Main Market Mover

After a stunning rally, the tech sector finally shed some weight. The sell-off was spurred by a seven-quarter low for Amazon’s profits and a revaluation of expectations for earnings reports. However, many investors were driven to take profits at the highs, using Amazon (NASDAQ:AMZN) as an excuse.

While the drop barley chipped the 40% increase in tech valuations, it’s a stark reminder that what goes up, must come down.

The bearish tones spread to Europe, Wall Street and Tokyo, where stocks are trading lower as investors pare back on risker assets.

Germany’s DAX 30 has given up 0.71% of its gains, while Wall Street’s proxy, the S&P 500 has shed 0.35%. The tech-heavy Nasdaq 100 has forfeited 0.83% of its value.

However, volatility remains at historically low levels, meaning investors aren’t shaking in their boots, just yet.

Forex

USD

The dollar remains at a 13-month low as investors mull over the dovish Federal Reserve’s speech on Wednesday.

With a flurry of US data coming in, a fresh driver for the dollar could come into focus. If these readings miss expectations, however there may be more bearish bets placed, as the market decreases the likelihood for another rate hike in 2017.

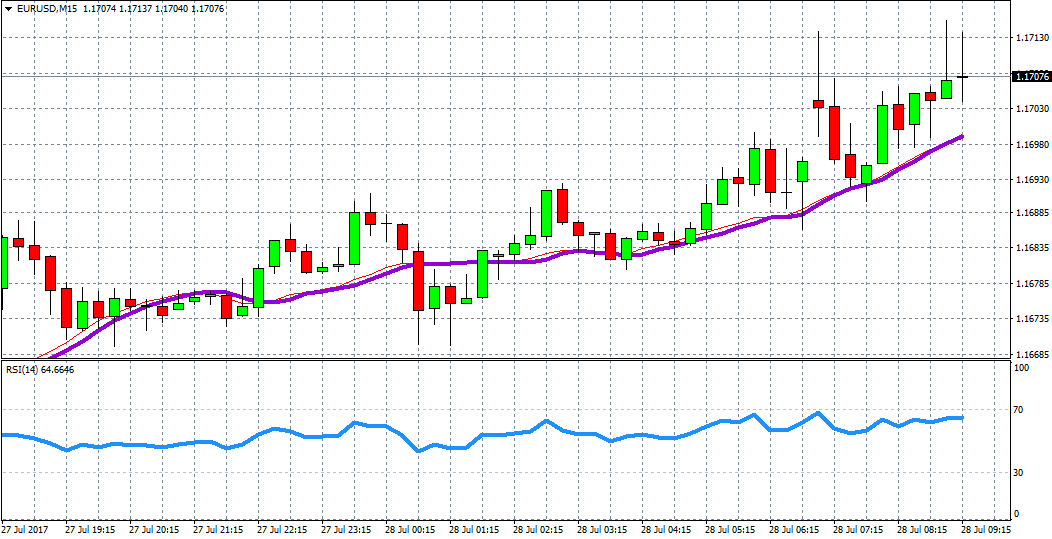

EUR

The euro added 0.22% as the single currency awaits inflation data. So far, French and Spanish inflation have come in as expected supporting the euro’s recent rally.

