We’ve had a volatile year with a couple of blindside shocks. But the markets have pushed higher as much of the anxiety and uncertainty that’s dogged investors over the past year has eased.

But there’s still that one nagging little fear generator left -- the coming interest-rate hike.

Many investors are wondering the same thing: What does a rate hike mean for the markets?

To answer this, I went back and looked at the best-performing sectors prior to the Fed lifting rates... and the best sectors following rate hikes.

The results hold some very important takeaways for investors.

What’s Best To Own (In Good Times And Bad)

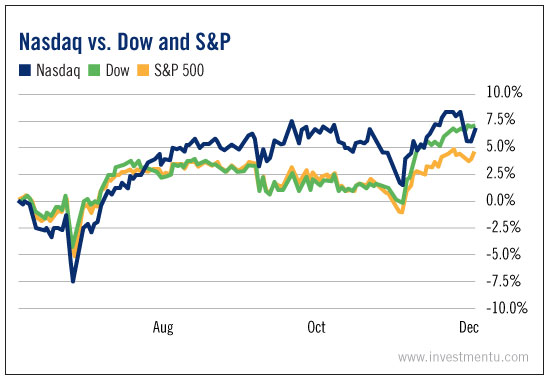

Historically, one of the best sectors to own in the months leading up to a Fed rate hike is Technology. And when we look at the tech-heavy Nasdaq’s performance over the past six months, we see this is especially true.

Last week, the Nasdaq suffered a couple days of big losses on worries about the effect of a stronger dollar. Prior to that, it was the best-performing index for the year, out ahead of the Dow Jones Industrial Average and the S&P 500. Even after losing nearly 3% over the course of a couple days, it’s still ahead of the S&P and in line with the Dow.

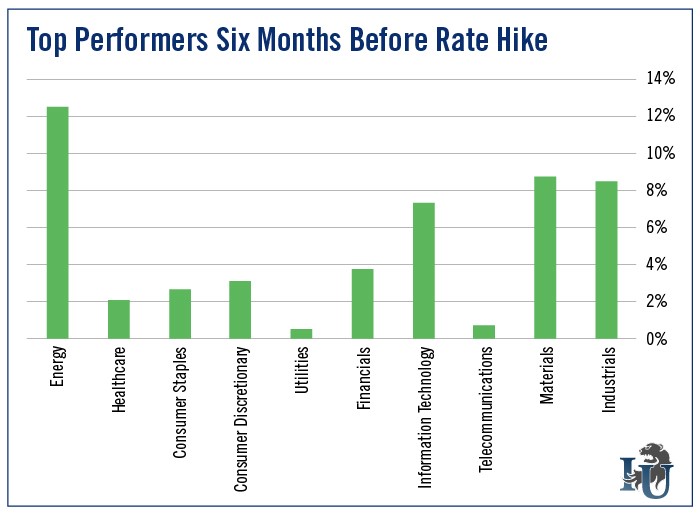

Looking at the six months before the last four rate increases, the best-performing sectors have typically been Energy, followed by Materials, Industrials and Information Technology. Utilities and Telecoms, on the other hand, were the worst performers.

With a December rate hike almost guaranteed at this point, it’s also worth noting that the SPDR Energy Select Sector ETF (NYSE:XLE) has gained 11% over the past six months. That’s right in line with the historic pre-hike average (12.46%).

So how have the rest of the sectors performed during the six months prior to a Fed rate hike since 1994? Let’s start by looking at the most recent six-month period.

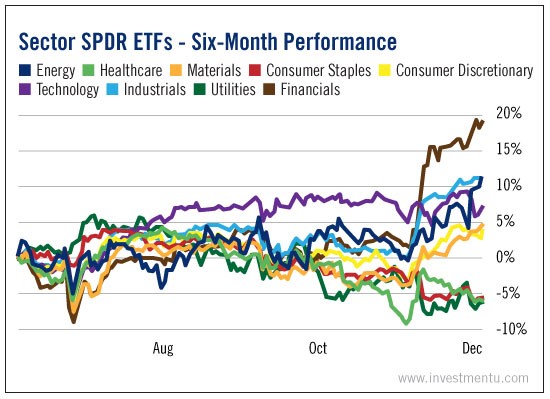

Our top performers so far, as measured by Sector SPDR ETFs, have been Financials, Industrials, Energy, Technology and Materials.

