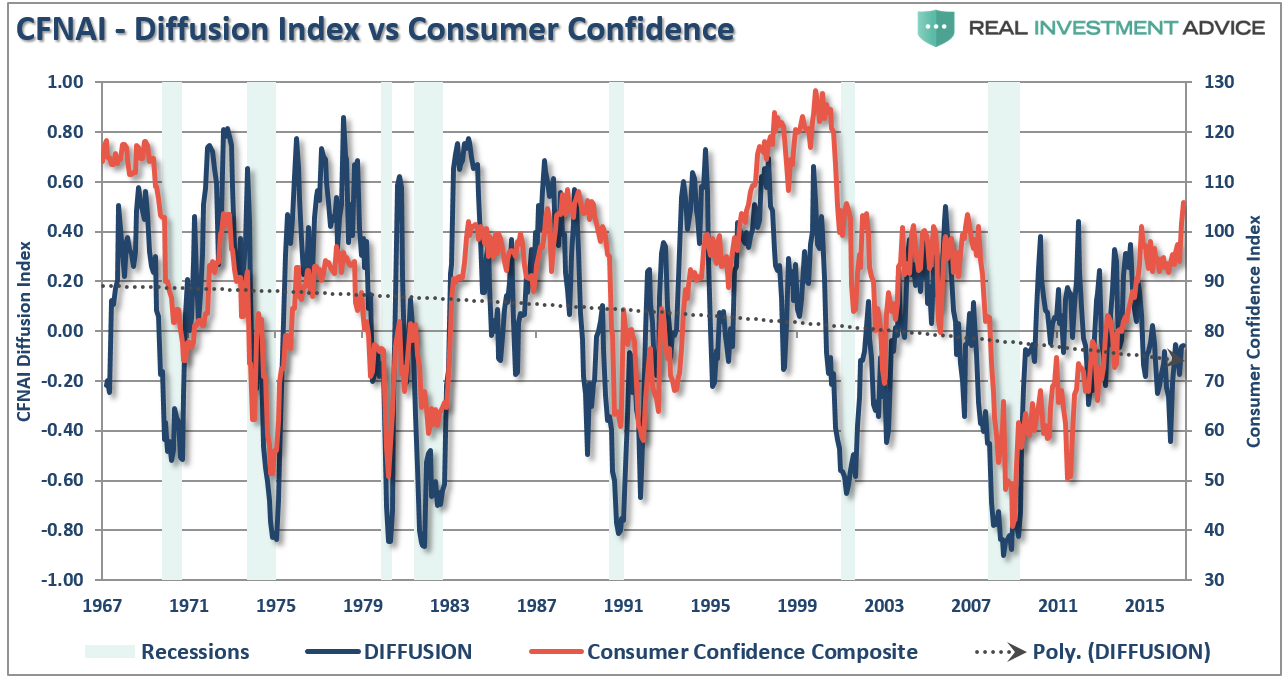

Wall Street’s ability to “pivot” to provide a reason for investors to remain “long” equities has been effective and has been supported by the shift in consumer sentiment as well. As I noted previously:

“There is little doubt that since the election both investor and consumer confidence has soared. In fact, confidence (soft data) has become extremely detached from the actual activity (hard data) within the economy.”

“Historically, this deviation has not lasted long, and it has always been ‘hope’ giving up ground to the underlying ‘reality.’ But nonetheless, it is ‘hope,’ which is more commonly known as ‘animal spirits,’ which drives markets higher in late stage market advances.”

While Wall Street’s media machine has been hard at work spinning a new narrative “forget health care, it’s all about tax reform,” here’s the problem for investors and the economy:

“Ignoring the fact that work on tax reform in earnest won’t start for 6-8 weeks as House Ways and Means member Merchant said moments ago, and may not even take place until fiscal 2018 (after August), the reality is that since Obamacare and tax reform are both parts of the Reconciliation process, as a result of not freeing up hundreds of billions from the deficit that the CBO estimated repealing Obamacare would do, it means that Trump’s tax cuts have been hobbled – by as much as $500 billion – before even starting.

Furthermore, with the Freedom Caucus flexing its muscle and openly defying Trump, another major headache for Trump’s tax reform is that the Border Adjustment Tax – an aspect of the reform that the Caucus has been vocally against – is likely off the table. And since BAT was expected to generate over $1 trillion in government revenues, it means that a matched amount in tax cuts is also now off the table.

