Given its insane movements, who knows where BTC will be by the time you read this, but as I’m typing this on Saturday evening, the cryptocurrency has lost a full 25% of its value in the span of just a few days. I remain slack-jawed they are rolling out derivative trading instruments on this thing. I mean, look, I don’t have a dog in this fight, but what if $17,300 was the peak, and this thing just craps itself back down to $1,000? The hype will vanish.

Anyway, who knows. It could be $50,000 in a month. Or $0. They say anything is possible in the world of trading, but with cryptos, ANYTHING is possible. It’s a sight to behold.

As for boring old equities (via S&P 500), there’s still a big portion of the market about which we can only say: gee whiz, it sure does keep floating higher, isn’t it? Golly gee, gosh almighty………

With a market like this, little can be said except that It Will Keep Going Up Until It Doesn’t, because eight years (and tens of trillions of dollars of CB funds) later, the market seems to be in a mode of permanently and inexorably grinding higher. The S&P 100 is no different:

There are a few cracks and fissures here and there, and I’m trying to take advantage of them, but Good God it’s frustrating (to say the least). The tech-laden NASDAQ, for instance, has had its share of recent stumbles.

Part of this weakness is coming from a sector which had been absolutely unstoppable for years, which is semiconductors.

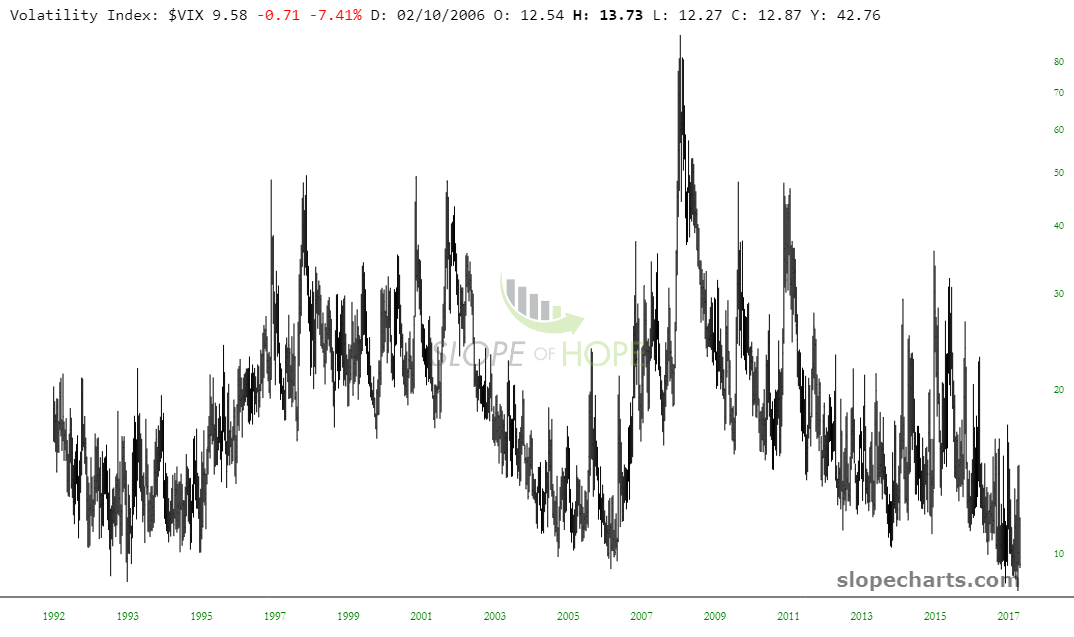

But in spite of these scattered pockets of weakness, the equity market overall continues to be the dominion of the permabulls and doe-eyed optimists. The VIX is once again in the single digits. Unless we get some shock to the system – – which we never do – – I can’t see why this market wouldn’t continue to float unashamedly higher like a child’s lost balloon for the balance of the year.