Not only did the NASDAQ Composite make a new all-time high as it exceeded 6000 by mid-day Tuesday, but it did so on record-high momentum, as shown on the following monthly chart.

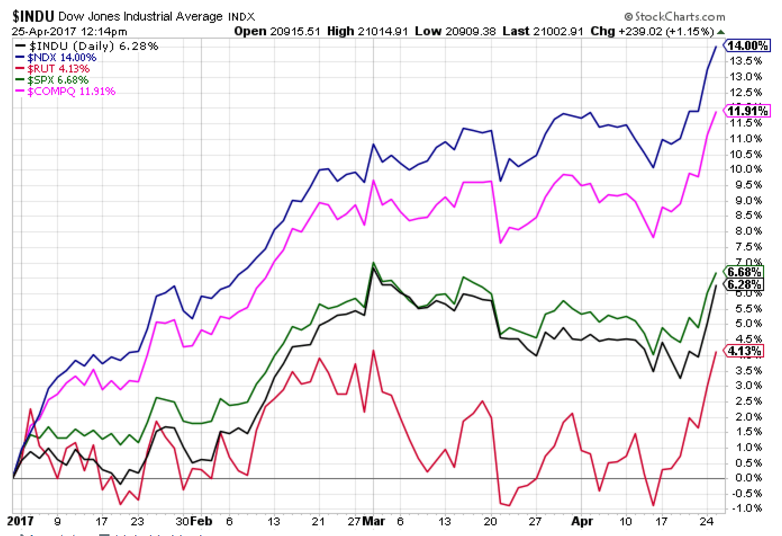

As I mentioned in my post of late April, I believe that the technology sector (NDX) holds the key to support a new bull equity market, which I discussed earlier this week.

As such, you can see, from the year-to-date percentage-increased comparison chart of the major Indices below, that technology continues to lead the way.

Any further advance of the NASDAQ Composite Index should be accompanied by higher momentum to confirm strong and convincing commitment in this market.

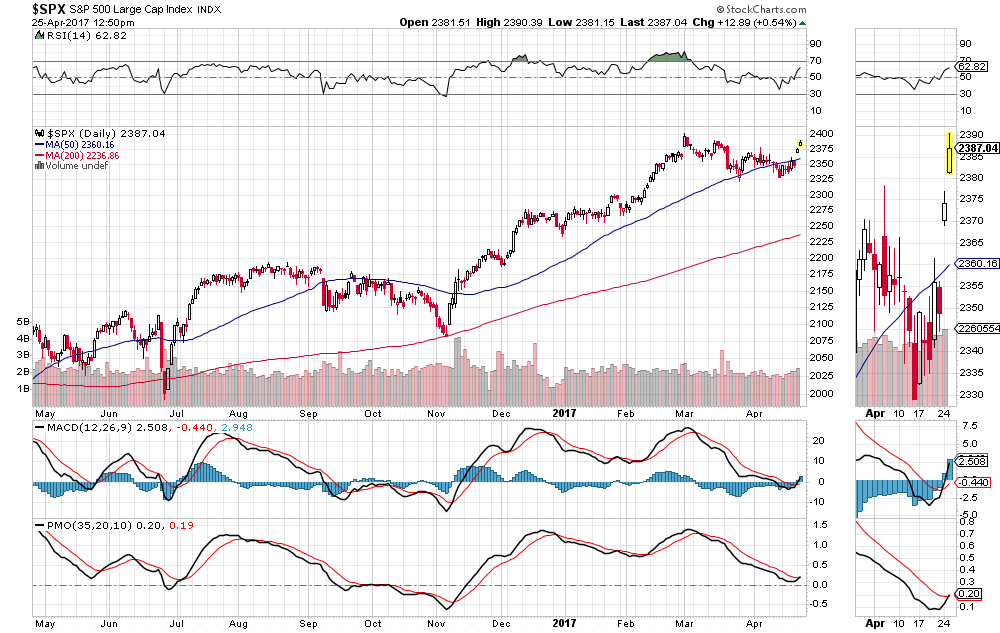

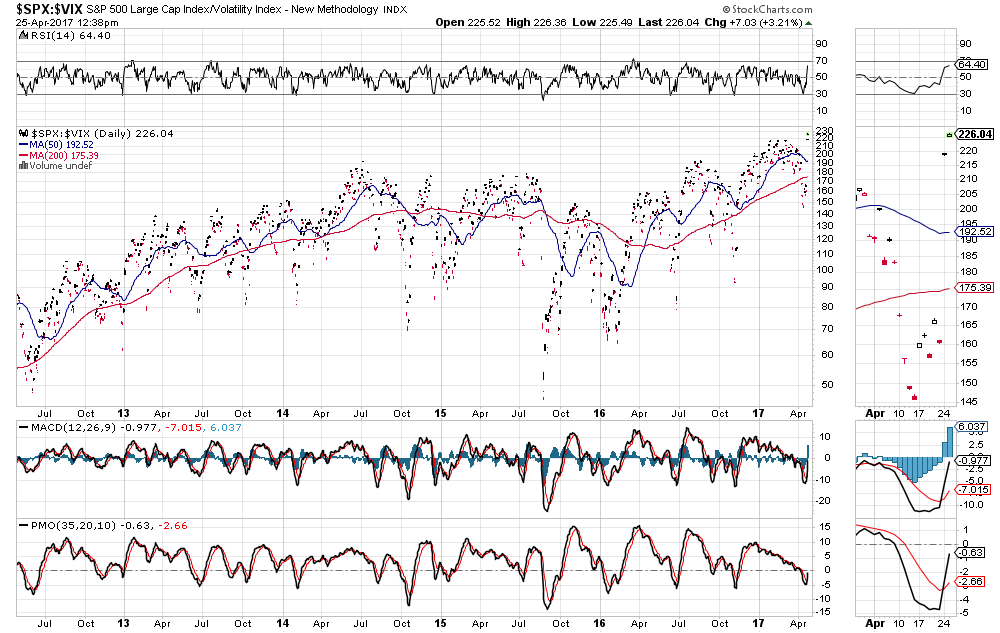

As an aside, I'd like to see the RSI on the SPX:VIX ratio make a new swing high (as shown on the following daily ratio chart), on any further advance in price, notwithstanding Tuesday's (even higher than Monday's) new all-time price high, to confirm any breakout to new highs (above 2400.98) on the SPX.