That’s the exact five we’ve seen in previous cycles as the top performers, with Financials getting an added boost over the past month because of the U.S. presidential election results.

The worst-performing sectors over the past six months? Utilities, Healthcare and Consumer Staples. Again, this is right in line with what we’ve come to expect. They’re three of the four worst performers in the six months leading up to previous rate hikes.

When looking at trends, we always want this kind of confirmation -- especially when we’re looking toward the future.

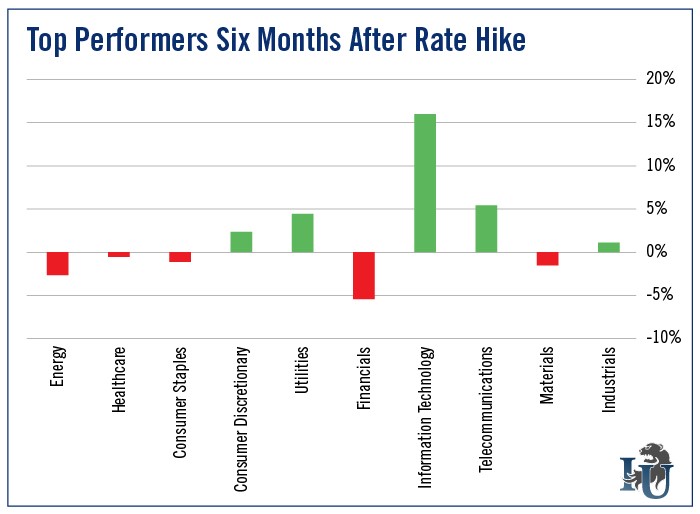

Now, in the six months following a rate increase, a completely different picture forms.

Energy, Healthcare, Consumer Staples, Financials and Materials all struggle. But Information Technology picks up pace, gaining an average of 16.12%.

The second-best performer is Telecom, followed by Utilities and Consumer Discretionary.

The fact that Utilities performed well was surprising. I thought it might have to do with the time of year the rate increases took place. But when we look a year out from the rate increase, we get a picture everyone should be happy with.

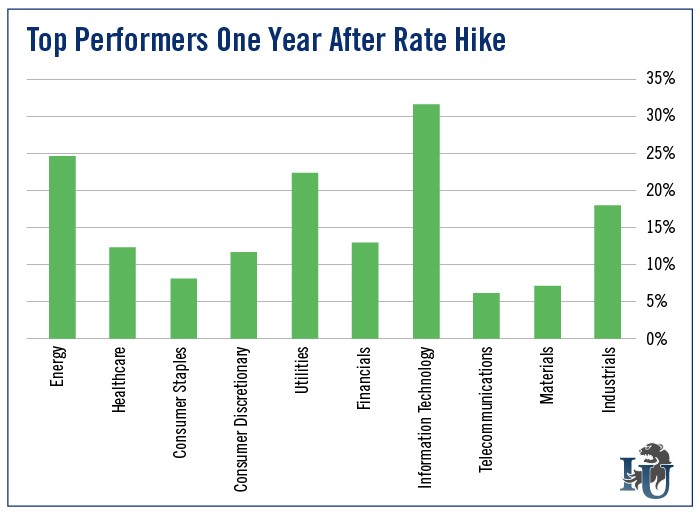

Telecoms are the worst-performing sector, not gaining much from the six-month mark. But everything is in the green. In fact, a year after a rate hike, the gain from Information Technology is nearly twice what it was at the six-month mark, while Utilities, Industrials and Energy absolutely surge.

So, in terms of stocks, no sector should get destroyed after the Fed raises rates. At least, not based on the past four occurrences.

And even though there’s a lot of concern about the Fed raising rates this year and what impact that might have, it’s technically a good thing.

It means the economy is improving and can manage on its own.

Good investing,