In summary, between Obamacare repeal and BAT being scrapped, roughly $1.5 trillion in budget ‘buffers’ are wiped out.”

This point should not be lost on investors.

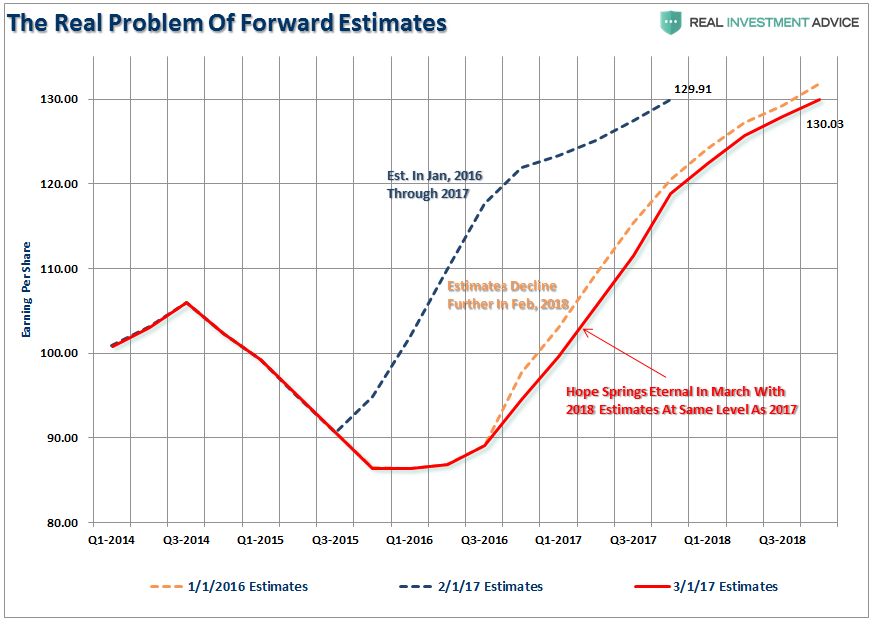

Prior to the election, earnings estimates were previously $130/share for 2017. But reality crushed those hopes with the collapse of oil prices. However, based on Trump’s tax cuts and infrastructure spending program, those $130/share estimates were revived but pushed out to the end of 2018. As I wrote at that time:

“In particular, is the repeated impact of tax cuts on earnings over the next year as recently reiterated by Bob Pisani:

‘Even before the election, analysts were anticipating a roughly 9 percent increase in earnings for the S&P 500, from roughly $118 in 2016 to $131 in 2017. But I noted back on Dec. 1 that Thomson Reuters estimated that every 1 percentage point reduction in the corporate tax rate could “hypothetically” add $1.31 to 2017 earnings. So with a full 20 percentage point reduction in the tax rate (from 35 percent to 15 percent), that’s $1.31 x 20 = $26.20.

That implies an increase in earnings of close to 20 percent, or $157. Even a modest boost to, say, $140, would bring the S&P to 2400 at the current 17 multiple, nearly 7 percent above where it is now.’”

Three Problems

First, earnings for 2016 did not come in at $118/share but rather $94.54, or a -25.5% shortfall.

Secondly, as noted by the Government Accountability Office, the average tax rate paid by U.S. corporations is not 35% but closer to 12.5%.

“Large, profitable U.S. corporations paid an average effective federal tax rate of 12.6% in 2010, the Government Accountability Office said Monday.

The federal corporate tax rate stands at 35%, and jumps to 39.2% when state rates are taken into account. But thanks to things like tax credits, exemptions, and offshore tax havens, the actual tax burden of American companies is much lower.

Even when foreign, state and local taxes were taken into account, the companies paid only 16.9% of their worldwide income in taxes in 2010.”

Therefore, the reduction in the legislative tax rates to 15-20% is likely to be far less impactful to earnings growth than what is currently estimated by Reuters.

Lastly, a math problem.

As discussed above, the expectations of a $1.31 boost to earnings for each percentage point of reduction in tax rates is also a bit “squishy.” The premise WAS based on the expected earnings in 2017 of $131.00 for the entirety of the S&P 500. The $1.31 increase is simply 1% of $131.00 in total operating earnings.

