The technology sector is piping hot and has been the best performing space this year amid concerns over stretched valuations. A rising rate environment, improving industry fundamentals, and emerging technologies such as wearables, VR headsets, drones, virtual reality devices, and artificial intelligence are the key catalysts to the sector’s growth.

Investors should note that uncertainty over Trump’s reforms is an added advantage to the sector’s growth as tech stocks are immune to policy uncertainties (read: ETFs to Buy/Avoid After Healthcare Bill Failure).

In fact, the S&P 500 information technology sector breached its dot-com era record set in March 2000 with a 22.8% increase year to date. As a result, four popular ETFs – Select Sector SPDR Technology ETF XLK, Vanguard Information Technology ETF (HN:VGT) , iShares Dow Jones US Technology ETF IYW and MSCI Information Technology Index ETF FTEC – have shown remarkable performances this year. VGT, IYW and FTEC are up nearly 23% while XLK has added a little less of nearly 20%.

The bullish trend is likely to continue heading into the sector’s Q2 earnings season. Most of the tech aces such as Apple (NASDAQ:AAPL) , Microsoft (NASDAQ:MSFT) , Alphabet (NASDAQ:GOOGL) and Facebook (NASDAQ:FB) are lined up to report this week and in the next. IYW has the largest concentration on these firms with a combined share of 44.4%, followed by 40.3% for VGT, 38.3% for XLK and 35.3% for FTEC (read: Top Sector ETFs of 1H).

Let’s dig deeper into the earnings picture of these companies that would drive the performance of the above-mentioned funds in the coming days:

According to the our methodology, a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) when combined with a positive Earnings ESP increases our chances of predicting an earnings beat, while a Zacks Rank #4 or 5 (Sell rated) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Inside Our Surprise Prediction

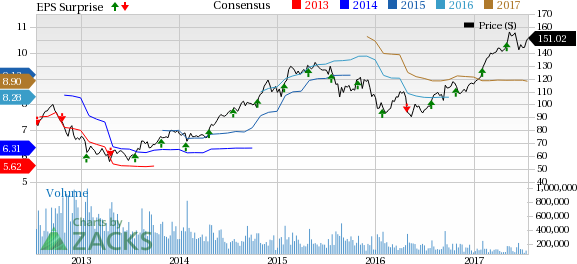

Apple is slated to release earnings after market close on August 1. The stock has a Zacks Rank #3 and an Earnings ESP of +1.91%, indicating reasonable chances of beating estimates this quarter. The iPhone maker delivered positive earnings surprises in the last four quarters, with an average beat of 2.77% and saw no earnings estimate revision over the past 90 days for the to-be-reported quarter. However, the stock has a VGM Style Score of D.

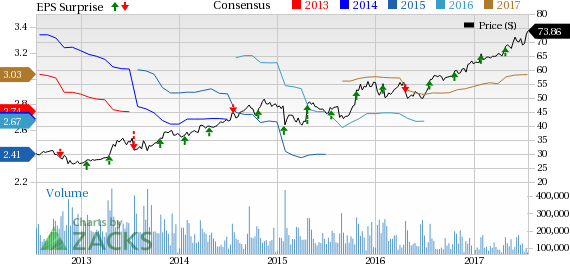

Microsoft has a Zacks Rank #2 and an Earnings ESP of -2.82%, which makes surprise prediction difficult. The Zacks Consensus Estimate for second-quarter 2017 increased by four cents over the past three months. Additionally, the stock delivered positive earnings surprises in the last four quarters, with an average beat of 10.40%. However, the stock has a VGM Style Score of D. The company is expected to report results after the closing bell on July 20.

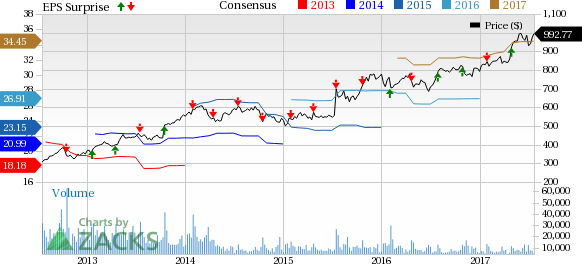

Alphabet has a Zacks Rank #3 and an Earnings ESP of -24.02%, indicating less chances of it beating estimates this quarter. Additionally, it witnessed negative earnings estimate revision of a nickel over the past 90 days for the to-be-reported quarter and has a VGM Style Score of C. Nevertheless, the earnings surprise track over the past four quarters is good with an average beat of 5.74%. The company will report after the closing bell on July 24 (read: Tech Face Off: Amazon (NASDAQ:AMZN) Versus Alphabet ETFs).

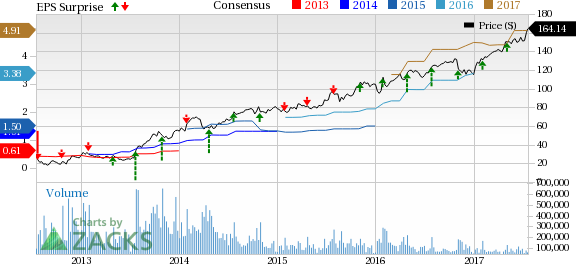

Facebook is expected to release its earnings report on July 26 after market close. It has a Zacks Rank #3 with an Earnings ESP of -0.89%, indicating less chances of beating estimates this quarter. Facebook delivered positive earnings surprises in the last four quarters, with an average beat of 16.69% and witnessed positive earnings estimate revision of eight cents over the past three months for the to-be-reported quarter. The stock has a solid VGM Style Score of B.

Summing Up

Overall, the tech sector is expected to post double-digit earnings growth in the second quarter and has a solid Zacks Rank in the top 34%, suggesting some outperformance in the weeks ahead (see: all the Technology ETFs here).

Given the favorable Zacks Rank and positive earnings outlook, surprises may well be in the cards. This could give a further boost to the technology ETFs. In particular, the four ETFs mentioned above have a Zacks ETF Rank of #1 or 2.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

FID-INFOTEC (FTEC): ETF Research Reports

VIPERS-INFO TEC (VGT): ETF Research Reports

ISHARS-US TECH (IYW): ETF Research Reports

Original post