CHF

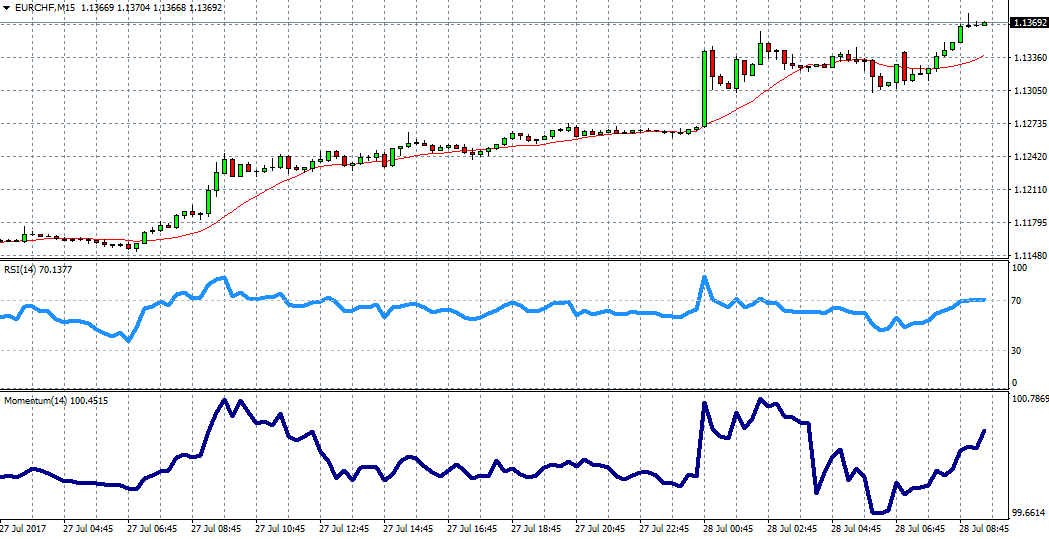

The Swiss franc dropped 2.8% against the euro over the past four days. The currency hit its lowest level since January 2015, when the Swiss Central Bank unpegged the franc.

Switzerland are encompassing a loose monetary policy as the European Central Bank navigate its way out of its easy-money programme.

The conflicting policies have sent bearish waves towards the Swiss franc.

EURCHF

The EURCHF is flirting with the 70 mark on the RSI, which could reverse this bullish trend.

Commodities

Oil is up 6.8% for the week, as dwindling stockpiles and stronger demand help elevate the commodity.

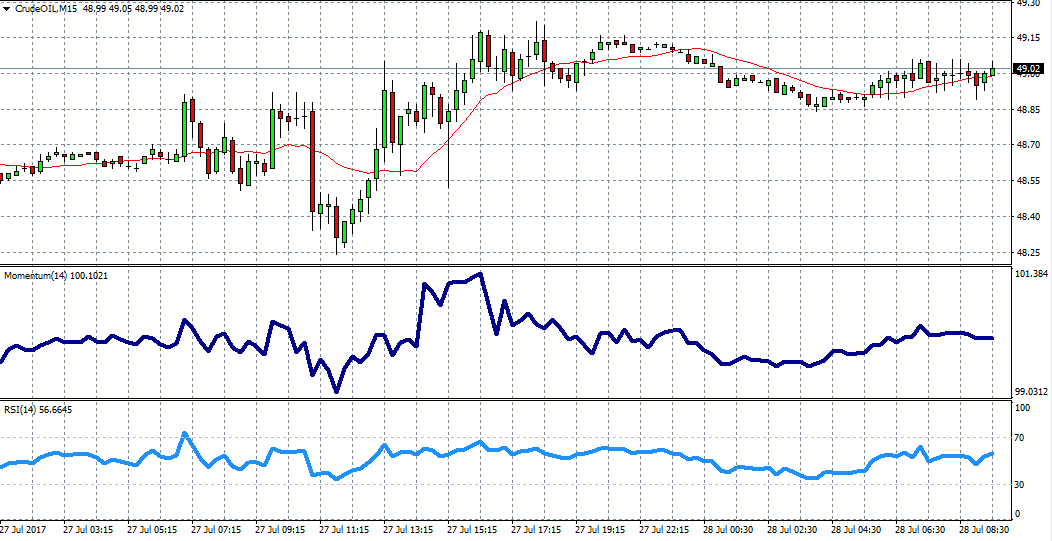

Crude Oil

Crude oil is tantalisingly close to $50 now, however it is tipping down 0.16%. The commodity could inch above that psychological level of $50 if next week’s inventory reading shows a further reduction in stockpiles.

From a technical stand point, it looks as though crude oil still has scope to add value, supported by an upward sloping moving averages curve.