Since actual earnings for 2016 was $94.54/share, this implies a $0.9454 increase per point, or an earnings boost of $18.91 (.9454 * 20) at best which would bring total 2017 estimates to $113.45. This is $5.38 less than what is currently estimated for 2017 and brings into serious question of 2018 estimates of $130.03.

Based on this math, forward valuations (assuming prices don’t move from yesterday’s close) would be 20.63x. This is far more expensive than the 17x earnings expected previously. But unfortunately, the news is already getting worse as estimates have continued to slide just in the last month.

Here is the issue.

IF analysts are correct, and they never are, and earnings do rise to $130/share in 2018, which is based on tax reform and infrastructure spending hopes, earnings will be at the same level as they were projected to be at the end of 2017 at the beginning of 2016

Add to this, the offset of the Border Adjustment Tax (BAT), the remaining ACA taxes on both corporations and individuals, and the reality that corporate tax reform will likely be less than advertised (25% vs 15-20%), and you have the makings of a substantial shortfall in current forward earnings estimates. As we saw with the Bush tax cuts in 2001, and the repatriation holiday in 2004, the impacts from policy changes are more “psychological” short-term boosts which are quickly absorbed by economic realities.

Bullish For Now, Bearish Later

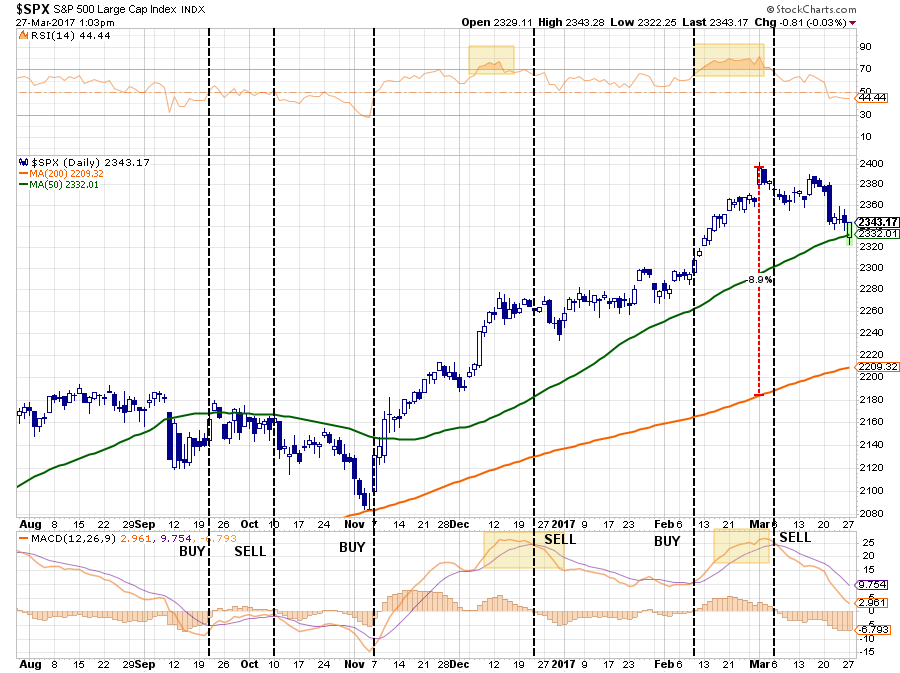

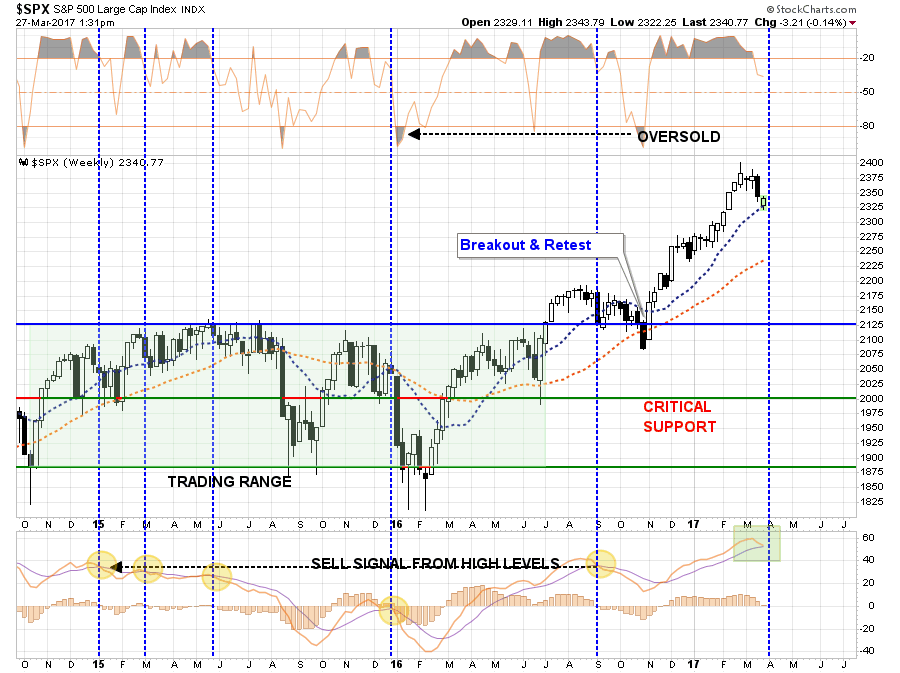

On Monday, the market was able to hold support at the 50-dma which keeps the bullish bias of the market intact. While the market currently remains on a short-term SELL signal, the ability for the market to hold the 50-dma while the overbought condition is reduced sets the market up for additions to equity allocations in the near future. This is assuming a “buy signal” is issued with the markets still in a bullish trend and without having broken previous support.

