Market Brief

The week starts with a risk rally amid a solid jobs data from the US and the victory of Shinzo Abe’s ruling coalition at the upper house election, winning 70 out of 121 seats (temporary results). After the catastrophic May’s figures, the US jobs report has been encouraging with 287,000 new nonfarm jobs added through June (versus 180k expected and 11k last). The unemployment rate deteriorated to 4.9% from 4.7% in the previous month as the labour force participation rate ticked up to 62.7% from 62.6%. EUR/USD was little changed in Tokyo, even though we saw some wild swings immediately before and after the publication of the data. EUR/USD initially fell to 1.10 before bouncing to 1.1120 and then stabilising at around its initial level at 1.1050. The market needs more than one good jobs report, investors want to see a pickup in momentum in both the job market and the inflation’s outlook. And when you have a look at the wage figures, the momentum is not here yet.

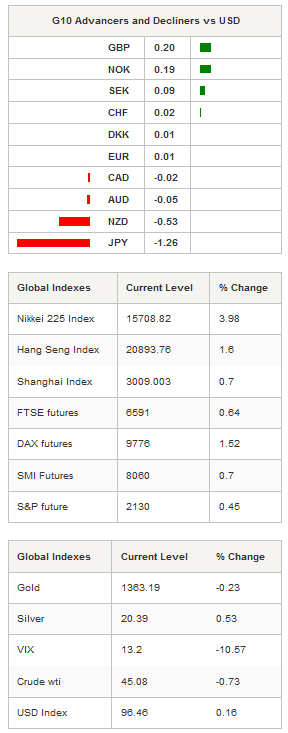

The Japanese yen fell 1.25% against the greenback during the Asian session after the victory of Shinzo Abe’s ruling coalition. On Sunday, the Prime Minister reiterated its call for a bigger stimulus package but declined to comment on the size of the package or the nature of the new set of measures. This result is coherent with our expectations for another round of stimulus, which would eventually help to weaken the Japanese yen. USD/JPY tested the 102 resistance level but was unable to break it. In the equity market, the popular Nikkei rose 3.98% to 15,708 points, while the broader Topix Index jumped 3.79%. The improving risk sentiment spread across Asian regional markets and boosted equities with the CSI 300 up 0.90%, the Hang Seng up 1.60%. Elsewhere, in Australia shares rose 2.04%, while in New Zealand the S&P/NZX was up 0.90%.

The New Zealand dollar slid 0.53% against a surging USD. NZD/USD erased partially the post-NFP gains and returned to 0.7260, down 40pips on the session, after failing to break the strong resistance at 0.73 (high from June 23rd and psychological level). It is a bit early to talk about a reversal as the currency pair is still trading within its uptrend channel. In the short-term, the kiwi will be subject to downward pressure as the greenback gains momentum again. On the downside, the $0.70 level will act as support.

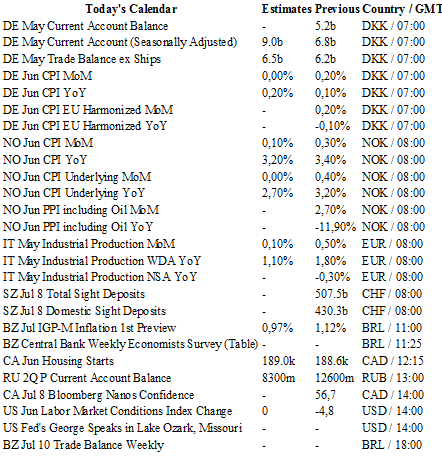

Today traders will be watching CPI from Denmark and Norway; sight deposits from Switzerland; industrial production from Italy; housing starts from Canada.

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1186

CURRENT: 1.1041

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.2945

S 1: 1.2798

S 2: 1.1880

USD/JPY

R 2: 106.84

R 1: 103.39

CURRENT: 101.86

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9830

S 1: 0.9522

S 2: 0.9444