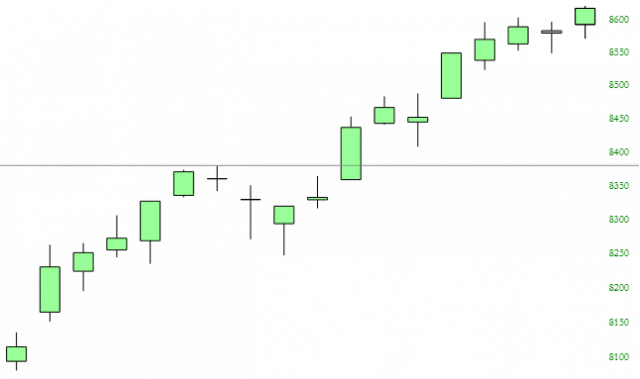

The trading week we just went through resolved nothing. The steady drip, drip, drip higher that’s been in place since Christmas continues unabated. Look at this chart of the Dow Jones Composite

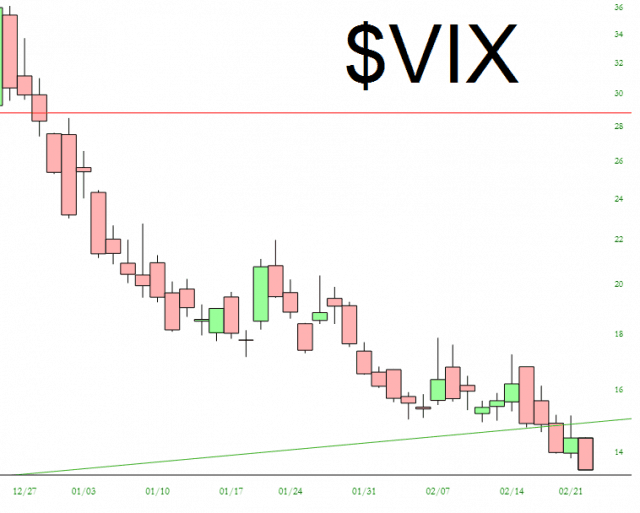

Green bars, day after day, with occasional overnight dips rendered moot within minutes. And if you needed any more convincing, witness volatility, after having had 65% of its value smashed away. We are now at a 13 handle with a real prospect of dropping to sub-teens.

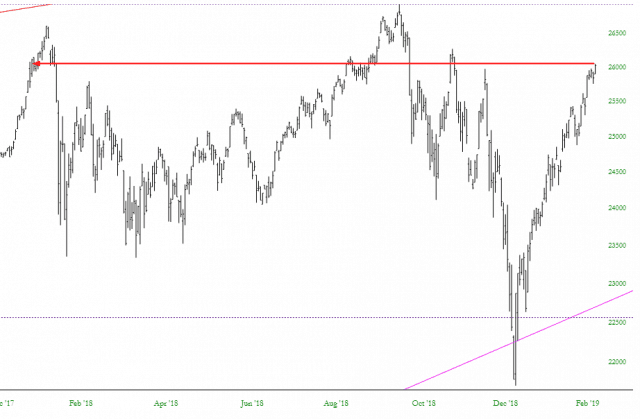

Over the course of the past 13 months, the market has been doing nowhere fast. Think of it this way, looking at the chart below: The Dow Jones Industrial Average is unchanged for the past 13 months, even after trillions of dollars from the central banks of China, the U.S., Japan, and Europe have been hurled at asset appreciation in the same timespan. Reality began to creep in for a glorious few weeks last autumn, but the reality is something the bankers cannot handle, so that was snuffed out and quickly.

The key “tests” I’ve been pointing out remain. The longer this takes, the more dramatic the resolution will be. And that resolution could be bullish (swiftly sending equities to new lifetime highs) or bearish (smashing down at least a portion of the historic ascent that has taken place over the past nine weeks). Here’s the Dow Jones Composite:

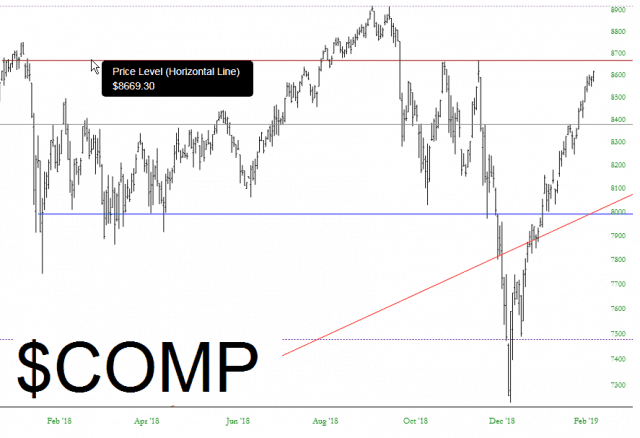

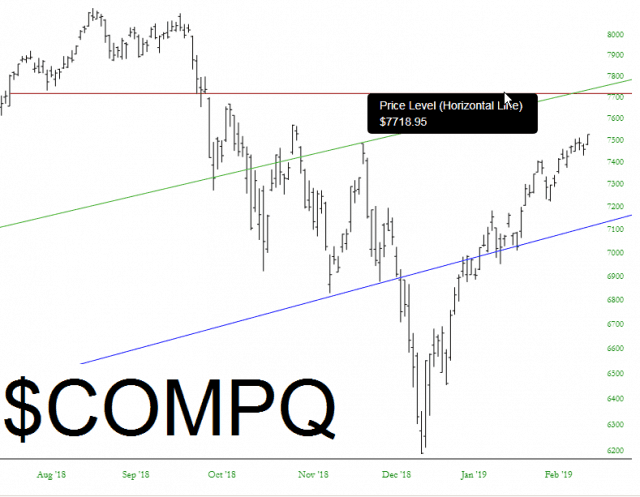

The NASDAQ Composite (again, take note of the price levels shown):