Given that Wall Street is now currently underpinning the market with views on short-term tax reform taking place, this bullish bias could very well continue. It is NOT WISE to try and counter-trade this trend currently as “exuberance” is still extremely prevalent in the market. As noted by JPM on Monday:

“Stocks are obviously weak but flows are orderly and not particularly busy (and the major indices have bounced well off their opening lows). Recalibrating political expectations is the main reason for the softness as investors debate the timing and scope of a tax bill, although the market isn’t abandoning hope of action on the tax front by any means and until that happens the SPX will struggle to sustain significant weakness.It seems like many are circling ~2300 as an approximate area of support (premised on the SPX’s ability to earn ~$133-135 in ’18 w/o anything happening in Washington) and thus sentiment isn’t alarmed or panicked.”

Again, note that last sentence.

Earnings for 2018 were cranked up to $130.03 from $94.54 (a 37.54% increase) based on the impact of tax reforms. Now, that seems to have been forgotten as the $130/share earnings mark has become the norm and anything from tax cuts is now an extra boost.

Someone is going to be very disappointed.

It is likely going to be you.

Below The Surface

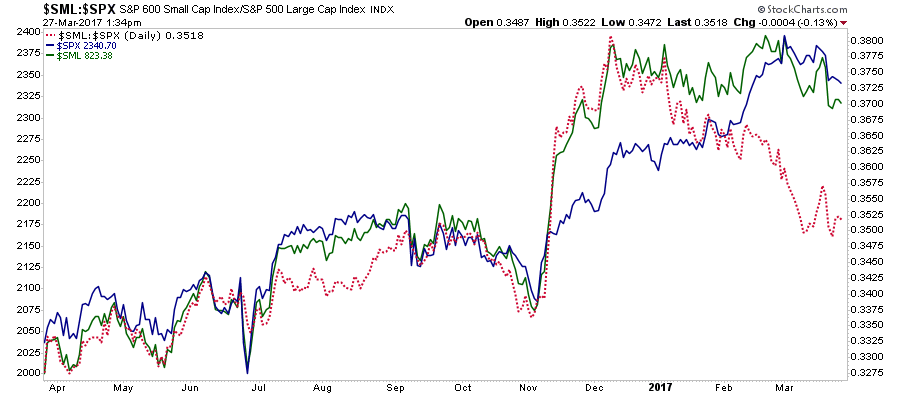

Below the surface of the major indices, which are capitalization weighted and prices can be skewed by a few major components like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Google (NASDAQ:GOOGL), etc., the underlying technicals continue to show short-term weakness. However, it was small capitalization stocks that took the lead following the election. That outperformance has significantly faded as investors have lost confidence in the “Trump Trade” particularly as the “hard economic data” has failed to follow suit.

