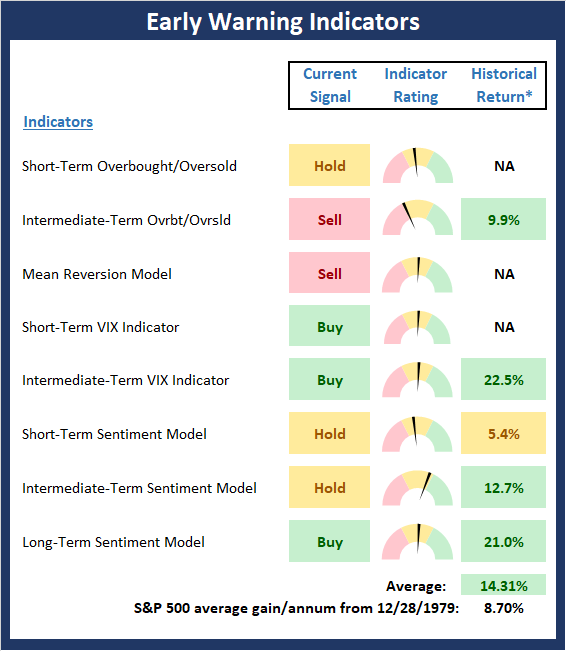

This batch of indicators is designed to suggest when the "table is set" for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns

are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability.

View Early Warning Indicator Board Online

My Take: The early warning board continues to be a mixed bag as neither team appears to hold an edge at the present time. This probably sounds a little odd given that a great many analysts consider the current market to be very overbought. However, the current situation is complicated. From my seat it is important to recognize that we are dealing with a bifurcated market, in which the major indices (save the NASDAQ) have been stuck in a trading range, while the NASDAQ Composite and Nasdaq 100 indices have been on an impressive roll and are indeed overbought – and due for a rest. So, while the table may be set for a pause in the NDX, the bulls would appear to have some room to run in the S&P 500, and especially in the indices that require an economic recovery to work such as the DJIA, Russell 2000, Midcaps, etc.

Stochastic Review

Over the years, I have found that reviewing the basic stochastics is perhaps the simplest way to determine when an index or security may be ripe to "go the other way" for a while. I like to keep it simple here by using a 14-day %K (with 1 day smoothing) and a 3-day %D. It's not fancy, but it tends to be an effective tool that I rely on.

S&P 500 - Daily

In the chart above, it is clear that the stochastics remain in overbought territory. However, it appears that a "good overbought" condition is developing. As opposed to a traditional overbought condition, which tends to lead to countertrend moves, a "good overbought" condition is where a market "gets overbought and stays overbought."

The bottom line is I see this as a "ally continuation" sign, which tends to have bullish tendencies. So, unless the bears can get something going quickly, my take is that we now have a "good overbought" condition on our hands.

Thought For The Day:

"Never ascribe to malice, that which can be explained by incompetence."

– Napoleon