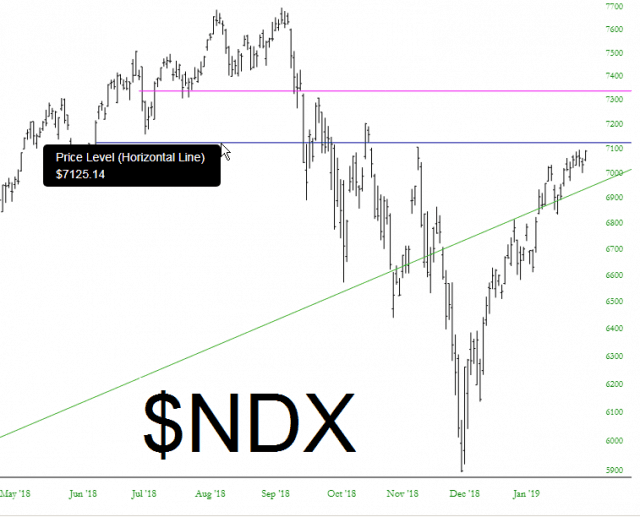

The Nasdaq 100:

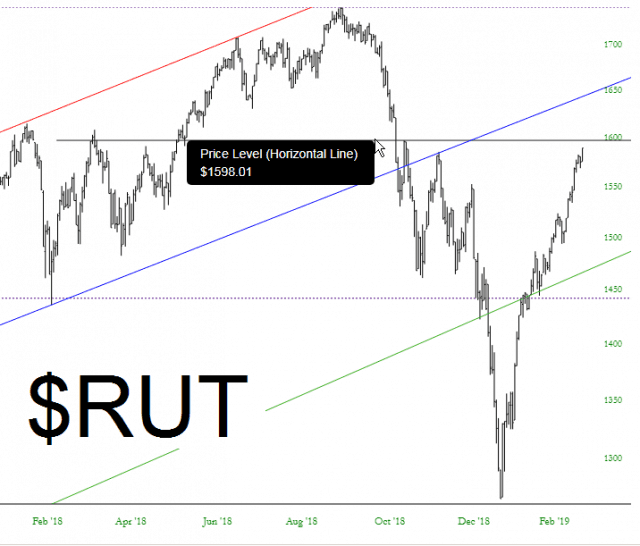

The small caps Russell 2000:

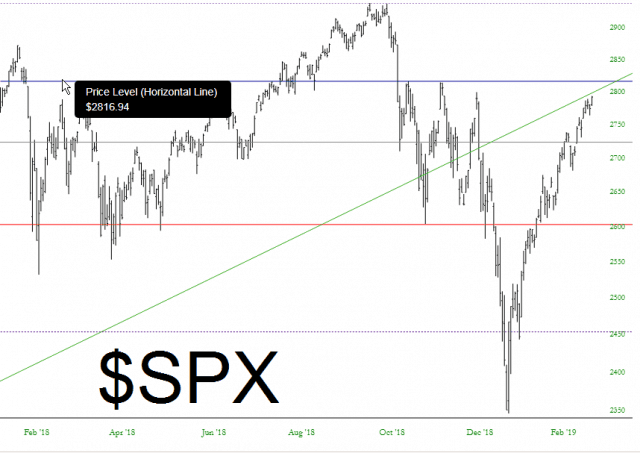

And, most importantly, the S&P 500. The “make or break” level around the 2800 zone is looming large, both with respect to the trio of tops made last quarter as well as being just beneath the long-term broken trendline.

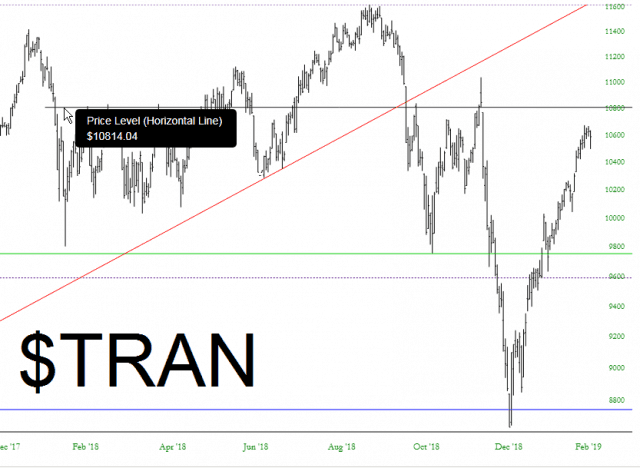

Of these, the Transports seems the most vulnerable, since it still has a very clear series of lower highs and an unclosed price gap.

Simply stated, until the above price levels are rendered judgment by the market, we’re just it grind-it-out mode. For better or worse, though, that resolution is coming soon, because there’s very little room left.