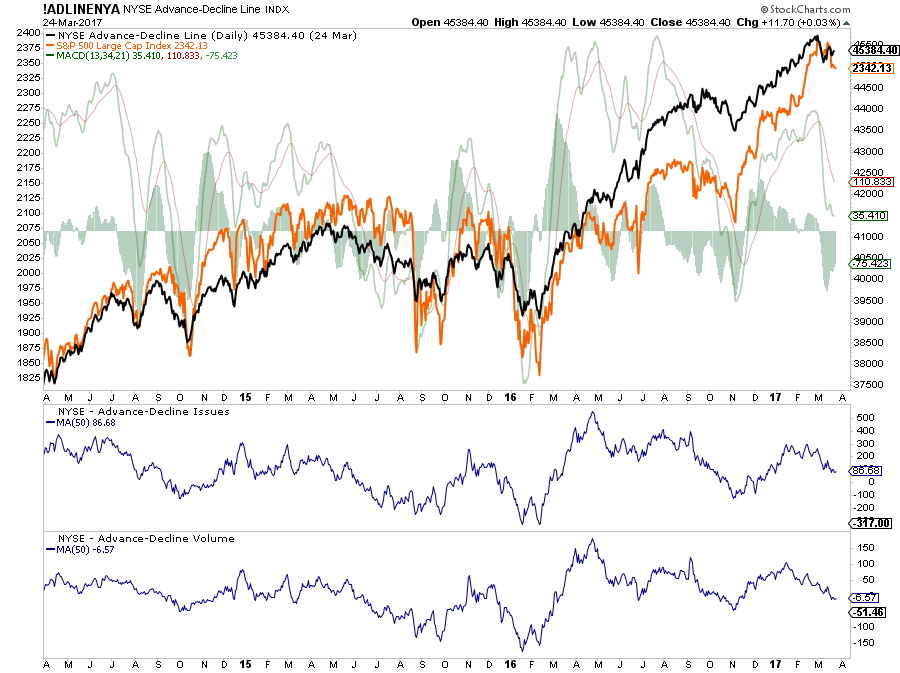

But it is not just the deterioration of small caps that is concerning, but also the lack of participation by stocks below the surface. While markets continue to hover near all-time highs, the number of advancing issues and volume continue to weaken.

While on a very short-term, daily basis the market is nearing an oversold, and potentially tradeable, condition, the longer-term dynamics still argue for a larger correction.

However, such a corrective process on a longer-term basis could very well come after a short-term rally back towards previous highs.

