Stronger USD – Bullish For Which Stock Indices?

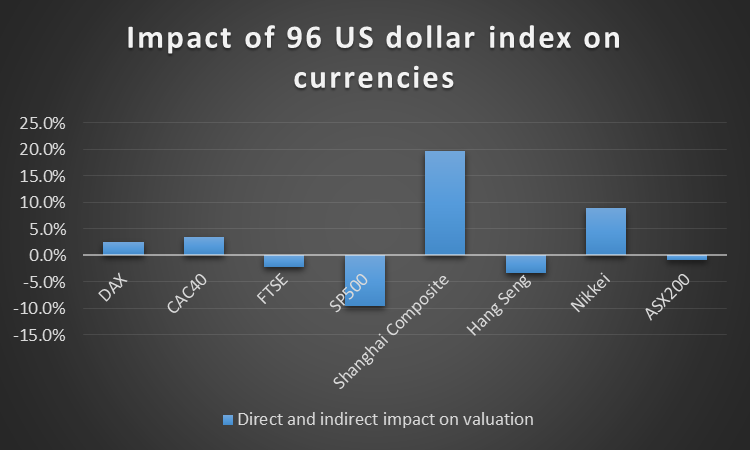

Whilst exchange rates are very difficult to predict, current sentiment is that the USD will continue to rise. The consensus is that US interest rates will rise this year and our own fair value indicator has the value of the US dollar index at over 96 (currently around 92). Volatility will be the norm, but we thought we would investigate – what would a US dollar index of 96 mean for the major stock indices?

Our fair value model can be interrogated to answer just that question. Any price we wish can be overlaid on the current price and the model will recalculate fair values based on the set of 22-driver-variable multiple regression equations. (The model will allow for indirect effects of the price change on the driver variables as well as the direct effect on the independent variable).

The results are graphed below.

Not surprisingly, the Shanghai Composite and Nikkei are big beneficiaries, probably reflecting the US being a major export destination for China and Japan. The analysis does raise a question mark over the S&P 500 (and Hang Seng, reflecting the HKD peg to the USD).

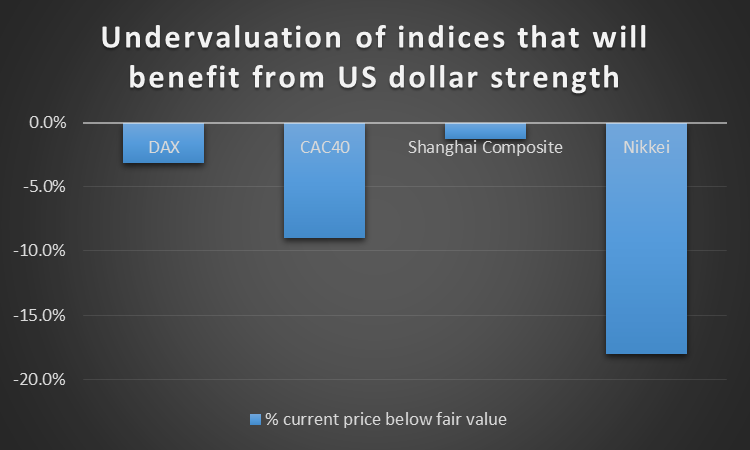

Interestingly, our fair value model has each of the indices which will benefit from US dollar strength as being undervalued on fundamentals – adding to the “bull case”. (Note that the fair values reflect current prices and historical correlations only, no forecasts).

Also interestingly, the under/over valuation indicator has proven reliable for trading the DAX, CAC 40 and Nikkei, although not for the Shanghai Composite. The under/over valuation is assessed daily by our model and can support a trading strategy whereby one would go long undervalued indices and short overvalued indices.

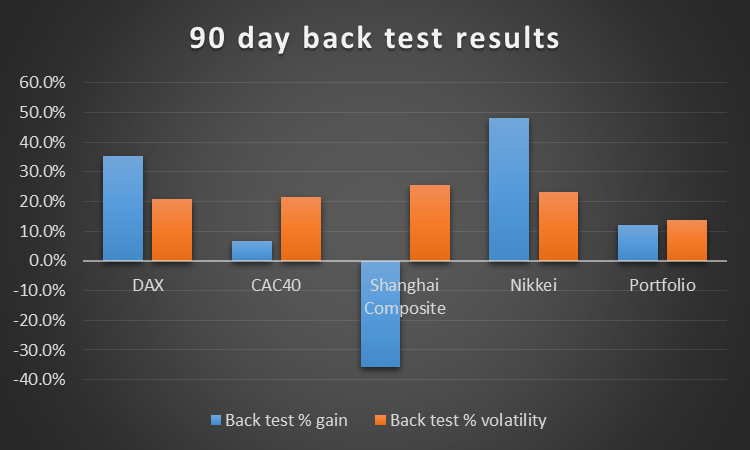

Backtesting of such a strategy provides an indication of the confidence we can have in the under/over valuation indicator. Results for the DAX, CAC 40, Shanghai Composite, Nikkei and portfolio of the four,are graphed below.

Clearly the Shanghai Composite detracts from the results, suggesting caution when using the indicator for that index.However the “bull case” remains intact overall - an equally-weighted portfolio of the four US dollar-correlated indices traded using the under/over valuation indicator would have gained an annualized 12% with volatility of 13.6%.