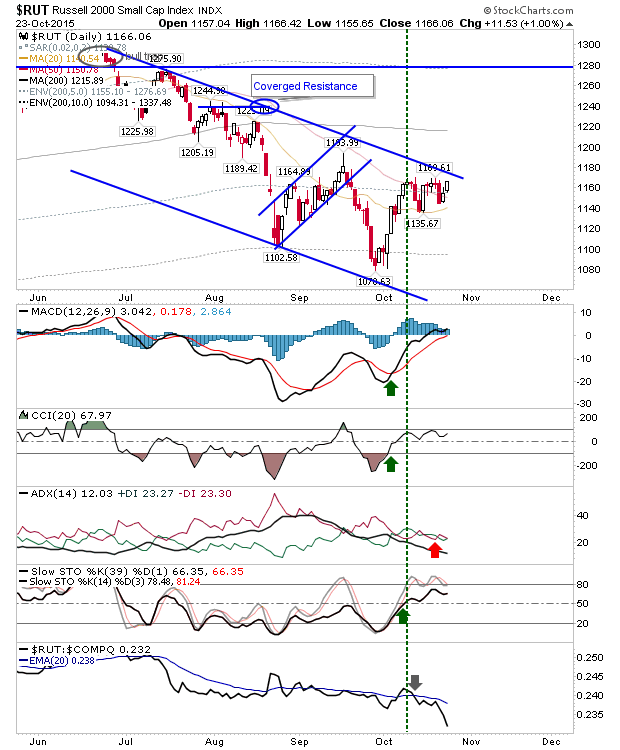

Friday was a good day for both Tech and Large Cap indices, with decent gains on modest volume. Small Caps also posted gains, but were unable to break the October consolidation or the declining channel. The relative performance of the Russell 2000 has dropped off a cliff through October, which is a concern. A lack of leadership from speculative small caps will quickly kill the sustainability of this rally in Large Caps and Tech indices.

If the Russell 2000 is to offer any form of leadership then it has to post gains on Monday as it's right against consolidation resistance. A push to 1,180 should be enough to break the declining channel. Of supporting technicals, only the +DI/-DI has yet to turn positive.

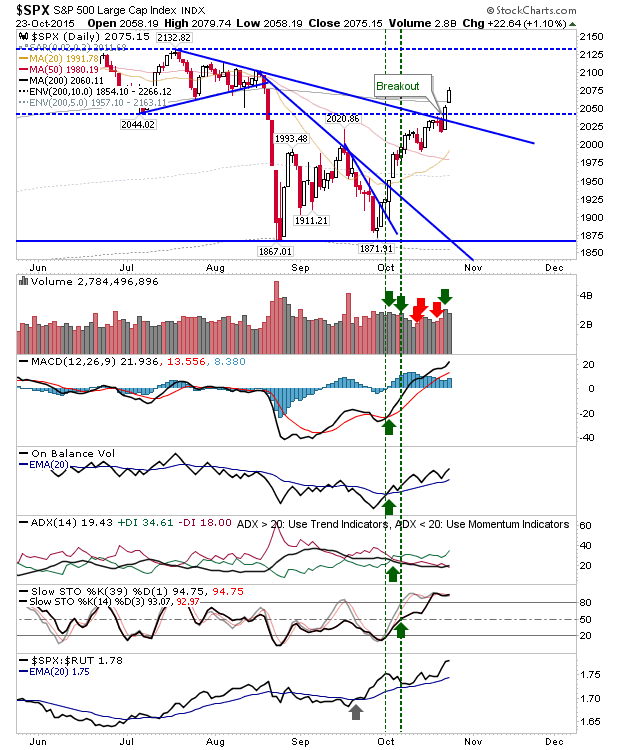

The S&P made a clean break of the 200-day MA with a bull cross between 20-day and 50-day MA. Technicals are in good shape and only trading volume was a little disappointing.

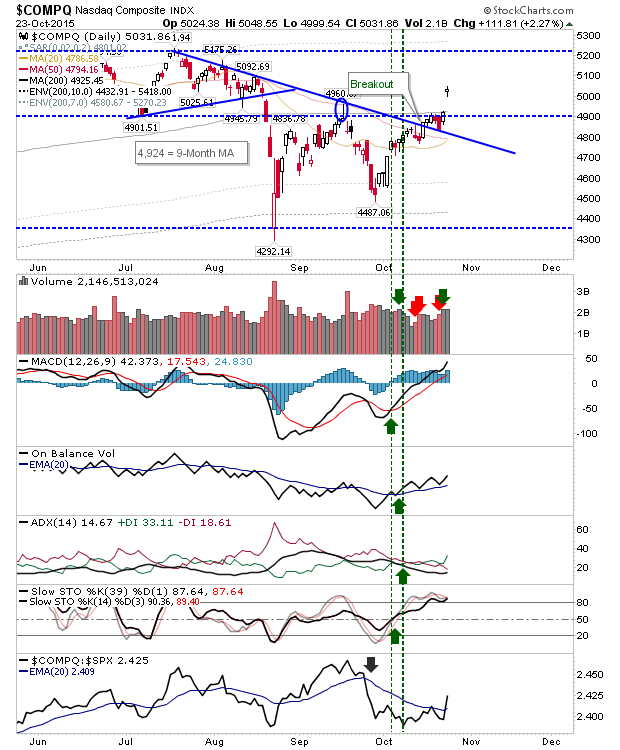

The NASDAQ posted most of its gains in the pre-market. However, trading volume during market hours was close to marking accumulation and Friday's gains gapped the index above its 200-day MA. This left the index firmly inside the trading range established in the first part of the year. Bulls now have a bit of room to work with, leaving shorts - quite literally - high and dry.

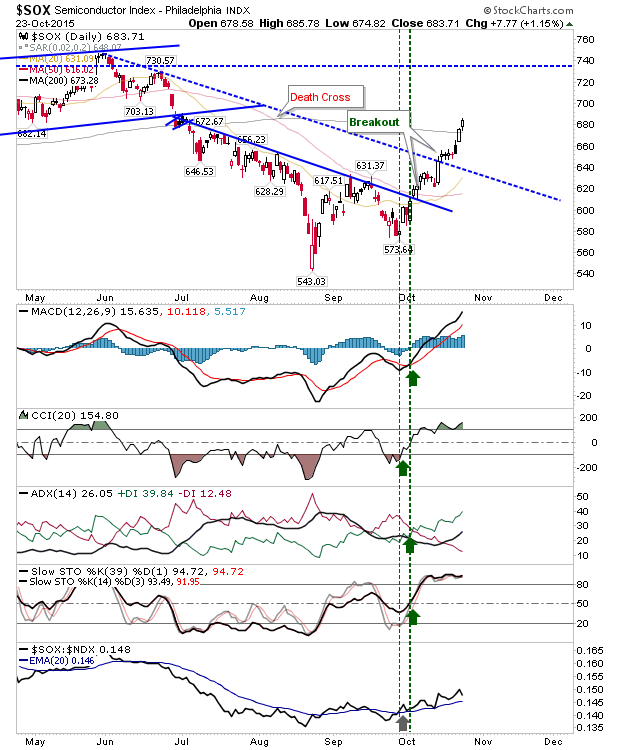

The Semiconductor Index continued its good run of form. It was able to post a gain above its 200-day MA, leaving it on course to challenge June highs.

Today will be about consolidating last week's gains, and building for a challenge of 2015 highs. The hard work of getting past resistance is done, so now it's a question of squeezing shorts and pushing on. If sellers do return, watch for distribution volume; sellers will need a strong day if they are to influence events beyond a single day.