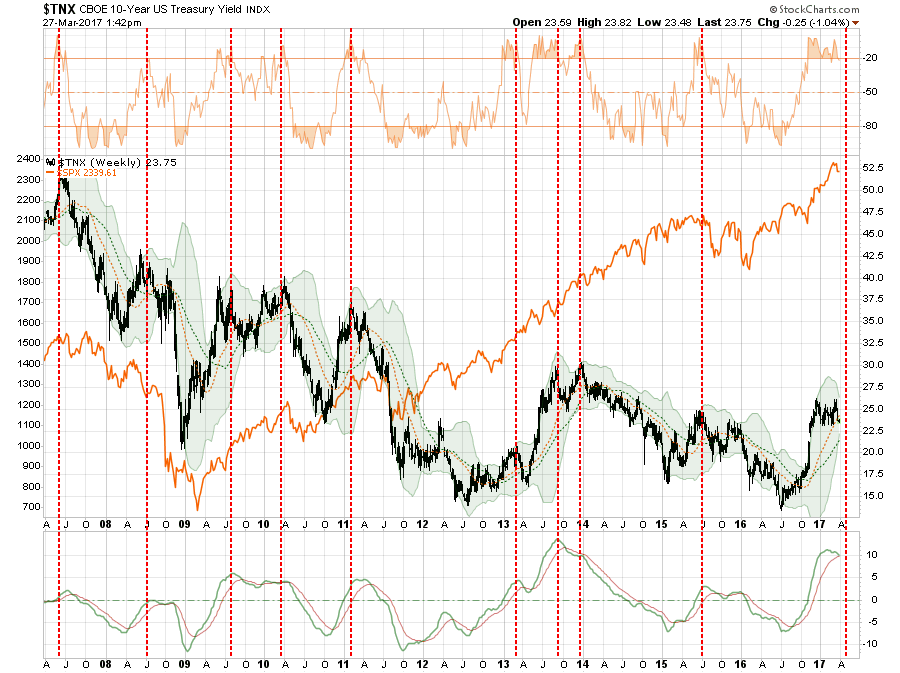

Lastly, the rotation from equities to fixed income (risk to safety trade) continues with bonds nearing a very important “buy signal.” Previous signals have given way to fairly large rallies in bonds. Given the post-election surge in rates, the reversal of that trade could be substantial and would also likely coincide with a further correction in equity prices.

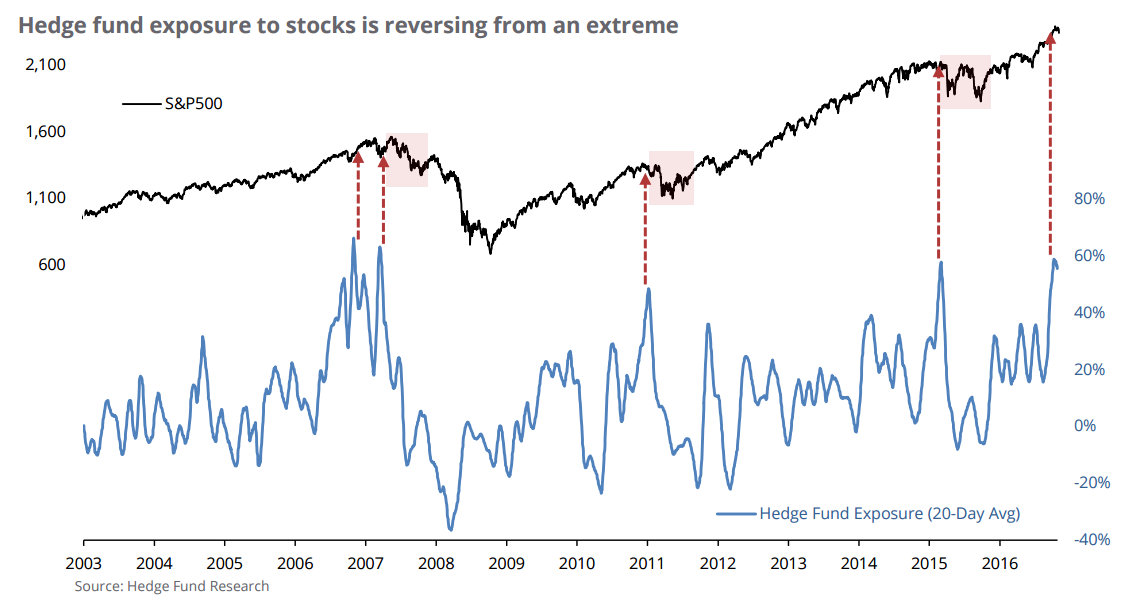

Lastly, Jason Goepfert via Sentimentrader.com made a very interesting observation last week:

“Over the past week, we’ve seen an increasing amount of risk aversion, with streaks of low volatility ending and momentum waning. That means, of course, that investors are decreasing their exposure. They have a ways to go.

Last week, we looked at hedger positions in index futures, which was near an all-time record bet against stocks. Speculators take the other side of those trades and a large percentage of those are trend-following funds. So it’s safe to say that speculative funds were holding near-record exposure to stocks, which means that if stocks slip to multi-week lows again and volatility spikes, then we will likely see increased pressure from these funds to lower their exposure.

The 20-day average of Hedge Fund Exposure has just started to roll over after nearing 60%, one of the highest readings in 15 years. The indicator is calculated by looking at changes in the performance of macro hedge funds versus changes in the S&P 500.”

“We can see that the three other times that Exposure got as high as it recently was over the past month, stocks did not manage to add much, if anything, on the upside, and fell 15%-20% over the next several months.”

So, while I am still bullish on the markets short-term (few days to weeks), I am becoming much more cautious. Over the longer-term (few weeks to several months), I am much more bearish.

Hedging risk continues to remain a prudent course of action.